Pfizer 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

2013 Financial Report

33

Key Activities

The targeted cost reductions were achieved through, among other things, the following actions:

• The closing of duplicative facilities and other site rationalization actions Company-wide, including research and development facilities,

manufacturing plants, sales offices and other corporate facilities. Among the more significant actions are the following:

Manufacturing: After the acquisition of Wyeth, our manufacturing sites totaled 59. Other acquisitions have added eight manufacturing

sites, and we have subsequently exited 11 sites, resulting in 56 sites supporting continuing operations as of December 31, 2013. Our

plant network strategy is expected to result in the exit of a further eight sites over the next several years. These site counts exclude five

Nutrition business-related manufacturing sites as the Nutrition business was sold in 2012, and exclude 24 Zoetis sites as the

disposition of the remaining 80.2% interest in Zoetis common stock was completed on June 24, 2013. See Notes to Consolidated

Financial Statements—Note 2B. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments: Divestitures

for more information.

Research and Development: After the acquisition of Wyeth, we operated in 20 R&D sites and announced that we would close a

number of sites. We have completed a number of site closures, including our Sandwich, U.K. research and development facility, except

for a small presence. In addition, in 2011, we rationalized several other sites to reduce and optimize the overall R&D footprint. We

disposed of our toxicology site in Catania, Italy; exited our R&D sites in Aberdeen and Gosport, U.K.; and disposed of a vacant site in

St. Louis, MO. We still maintain laboratories in St. Louis, MO that focus on the area of biologics. We are presently marketing for sale,

lease or sale/lease-back, either a portion of or all of certain of our R&D campuses. Locations with R&D operations are in the U.S.,

Europe, Canada and China, with five major research sites in addition to a number of specialized units. We also re-prioritized our

commitments to disease areas and have discontinued certain therapeutic areas and R&D programs as part of our R&D productivity

initiative. Our research primarily focuses on five high-priority areas that have a mix of small and large molecules—immunology and

inflammation; oncology; cardiovascular and metabolic diseases; neuroscience and pain; and vaccines. Other areas of focus include

rare diseases and biosimilars.

• Workforce Reductions: Across all areas of our business, we reduced our workforce and completed other organizational changes,

primarily in the U.S. field force, manufacturing, R&D and corporate functions. We identified areas for a reduction in workforce across all of

our businesses. From 2009, when the workforce was approximately 130,000, through the end of 2012, we achieved a reduction of

38,500, and by the end of 2013, we achieved a reduction of 52,300. In 2013, the workforce declined by 13,800, from 91,500 to 77,700,

primarily due to the full disposition of Zoetis, which resulted in a workforce reduction of approximately 9,300. The aforementioned

workforce reductions include the impact of acquisitions and divestitures subsequent to the Wyeth acquisition.

• The increased use of shared services and centers of excellence.

• Procurement savings.

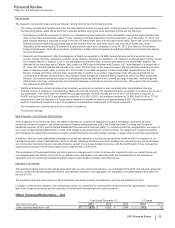

New Programs––2014 through 2016 Activities

At the beginning of our fiscal year 2014, we began to manage our commercial operations through a new global commercial structure

consisting of three businesses––the Global Innovative Pharmaceutical business (GIP); the Global Vaccines, Oncology and Consumer

Healthcare business (VOC); and the Global Established Pharmaceutical business (GEP). In connection with this reorganization, we expect to

incur costs of approximately $350 million in 2014-2016 related to the streamlining of certain functions, the realignment of regional locations

and colleagues to support the businesses, as well as implementing the necessary system changes to support future reporting requirements.

In addition, while we have substantially completed our previously described cost-reduction/productivity initiatives with the exception of our

manufacturing plant network rationalization, which is already underway and where execution timelines are necessarily long, we have tasked

our commercial, manufacturing and corporate divisions, as part of our annual budgeting process, with the identification of new cost-savings

opportunities and expect those new programs to be implemented in 2014-2016.

The development of these opportunities and action plans is underway and, in order to achieve the targeted savings, we expect that we will

incur approximately $2.4 billion in 2014-2016 (in addition to the anticipated costs associated with the reorganization of our commercial

operations and our continuing manufacturing plant network rationalization activities, described above).

Expected Cost Savings

The expected ongoing annual cost savings associated with our new commercial structure, our anticipated 2014-2016 cost-reduction programs

and our continuing manufacturing plant network rationalization activities, in the aggregate, are estimated to be approximately $2.9 billion by

the end of 2016.

The expected costs and costs savings in 2014 associated with these activities are reflected in our financial guidance for 2014.

In addition to these major initiatives, we continuously monitor our operations for cost reduction and/or productivity opportunities, especially in

light of the losses of exclusivity and the expiration of collaborative arrangements for various products.

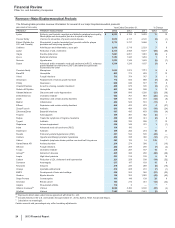

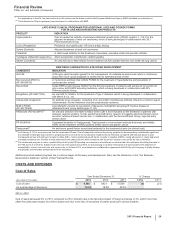

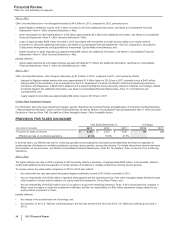

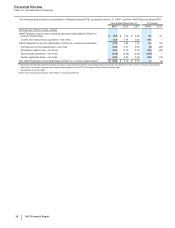

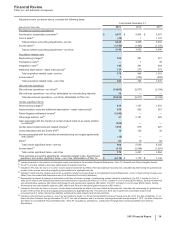

Other (Income)/Deductions––Net

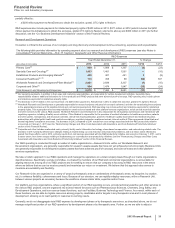

Year Ended December 31, % Change

(MILLIONS OF DOLLARS) 2013 2012 2011 13/12 12/11

Other (income)/deductions—net $(532)$4,022 $2,486 (113)62