Pfizer 2013 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

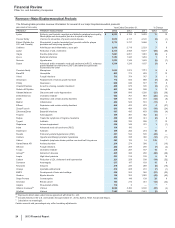

Financial Review

Pfizer Inc. and Subsidiary Companies

14

2013 Financial Report

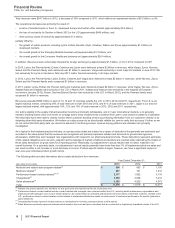

• In 2011, $834 million, the majority of which relates to intangible assets that were acquired as part of our acquisition of Wyeth. These

impairment charges reflect (i) $458 million of IPR&D assets, primarily related to two compounds for the treatment of certain autoimmune

and inflammatory diseases; (ii) $193 million related to our biopharmaceutical indefinite-lived brand, Xanax/Xanax XR; and (iii) $183

million related to developed technology rights comprising the impairment of five assets. The intangible asset impairment charges for 2011

reflect, among other things, the impact of new scientific findings and an increased competitive environment. The impairment charges in

2011 are associated with the following: Worldwide Research and Development ($394 million); Established Products ($193 million);

Specialty Care ($135 million); Primary Care ($56 million); and Oncology ($56 million).

For a description of our accounting policy, see Notes to Consolidated Financial Statements––Note 1K. Basis of Presentation and Significant

Accounting Policies: Amortization of Intangible Assets, Depreciation and Certain Long-Lived Assets.

When we are required to determine the fair value of intangible assets other than goodwill, we use an income approach, specifically the multi-

period excess earnings method, also known as the discounted cash flow method. We start with a forecast of all the expected net cash flows

associated with the asset, which includes the application of a terminal value for indefinite-lived assets, and then we apply an asset-specific

discount rate to arrive at a net present value amount. Some of the more significant estimates and assumptions inherent in this approach

include: the amount and timing of the projected net cash flows, which includes the expected impact of competitive, legal and/or regulatory

forces on the projections and the impact of technological risk associated with IPR&D assets, as well as the selection of a long-term growth

rate; the discount rate, which seeks to reflect the various risks inherent in the projected cash flows; and the tax rate, which seeks to

incorporate the geographic diversity of the projected cash flows.

While all intangible assets other than goodwill can face events and circumstances that can lead to impairment, in general, intangible assets

other than goodwill that are most at risk of impairment include IPR&D assets (approximately $443 million as of December 31, 2013) and newly

acquired or recently impaired indefinite-lived brand assets (approximately $1.5 billion as of December 31, 2013). IPR&D assets are high-risk

assets, as research and development is an inherently risky activity. Newly acquired and recently impaired indefinite-lived assets are more

vulnerable to impairment as the assets are recorded at fair value and are then subsequently measured at the lower of fair value or carrying

value at the end of each reporting period. As such, immediately after acquisition or impairment, even small declines in the outlook for these

assets can negatively impact our ability to recover the carrying value and can result in an impairment charge.

• One of our indefinite-lived biopharmaceutical brands, Xanax/Xanax XR, was written down to its fair value of $1.2 billion at the end of the

third quarter of 2013. This asset continues to be at risk for future impairment. Any negative change in the undiscounted cash flows,

discount rate and/or tax rate could result in an impairment charge. Xanax/Xanax XR, which was launched in the mid-1980s and acquired

in 2003, must continue to remain competitive against its generic challengers or the associated asset may become impaired again. We re-

considered and confirmed the classification of this asset as indefinite-lived at the time of the impairment. We will continue to closely

monitor this asset.

Goodwill

As a result of our goodwill impairment review work, we concluded that none of our goodwill is impaired as of December 31, 2013, and we do

not believe the risk of impairment is significant at this time.

For a description of our accounting policy, see Notes to Consolidated Financial Statements—Note 1K. Basis of Presentation and Significant

Accounting Policies: Amortization of Intangible Assets, Depreciation and Certain Long-Lived Assets.

When we are required to determine the fair value of a reporting unit, as appropriate for the individual reporting unit, we may use the market

approach, the income approach or a weighted-average combination of both approaches.

• The market approach is a historical approach to estimating fair value and relies primarily on external information. Within the market

approach are two methods that we may use:

Guideline public company method—this method employs market multiples derived from market prices of stocks of companies that

are engaged in the same or similar lines of business and that are actively traded on a free and open market and the application of

the identified multiples to the corresponding measure of our reporting unit’s financial performance.

Guideline transaction method—this method relies on pricing multiples derived from transactions of significant interests in companies

engaged in the same or similar lines of business and the application of the identified multiples to the corresponding measure of our

reporting unit’s financial performance.

The market approach is only appropriate when the available external information is robust and deemed to be a reliable proxy for the

specific reporting unit being valued; however, these assessments may prove to be incomplete or inaccurate. Some of the more significant

estimates and assumptions inherent in this approach include: the selection of appropriate guideline companies and transactions and the

determination of applicable premiums and discounts based on any differences in ownership percentages, ownership rights, business

ownership forms or marketability between the reporting unit and the guideline companies and transactions.

• The income approach is a forward-looking approach to estimating fair value and relies primarily on internal forecasts. Within the income

approach, the method that we use is the discounted cash flow method. We start with a forecast of all the expected net cash flows

associated with the reporting unit, which includes the application of a terminal value, and then we apply a reporting unit-specific discount

rate to arrive at a net present value amount. Some of the more significant estimates and assumptions inherent in this approach include:

the amount and timing of the projected net cash flows, which includes the expected impact of technological risk and competitive, legal

and/or regulatory forces on the projections, as well as the selection of a long-term growth rate; the discount rate, which seeks to reflect

the various risks inherent in the projected cash flows; and the tax rate, which seeks to incorporate the geographic diversity of the

projected cash flows.