Pfizer 2013 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

8

2013 Financial Report

having a negative impact on earnings, and our overall expenses would decrease, having a positive impact on earnings. Therefore,

significant changes in foreign exchange rates can impact our results and our financial guidance.

The impact of possible currency devaluations in countries experiencing high inflation rates or significant exchange fluctuations can impact

our results and financial guidance. For example, on February 13, 2013, the Venezuelan government devalued its currency from a rate of

4.3 to 6.3 of Venezuelan currency to the U.S. dollar. We incurred a foreign currency loss of $80 million immediately on the devaluation as

a result of remeasuring the local balance sheets, and we have experienced and will continue to experience ongoing adverse impacts to

earnings as our revenues and expenses will be translated into U.S. dollars at a lower rate. We cannot predict whether there will be further

devaluations of the Venezuelan currency or devaluations of any other currencies.

Despite the challenging financial markets, Pfizer maintains a strong financial position. Due to our significant operating cash flows, financial

assets, access to capital markets and available lines of credit and revolving credit agreements, we continue to believe that we have, and will

maintain, the ability to meet our liquidity needs for the foreseeable future. Our long-term debt is rated high quality by both Standard & Poor’s

(S&P) and Moody’s Investors Service. As market conditions change, we continue to monitor our liquidity position. We have taken and will

continue to take a conservative approach to our financial investments. Both short-term and long-term investments consist primarily of high-

quality, highly liquid, well-diversified and available-for-sale debt securities. For further discussion about our financial condition, see the

“Analysis of Financial Condition, Liquidity and Capital Resources” section of this Financial Review.

These and other industry-wide factors that may affect our businesses should be considered along with information presented in the “Forward-

Looking Information and Factors That May Affect Future Results” section of this Financial Review and in Part I, Item 1A, “Risk Factors,” of our

2013 Annual Report on Form 10-K.

Our Strategy

We believe that our medicines provide significant value for both healthcare providers and patients, not only from the improved treatment of

diseases but also from a reduction in other healthcare costs, such as emergency room or hospitalization costs, as well as improvements in

health, wellness and productivity. We continue to actively engage in dialogues about the value of our products and how we can best work with

patients, physicians and payers to prevent and treat disease and improve outcomes. We continue to work within the current legal and pricing

structures, as well as continue to review our pricing arrangements and contracting methods with payers, to maximize access to patients and

minimize any adverse impact on our revenues. We remain firmly committed to fulfilling our company's purpose of innovating to bring therapies

to patients that significantly improve their lives. By doing so, we expect to create value for the patients we serve and for our shareholders.

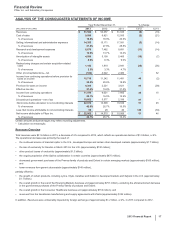

Commercial Operations

Following the full disposition of our Animal Health business on June 24, 2013, we managed our commercial operations through four operating

segments––Primary Care; Specialty Care and Oncology; Established Products and Emerging Markets; and Consumer Healthcare. Prior to

June 24, 2013, we managed our operations through these four operating segments, as well as our Animal Health operating segment. For

additional information about this operating structure, see Notes to Consolidated Financial Statements––Note 18A. Segment, Geographic and

Other Revenue Information: Segment Information.

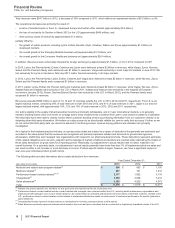

At the beginning of our fiscal year 2014, we began to manage our commercial operations through a new global commercial structure

consisting of three businesses, each of which is led by a single manager––the Global Innovative Pharmaceutical business (GIP); the Global

Vaccines, Oncology and Consumer Healthcare business (VOC); and the Global Established Pharmaceutical business (GEP). Beginning with

our first quarter 2014 financial results, we will report under our new structure and will provide financial transparency into each of these

businesses. Results for 2013 and prior periods in our 2013 Annual Report on Form 10-K and in this 2013 Financial Review are reported on the

basis under which we managed our businesses in 2013 and do not reflect the 2014 reorganization.

A significant change effected by our new structure is the full integration of emerging markets into each business. Emerging markets are an

important component of our strategy for global leadership, and our new structure recognizes that the demographics and rising economic

power of the fastest-growing emerging markets are becoming more closely aligned with the profile found within developed markets.

Some additional information about each product grouping follows:

• Global Innovative Pharmaceutical business––GIP comprises medicines within several therapeutic areas that are generally expected to

have market exclusivity beyond 2015. These therapeutic areas include immunology and inflammation, cardiovascular/metabolic,

neuroscience and pain, rare diseases and women's/men's health.

• Global Vaccines, Oncology and Consumer Healthcare business––VOC focuses on the development and commercialization of vaccines

and products for oncology and consumer healthcare. Each of the three businesses that comprise this group operates as a separate,

global business, with distinct specialization in terms of the science, talent and market approach necessary to deliver value to consumers

and patients.

• Global Established Pharmaceutical business––GEP includes the brands that have lost market exclusivity and, generally, the mature,

patent-protected products that are expected to lose exclusivity through 2015 in most major markets and, to a much smaller extent,

generic pharmaceuticals. Additionally, GEP includes our sterile injectable products and biosimilar development portfolio, as well as

current established product collaborations, such as our existing agreements with Mylan Inc. in Japan, Zhejiang Hisun Pharmaceuticals

Co., Ltd. in China and Laboratório Teuto Brasileiro S.A. in Brazil.

We expect that the GIP and VOC biopharmaceutical portfolios of innovative, largely patent-protected, in-line products will be sustained by

ongoing internal investments and targeted business development designed to maximize the value of our in-line products and ensure a robust

pipeline of highly-differentiated product candidates in areas of unmet medical need. In addition, VOC includes our Consumer Healthcare