Pfizer 2013 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

2013 Financial Report

11

• Biocon Alliance––On March 12, 2012, Biocon and Pfizer concluded their October 18, 2010 alliance to commercialize Biocon’s biosimilar

versions of insulin and insulin analog products. The companies agreed that, due to the individual priorities for their respective biosimilars

businesses, each company would move forward independently.

• Alacer Corp. (Alacer)––On February 26, 2012, we completed our acquisition of Alacer, a company that manufactured, marketed and

distributed Emergen-C, a line of effervescent, powdered drink mix vitamin supplements. For additional information, see Notes to

Consolidated Financial Statements—Note 2A. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments:

Acquisitions.

• Ferrosan Holding A/S (Ferrosan)––On December 1, 2011, we completed our acquisition of the consumer healthcare business of

Ferrosan, a Danish company engaged in the sale of science-based consumer healthcare products, including dietary supplements and

lifestyle products, primarily in the Nordic region and the emerging markets of Russia and Central and Eastern Europe. For additional

information, see Notes to Consolidated Financial Statements—Note 2A. Acquisitions, Divestitures, Collaborative Arrangements and

Equity-Method Investments: Acquisitions.

• Excaliard Pharmaceuticals, Inc. (Excaliard)––On November 30, 2011, we completed our acquisition of Excaliard, a privately owned

biopharmaceutical company. Excaliard‘s lead compound, EXC-001, a Phase 2 compound, is an antisense oligonucleotide designed to

interrupt the process of skin fibrosis by inhibiting expression of connective tissue growth factor (CTGF). The total consideration for the

acquisition was approximately $174 million. For additional information, see Notes to Consolidated Financial Statements—Note 2A.

Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments: Acquisitions.

• GlycoMimetics, Inc. (GlycoMimetics)––In October 2011, we entered into an agreement with GlycoMimetics for their investigational

compound GMI-1070. GMI-1070 is a pan-selectin antagonist in development for the treatment of vaso-occlusive crisis associated with

sickle cell disease. GMI-1070 has received Orphan Drug and Fast Track status from the FDA. Under the terms of the agreement, Pfizer

received an exclusive worldwide license to GMI-1070 for vaso-occlusive crisis associated with sickle cell disease and for other diseases

for which the drug candidate may be developed. GlycoMimetics was responsible for completion of the Phase 2 trial under Pfizer’s

oversight, and Pfizer is responsible for all further development and commercialization. GlycoMimetics is entitled to payments up to

approximately $340 million, including an upfront payment as well as development, regulatory and commercial milestones. GlycoMimetics

is also eligible for royalties on any sales.

• Icagen, Inc. (Icagen)––On September 20, 2011, we completed our cash tender offer for the outstanding shares of Icagen, resulting in an

approximate 70% ownership of the outstanding shares of Icagen, a biopharmaceutical company focused on discovery, development and

commercialization of novel, orally-administered small molecule drugs that modulate ion channel targets. On October 27, 2011, we

acquired all of the remaining shares of Icagen. For additional information, see Notes to Consolidated Financial Statements—Note 2A.

Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments: Acquisitions.

• Capsugel––On August 1, 2011, we sold our Capsugel business for approximately $2.4 billion in cash. For additional information, see

Notes to Consolidated Financial Statements—Note 2B. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method

Investments: Divestitures.

• King Pharmaceuticals, Inc. (King)––On January 31, 2011 (the acquisition date), we completed a tender offer for the outstanding shares of

common stock of King and acquired approximately 92.5% of the outstanding shares for approximately $3.3 billion in cash. On

February 28, 2011, we acquired the remaining shares of King for approximately $300 million in cash. As a result, the total fair value of

consideration transferred for King was approximately $3.6 billion in cash ($3.2 billion, net of cash acquired). For additional information,

see Notes to Consolidated Financial Statements—Note 2A. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method

Investments: Acquisitions.

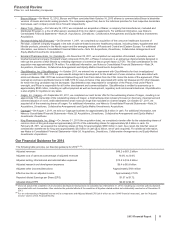

Our Financial Guidance for 2014

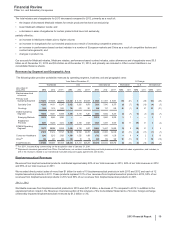

The following table provides our financial guidance for 2014(a), (b):

Adjusted revenues $49.2 to $51.2 billion

Adjusted cost of sales as a percentage of adjusted revenues 19.0% to 20.0%

Adjusted selling, informational and administrative expenses $13.5 to $14.5 billion

Adjusted research and development expenses $6.4 to $6.9 billion

Adjusted other (income)/deductions Approximately $100 million

Effective tax rate on adjusted income Approximately 27.0%

Reported diluted Earnings per Share (EPS) $1.57 to $1.72

Adjusted diluted EPS $2.20 to $2.30

(a) Does not assume the completion of any business-development transactions not completed as of December 31, 2013, including any one-time upfront payments

associated with such transactions. Also excludes the potential effects of the resolution of litigation-related matters not substantially resolved as of December 31,

2013.

(b) For an understanding of Adjusted income and its components and Adjusted diluted EPS (all of which are non-GAAP financial measures), see the "Adjusted

Income" section of this Financial Review.