Pfizer 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

46

2013 Financial Report

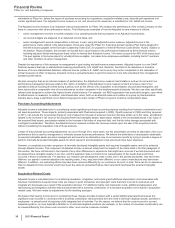

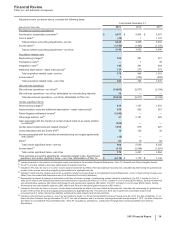

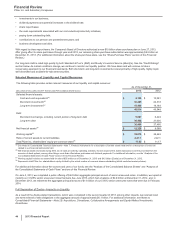

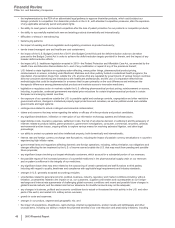

Contractual Obligations

Payments due under contractual obligations as of December 31, 2013, mature as follows:

Years

(MILLIONS OF DOLLARS) Total 2014 2015-2016 2017-2018 Thereafter

Long-term debt, including current portion(a) $32,522 $2,060 $7,452 $5,073 $17,937

Interest payments on long-term debt obligations(b) 17,320 1,368 2,492 2,119 11,341

Other long-term liabilities(c) 4,654 451 829 858 2,516

Lease commitments(d) 1,476 210 306 181 779

Purchase obligations and other(e) 3,376 1,265 1,417 641 53

Uncertain tax positions(f) 98 98 — — —

(a) Long-term debt consists of senior unsecured notes, including fixed and floating rate, foreign currency denominated, and other notes.

(b) Our calculations of expected interest payments incorporate only current period assumptions for interest rates, foreign currency translation rates and hedging

strategies (see Notes to Consolidated Financial Statements—Note 7. Financial Instruments), and assume that interest is accrued through the maturity date or

expiration of the related instrument.

(c) Includes expected payments relating to our unfunded U.S. supplemental (non-qualified) pension plans, postretirement plans and deferred compensation plans.

Excludes amounts relating to our U.S. qualified pension plans and international pension plans, all of which have a substantial amount of plan assets, because

the required funding obligations are not expected to be material and/or because such liabilities do not necessarily reflect future cash payments, as the impact of

changes in economic conditions on the fair value of the pension plan assets and/or liabilities can be significant; however, we currently anticipate contributing

approximately $311 million to these plans in 2014. Also excludes $3.7 billion of liabilities related to legal matters, employee terminations and the fair value of

derivative financial instruments and other, most of which do not represent contractual obligations. See also our liquidity discussion above in this "Analysis of

Financial Condition, Liquidity and Capital Resources" section, as well as the Notes to Consolidated Financial Statements—Note 3. Restructuring Charges and

Other Costs Associated with Acquisitions and Cost-Reduction/Productivity Initiatives, Note 7A. Financial Instruments: Selected Financial Assets and Liabilities,

Note 11E. Pension and Postretirement Benefit Plans and Defined Contribution Plans: Cash Flows, and Note 17. Commitments and Contingencies.

(d) Includes operating and capital lease obligations.

(e) Includes agreements to purchase goods and services that are enforceable and legally binding and includes amounts relating to advertising, information

technology services, employee benefit administration services, and potential milestone payments deemed reasonably likely to occur.

(f) Includes amounts reflected in Income taxes payable only. We are unable to predict the timing of tax settlements related to our noncurrent obligations for

uncertain tax positions as tax audits can involve complex issues and the resolution of those issues may span multiple years, particularly if subject to negotiation

or litigation.

The above table includes amounts for potential milestone payments under collaboration, licensing or other arrangements, if the payments are

deemed reasonably likely to occur. Payments under these agreements generally become due and payable only upon the achievement of

certain development, regulatory and/or commercialization milestones, which may span several years and which may never occur.

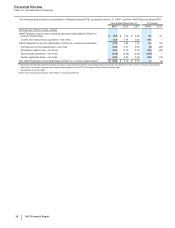

In 2014, we expect to spend approximately $1.3 billion on property, plant and equipment. Planned capital spending mostly represents

investment to maintain existing facilities and capacity. We rely largely on operating cash flows to fund our capital investment needs. Due to our

significant operating cash flows, we believe we have the ability to meet our capital investment needs and anticipate no delays to planned

capital expenditures.

Off-Balance Sheet Arrangements

In the ordinary course of business and in connection with the sale of assets and businesses, we often indemnify our counterparties against

certain liabilities that may arise in connection with a transaction or that are related to activities prior to a transaction. These indemnifications

typically pertain to environmental, tax, employee and/or product-related matters, and patent-infringement claims. If the indemnified party were

to make a successful claim pursuant to the terms of the indemnification, we would be required to reimburse the loss. These indemnifications

generally are subject to threshold amounts, specified claim periods and other restrictions and limitations. Historically, we have not paid

significant amounts under these provisions and, as of December 31, 2013, recorded amounts for the estimated fair value of these

indemnifications are not significant.

Certain of our co-promotion or license agreements give our licensors or partners the rights to negotiate for, or in some cases to obtain under

certain financial conditions, co-promotion or other rights in specified countries with respect to certain of our products.

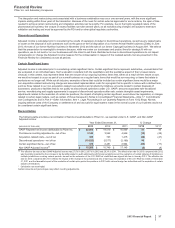

Share-Purchase Plans

On December 12, 2011, we announced that the Board of Directors had authorized a $10 billion share-purchase plan (the December 2011

Stock Purchase Plan), which was exhausted in the first quarter of 2013. On November 1, 2012, we announced that the Board of Directors had

authorized an additional $10 billion share-purchase plan, which became effective on November 30, 2012 and was exhausted in October 2013.

On June 27, 2013, we announced that the Board of Directors had authorized an additional $10 billion share-purchase plan, and share

purchases commenced thereunder in October 2013.

In 2013, we purchased approximately 563 million shares of our common stock for approximately $16.3 billion under our publicly announced

share-purchase plans. In 2012, we purchased approximately 349 million shares of our common stock for approximately $8.2 billion under our

publicly announced share-purchase plans. In 2011, we purchased approximately 459 million shares of our common stock for approximately

$9.0 billion under our publicly announce share-purchase plans. After giving effect to share purchases through year-end 2013, our remaining

share-purchase authorization was approximately $5.5 billion at December 31, 2013.