Pfizer 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Financial Report 65

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

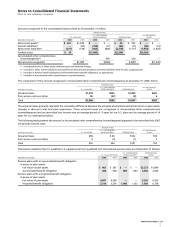

or settle the contracts for cash. Other contract terms are as

follows:

MAXIMUM

MATURITY

PER SHARE

AS OF DEC. 31,

PURCHASE

(YEARS)

(THOUSANDS OF SHARES) PRICE 2006 2005

3,051 $33.85 0.4 —

3,051 33.84 — 0.4

The financial statements include the following items related to

these contracts:

Prepaid expenses and taxes includes:

•

fair value of these contracts.

Other (income)/deductions—net includes:

•

changes in the fair value of these contracts.

E. Restricted Stock

Restricted stock grants, which entitle the holder to receive, at the

end of a vesting term, a specified number of shares of our

common stock, and which also entitle the holder to receive

dividends paid on such grants, are accounted for at fair value at

the date of grant.

Senior and key members of management received restricted

stock awards prior to 2005. In most instances, restricted stock

grants vest after three years of continuous service from the grant

date. The vesting terms are equal to the contractual terms. These

awards have not been significant.

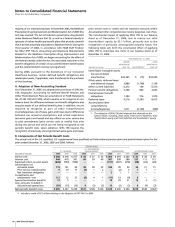

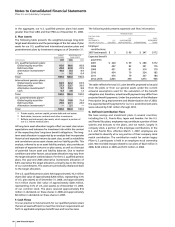

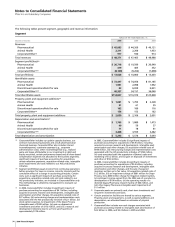

F. Transition Information

The following table shows the effect on results for 2005 and

2004 as if we had applied the fair-value-based recognition

provisions to measure stock-based compensation expense for the

option grants:

YEAR ENDED DEC. 31,

________________________________________

(MILLIONS OF DOLLARS, EXCEPT PER

COMMON SHARE DATA)

2005 2004

Net income available to common

shareholders used in the

calculation of basic earnings

per common share:

As reported under GAAP

(a)

$8,079 $11,357

Compensation expense—

net of tax

(b)

(457) (574)

Pro forma $7,622 $10,783

Basic earnings per common share:

As reported under GAAP

(a)

$ 1.10 $ 1.51

Compensation expense—

net of tax

(b)

(0.06) (0.08)

Pro forma $ 1.04 $ 1.43

Net income available to common

shareholders used in the

calculation of diluted earnings

per common share:

As reported under GAAP

(a)

$8,080 $11,356

Compensation expense—

net of tax

(b)

(457) (574)

Pro forma $7,623 $10,782

Diluted earnings per common share:

As reported under GAAP

(a)

$ 1.09 $ 1.49

Compensation expense—

net of tax

(b)

(0.06) (0.08)

Pro forma $ 1.03 $ 1.41

(a)

Includes stock-based compensation expense, net of related tax

effects, of $107 million in 2005 (of which $70 million related to

RSUs and a nominal amount was a result of acceleration of vesting

due to our AtS productivity initiative) and $38 million in 2004.

(b)

Pro forma compensation expense related to stock options that are

subject to accelerated vesting upon retirement is recognized over

the period of employment up to the vesting date of the grant.