Pfizer 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

2013 Financial Report

9

business, which manufactures and markets several well-known over-the-counter (OTC) brands. The assets managed by these groups are

science-driven, highly differentiated and generally require a high-level of engagement with healthcare providers and consumers.

GEP is expected to generate strong consistent cash flow by providing patients around the world with access to effective, lower-cost, high-

value treatments. GEP leverages our biologic development, regulatory and manufacturing expertise to advance its biosimilar development

portfolio. GEP may also engage in targeted business development to further enable its commercial strategies.

In addition, one of our goals in implementing the new commercial structure is to streamline the critical capabilities needed to effectively

demonstrate the value of our medicines to payers, institutions and policy makers. We expect to do this through the Global Health and Value

function that is intended to align market access, pricing, health economics, real world data and outcomes research.

Research Operations

We continue to transform our global R&D organization and pursue strategies intended to improve innovation and overall productivity in R&D to

achieve a sustainable pipeline that will deliver value in the near term and over time.

Our R&D priorities include delivering a pipeline of differentiated therapies with the greatest scientific and commercial promise, innovating new

capabilities that can position Pfizer for long-term leadership, and creating new models for biomedical collaboration that will expedite the pace

of innovation and productivity. To that end, our research primarily focuses on five high-priority areas that have a mix of small molecules and

large molecules––immunology and inflammation; oncology; cardiovascular and metabolic diseases; neuroscience and pain; and vaccines.

Other areas of focus include rare diseases and biosimilars.

While a significant portion of R&D is done internally, we continue to seek to expand our pipeline by entering into agreements with other

companies to develop, license or acquire promising compounds, technologies or capabilities. Collaboration, alliance and license agreements

and acquisitions allow us to capitalize on these compounds to expand our pipeline of potential future products. In addition, collaborations and

alliances allow us to share risk and to access external scientific and technological expertise.

For additional information about R&D by operating segment, see the “Costs and Expenses––Research and Development (R&D) Expenses––

Research and Development Operations” section of this Financial Review. For additional information about our pending new drug applications

and supplemental filings, see the “Analysis of the Consolidated Statements of Income––Product Developments––Biopharmaceutical” section

of this Financial Review. For additional information about current and recent restructuring activities, see the “Costs and Expenses––

Restructuring Charges and Other Costs Associated with Acquisitions and Cost-Reduction/Productivity Initiatives” section of this Financial

Review. For additional information about recent transactions and strategic investments that we believe advance our pipeline and maximize the

value of our in-line products, see the “Our Business Development Initiatives” section of this Financial Review.

Business Development

We continue to build on our broad portfolio of businesses and to expand our R&D pipeline through various business development

transactions. For additional information about recent transactions and strategic investments that we believe have the potential to advance our

pipeline, enhance our product portfolio and maximize the value of our in-line products, see the “Our Business Development Initiatives” section

of this Financial Review.

Intellectual Property Rights

We continue to aggressively defend our patent rights against increasingly aggressive infringement whenever appropriate, and we will continue

to support efforts that strengthen worldwide recognition of patent rights while taking necessary steps designed to ensure appropriate patient

access. In addition, we will continue to employ innovative approaches designed to prevent counterfeit pharmaceuticals from entering the

supply chain and to achieve greater control over the distribution of our products, and we will continue to participate in the generics market for

our products, whenever appropriate, once they lose exclusivity. For additional information about our current efforts to enforce our intellectual

property rights, see Notes to Consolidated Financial Statements––Note 17A1. Commitments and Contingencies: Legal Proceedings––Patent

Litigation.

Capital Allocation and Expense Management

We seek to maintain a strong balance sheet and robust liquidity so that we continue to have the financial resources necessary to take

advantage of prudent commercial, research and business development opportunities and to directly enhance shareholder value through

dividends and share repurchases. For additional information about our financial condition, liquidity, capital resources, share repurchases and

dividends, see the “Analysis of Financial Condition, Liquidity and Capital Resources” section of this Financial Review.

We remain focused on achieving an appropriate cost structure for the Company. For additional information about our cost-reduction and

productivity initiatives, see the “Costs and Expenses––Restructuring Charges and Other Costs Associated with Acquisitions and Cost-

Reduction/Productivity Initiatives” section of this Financial Review.

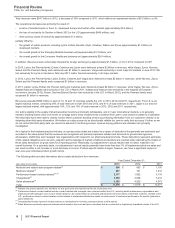

On June 27, 2013, our Board of Directors authorized a new $10 billion share-purchase plan, to be utilized over time. Also, on December 16,

2013, our Board of Directors declared a first-quarter 2014 dividend of $0.26 per share, an increase from the $0.24 per-share quarterly dividend

paid during 2013.