Pfizer 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

76

2013 Financial Report

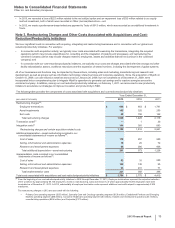

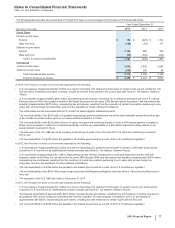

(h) Costs incurred in connection with the IPO of an approximate 19.8% ownership interest in Zoetis. Includes expenditures for banking, legal, accounting and

similar services. For additional information, see Note 2B. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments: Divestitures.

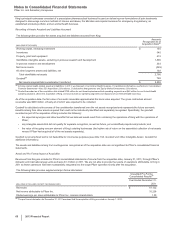

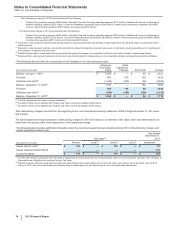

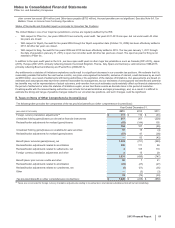

The asset impairment charges included in Other (income)/deductions––net in 2013 primarily relate to identifiable intangible assets and are

based on estimates of fair value.

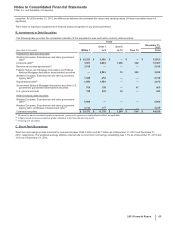

The following table provides additional information about the intangible assets that were impaired during 2013 in Other (income)/

deductions––net :

Year Ended

December 31,

Fair Value(a) 2013

(MILLIONS OF DOLLARS) Amount Level 1 Level 2 Level 3 Impairment

Intangible assets––Developed technology rights(b) $ 564$—$—$

564 $394

Intangible assets––Indefinite-lived Brands(b) 1,499 ——

1,499 109

Intangible assets––IPR&D(b) 218 — — 218 227

Intangible assets––Other ———— 73

Total $2,281 $—$—$

2,281 $803

(a) The fair value amount is presented as of the date of impairment, as these assets are not measured at fair value on a recurring basis. See also Note 1E. Basis of

Presentation and Significant Accounting Policies: Fair Value.

(b) Reflects intangible assets written down to their fair value in 2013. Fair value was determined using the income approach, specifically the multi-period excess

earnings method, also known as the discounted cash flow method. We started with a forecast of all the expected net cash flows associated with the asset and

then we applied an asset-specific discount rate to arrive at a net present value amount. Some of the more significant estimates and assumptions inherent in this

approach include: the amount and timing of the projected net cash flows, which includes the expected impact of competitive, legal and/or regulatory forces on

the product and the impact of technological risk associated with IPR&D assets; the discount rate, which seeks to reflect the various risks inherent in the

projected cash flows; and the tax rate, which seeks to incorporate the geographic diversity of the projected cash flows.

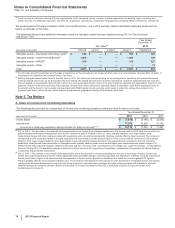

Note 5. Tax Matters

A. Taxes on Income from Continuing Operations

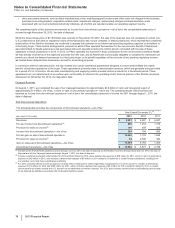

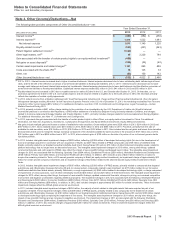

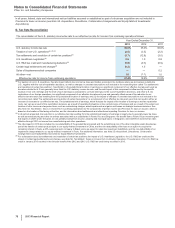

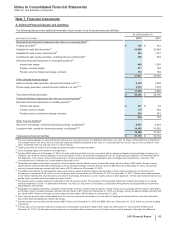

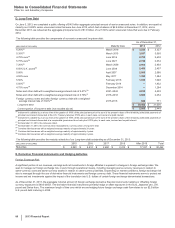

The following table provides the components of Income from continuing operations before provision for taxes on income:

Year Ended December 31,

(MILLIONS OF DOLLARS) 2013 2012 2011

United States $ (1,678) $(5,148)$ (2,655)

International 17,394 16,390 14,136

Income from continuing operations before provision for taxes on income(a), (b) $15,716 $11,242 $11,481

(a) 2013 v. 2012––The decrease in the domestic loss was primarily due to income from a litigation settlement in the second quarter of 2013 with Teva and Sun for

patent-infringement damages resulting from their “at-risk” launches of generic Protonix in the U.S., lower charges related to other legal matters, lower

restructuring charges and other costs associated with acquisitions and cost-reduction/productivity initiatives, partially offset by lower revenues. The increase in

international income is primarily related to the gain associated with the transfer of certain product rights to Pfizer’s equity-method investment in China (Hisun

Pfizer) in 2013, lower charges related to other legal matters, lower restructuring charges and other costs associated with acquisitions and cost-reduction/

productivity Initiatives and lower amortization of intangible assets, partially offset by lower revenues and higher asset impairments and related charges. For

additional information about the litigation settlement with Teva and Sun, see Note 17A5. Commitments and Contingencies: Legal Proceedings––Certain Matters

Resolved During 2013. For additional information about Hisun Pfizer, see Note 2D. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method

Investments: Equity-Method Investments.

(b) 2012 v. 2011––The increase in the domestic loss was primarily due to the reduction in revenues resulting from the loss of exclusivity of Lipitor, Geodon and

certain other biopharmaceutical products; certain legal settlements and related charges, primarily associated with Rapamune, Celebrex, hormone-replacement

therapy and Chantix; higher costs associated with the separation of Zoetis; and the payment to AstraZeneca to obtain the exclusive global OTC rights to

Nexium, partially offset by lower acquisition-related costs. The increase in international income was due to lower amortization of intangible assets and charges

resulting from fair value adjustments to inventory sold during the period, lower restructuring charges and other costs associated with acquisitions and cost-

reduction/productivity initiatives, partially offset by the reduction in revenues resulting from the loss of exclusivity of Lipitor, Geodon and certain other

biopharmaceutical products.