Pfizer 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

62

2013 Financial Report

experience and expectations about the future. We adjust our estimates and assumptions when facts and circumstances indicate the need for

change. Those changes generally will be reflected in our financial statements on a prospective basis unless they are required to be treated

retrospectively under relevant accounting standards. It is possible that others, applying reasonable judgment to the same facts and

circumstances, could develop and support a range of alternative estimated amounts.

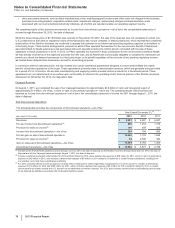

D. Acquisitions

Our consolidated financial statements include the operations of an acquired business after the completion of the acquisition. We account for

acquired businesses using the acquisition method of accounting, which requires, among other things, that most assets acquired and liabilities

assumed be recognized at their estimated fair values as of the acquisition date and that the fair value of acquired IPR&D be recorded on the

balance sheet. Transaction costs are expensed as incurred. Any excess of the consideration transferred over the assigned values of the net

assets acquired is recorded as goodwill. When we acquire net assets that do not constitute a business as defined in U.S. GAAP, no goodwill is

recognized and acquired IPR&D is expensed.

Contingent consideration in business acquisitions is included as part of the acquisition cost and is recognized at fair value as of the acquisition

date. Fair value is generally estimated by using a probability-weighted discounted cash flow approach. Any liability resulting from contingent

consideration is remeasured to fair value at each reporting date until the contingency is resolved. These changes in fair value are recognized

in earnings in Other (income)/deductions––net.

Amounts recorded for acquisitions can result from a complex series of judgments about future events and uncertainties and can rely heavily

on estimates and assumptions. For information about the risks associated with estimates and assumptions, see Note 1C. Basis of

Presentation and Significant Accounting Policies: Estimates and Assumptions.

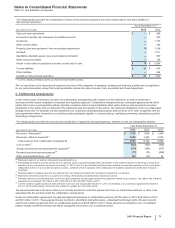

E. Fair Value

We are often required to measure certain assets and liabilities at fair value, either upon initial recognition or for subsequent accounting or

reporting. For example, we use fair value extensively in the initial recognition of net assets acquired in a business combination, when

measuring certain impairment losses and when accounting for and reporting on certain financial instruments. We estimate fair value using an

exit price approach, which requires, among other things, that we determine the price that would be received to sell an asset or paid to transfer

a liability in an orderly market. The determination of an exit price is considered from the perspective of market participants, considering the

highest and best use of non-financial assets and, for liabilities, assuming that the risk of non-performance will be the same before and after the

transfer.

When estimating fair value, depending on the nature and complexity of the asset or liability, we may use one or all of the following approaches:

• Income approach, which is based on the present value of a future stream of net cash flows.

• Market approach, which is based on market prices and other information from market transactions involving identical or comparable

assets or liabilities.

• Cost approach, which is based on the cost to acquire or construct comparable assets less an allowance for functional and/or

economic obsolescence.

Our fair value methodologies depend on the following types of inputs:

• Quoted prices for identical assets or liabilities in active markets (Level 1 inputs).

• Quoted prices for similar assets or liabilities in active markets or quoted prices for identical or similar assets or liabilities in markets

that are not active or are directly or indirectly observable (Level 2 inputs).

• Unobservable inputs that reflect estimates and assumptions (Level 3 inputs).

A single estimate of fair value can result from a complex series of judgments about future events and uncertainties and can rely heavily on

estimates and assumptions. For information about the risks associated with estimates and assumptions, see Note 1C. Basis of Presentation

and Significant Accounting Policies: Estimates and Assumptions.

F. Foreign Currency Translation

For most of our international operations, local currencies have been determined to be the functional currencies. We translate functional

currency assets and liabilities to their U.S. dollar equivalents at exchange rates in effect as of the balance sheet date and we translate

functional currency income and expense amounts to their U.S. dollar equivalents at average exchange rates for the period. The U.S. dollar

effects that arise from changing translation rates are recorded in Other comprehensive income/(loss). The effects of converting non-functional

currency monetary assets and liabilities into the functional currency are recorded in Other (income)/deductions––net. For operations in highly

inflationary economies, we translate monetary items at rates in effect as of the balance sheet date, with translation adjustments recorded in

Other (income)/deductions––net, and we translate non-monetary items at historical rates.

G. Revenues

Revenue Recognition—We record revenues from product sales when the goods are shipped and title passes to the customer. At the time of

sale, we also record estimates for a variety of sales deductions, such as sales rebates, discounts and incentives, and product returns. When

we cannot reasonably estimate the amount of future product returns and/or other sales deductions, we record revenues when the risk of