Pfizer 2013 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

26

2013 Financial Report

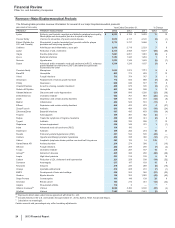

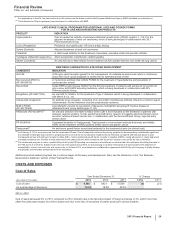

the impact of loss of exclusivity;

the continuing impact of an intensely competitive lipid-lowering market with competition from generics and branded products

worldwide; and

the increased payer pressure worldwide, including the need for flexible rebate policies.

Geographically,

in the U.S., revenues decreased 54% in 2013, compared to 2012; and

in our international markets, revenues decreased 38% in 2013, compared to 2012. Foreign exchange had an unfavorable impact on

international revenues of 3% in 2013, compared to 2012.

See the “Our Operating Environment” section of this Financial Review for a discussion concerning losses of exclusivity for Lipitor in various

markets.

• Viagra is indicated for the treatment for erectile dysfunction. Viagra worldwide revenues decreased 8% in 2013, compared to 2012,

primarily due to a decrease in international revenues. International revenues decreased 18% in 2013, compared to 2012, primarily due to

the entry of generics in developed Europe. In emerging markets, the decrease was primarily due to the impact of both herbal and generic

competition. Loss of exclusivity for Viagra in major European markets occurred in late-June 2013 and reduced revenues by approximately

$108 million, in comparison with 2012. Revenues in the U.S. were essentially flat in 2013, compared to 2012.

• Zyvox is the world’s best-selling branded agent among those used to treat serious Gram-positive pathogens, including methicillin-resistant

staphylococcus-aureus. Zyvox worldwide revenues increased 1% in 2013, compared to 2012. The increase in 2013 was primarily due to

increased demand in both the U.S. and Europe, partly offset by the unfavorable impact of foreign exchange of 2%.

• Norvasc is indicated for the treatment of hypertension. Norvasc worldwide revenues decreased 9% in 2013, compared to 2012, and

reflects, among other factors, the unfavorable impact of foreign exchange of 6%.

• Sutent is indicated for the treatment of advanced renal cell carcinoma, including metastatic renal cell carcinoma (mRCC); gastrointestinal

stromal tumors after disease progression on, or intolerance to, imatinib mesylate; and advanced pancreatic neuroendocrine tumor. Sutent

worldwide revenues decreased 3% in 2013, compared to 2012, as a result of increased competition and cost-containment measures in

developed Europe and Japan, as well as some conversion from Sutent to Inlyta in Japan as a result of the broader label for Inlyta in

Japan, which overlaps with the Sutent indication, and the unfavorable impact of foreign exchange of 2%, partially offset by price increases

in the U.S. and increases in uptake in key emerging markets, most notably Russia, China and the Levant (a group of countries bordering

the Eastern Mediterranean).

• Our Premarin family of products helps women address moderate-to-severe menopausal symptoms. Premarin worldwide revenues

increased 2% in 2013, compared to 2012. Revenues in the U.S. were favorably impacted by two price increases and growth in Premarin

Vaginal Cream prescription volume, and unfavorably impacted by prescription volume declines for Premarin Family Oral brands.

• BeneFIX and ReFacto AF/Xyntha are hemophilia products using state-of-the-art manufacturing that assist patients with their lifelong

bleeding disorders. BeneFIX recorded an increase in worldwide revenues of 7% in 2013, compared to 2012, primarily due to greater

consumption and price increases in the U.S., as well as the launch of 3000 IU SKU in Europe and continued product uptake in Japan.

ReFacto AF/Xyntha recorded a 3% increase in worldwide revenues in 2013, compared to 2012, as a result of continued competitive

patient conversions and increased hospital utilization in the U.S. and the successful completion of the dual chamber syringe ("FuseNGO")

launches across the developed EU.

• Pristiq is approved for the treatment of major depressive disorder in the U.S. and in various other countries. Pristiq has also been

approved for treatment of moderate-to-severe vasomotor symptoms (VMS) associated with menopause in Thailand, Mexico, the

Philippines and Ecuador. Pristiq recorded an increase in worldwide revenues of 11% in 2013, compared to 2012, primarily due to

prescription growth in the emerging markets, Canada and Australia, as well as a price increase in the U.S.

• Chantix/Champix is an aid to smoking-cessation in adults 18 years of age and older. Worldwide revenues decreased 3% in 2013,

compared to 2012. Revenues in the U.S. increased 10% in 2013, compared to 2012, primarily due to price increases in January and July

2013. International revenues decreased 15% in 2013, compared to 2012, primarily due to an overall market decline across several key

markets as a result of a challenging macro-economic environment, as well as the lingering impact from previous negative media exposure

and the unfavorable impact of foreign exchange of 5%.

• Inlyta, for the treatment of patients with advanced renal cell carcinoma (RCC) after failure of a prior systemic treatment, is approved in 59

countries, including the U.S., EU, Switzerland, Japan, Canada, Australia, South Korea and some emerging markets, including Russia,

Mexico and Turkey (exact indications vary by region). Inlyta recorded worldwide revenues of $319 million in 2013.

• Xalkori, for the treatment of patients with locally advanced or metastatic non-small cell lung cancer (NSCLC) that is anaplastic lymphoma

kinase (ALK)-positive, is now approved in more than 70 countries, including the U.S., EU (conditional), Japan, South Korea, Canada,

Australia and Switzerland, as well as in many emerging markets, including China, Russia, Mexico, India and Turkey. Xalkori recorded

worldwide revenues of $282 million in 2013.

• Xeljanz was approved in the U.S. in November 2012 and in various other countries in 2013 for the treatment of adult patients with

moderately to severely active rheumatoid arthritis. Xeljanz recorded worldwide revenues of $114 million in 2013, virtually all in the U.S.

• Alliance revenues worldwide decreased 25% in 2013, compared to 2012, mainly due to:

the near-term expiration of the co-promotion collaboration for Spiriva in the U.S. and certain European countries combined with the

expiration of the collaboration in Australia, Canada and certain other European countries, which resulted in declines of $517 million in

2013, compared to 2012, in Pfizer's share of Spiriva's revenues;