Pfizer 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

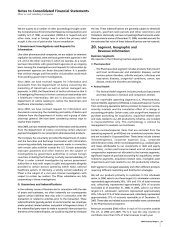

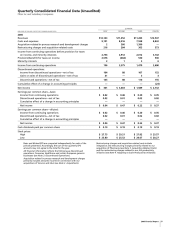

2006 Financial Report 79

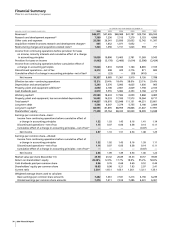

Financial Summary

Pfizer Inc and Subsidiary Companies

On April 16, 2003, Pfizer acquired Pharmacia Corporation in a

transaction accounted for as a purchase. All financial information

reflects the following as discontinued operations: our Consumer

Healthcare, in-vitro allergy and autoimmune diagnostic testing, certain

European generics, surgical ophthalmic, confectionery, shaving and fish-

care products businesses and the femhrt, Loestrin and Estrostep

women’s health product lines, as applicable.

In addition, depreciation and amortization includes amortization of

goodwill prior to our adoption of SFAS No. 142, Goodwill and Other

Intangible Assets, in 2002.

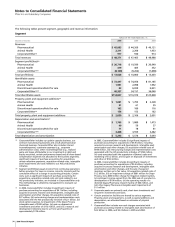

(a)

In 2001, we brought the accounting methodology pertaining to

accruals for estimated liabilities related to Medicaid discounts and

contract rebates of Warner-Lambert into conformity with our

historical method. This adjustment increased revenues in 2001 by

$175 million. 2001 data reflects reclassifications between

Revenues and Other costs and expenses of $108 million, as a result

of the January 1, 2002, adoption of EITF Issue No. 00-25, Vendor

Income Statement Characterization of Consideration Paid to a

Reseller of the Vendor’s Products.

(b)

Research and development expenses includes co-promotion

charges and milestone payments for intellectual property rights of

$292 million in 2006: $156 million in 2005; $160 million in 2004;

$380 million in 2003; $32 million in 2002; and $206 million in

2001.

(c)

In 2006, 2005, 2004 and 2003, we recorded charges for the

estimated portion of the purchase price of acquisitions allocated

to in-process research and development.

(d)

Restructuring charges and acquisition-related costs primarily

includes the following:

2006 — Restructuring charges of $1.3 billion related to our AtS

productivity initiative.

2005 — Integration costs of $532 million and restructuring

charges of $372 million related to our acquisition of Pharmacia in

2003 and restructuring charges of $438 million related to our AtS

productivity initiative.

2004 — Integration costs of $454 million and restructuring

charges of $680 million related to our acquisition of Pharmacia in

2003.

2003 — Integration costs of $808 million and restructuring

charges of $166 million related to our acquisition of Pharmacia in

2003.

2002 — Integration costs of $333 million and restructuring

charges of $167 million related to our merger with Warner-

Lambert in 2000 and pre-integration costs of $94 million related

to our pending acquisition of Pharmacia.

2001 — Integration costs of $428 million and restructuring

charges of $329 million related to our merger with Warner-

Lambert in 2000.

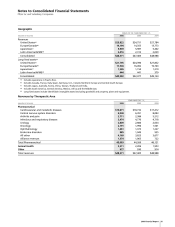

(e)

In 2005, as a result of adopting FIN 47, Accounting for Conditional

Asset Retirement Obligations, we recorded a non-cash pre-tax

charge of $40 million ($23 million, net of tax). In 2003, as a result

of adopting SFAS No. 143, Accounting for Asset Retirement

Obligations, we recorded a non-cash pre-tax charge of $47 million

($30 million, net of tax).

In 2002, as a result of adopting SFAS No. 142, Goodwill and Other

Intangible Assets, we recorded pre-tax charges of $565 million

($410 million, net of tax).

(f)

Includes discontinued operations, (see Notes to Consolidated

Financial Statements—Note 20. Segment, Geographic and

Revenue Information.)

(g)

For 2005 through 2001, includes assets held for sale of our

Consumer Healthcare business, and for 2004 through 2001, also

includes in-vitro allergy and autoimmune diagnostic testing,

surgical ophthalmic, certain European generics, confectionery and

shaving businesses (and the Tetra business in 2001) and the

femhrt, Loestrin and Estrostep women’s health product lines.

(h)

Defined as long-term debt, deferred taxes, minority interests and

shareholders’ equity.