Pfizer 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

continue to make the investments necessary to sustain long-term

growth. We remain confident that Pfizer has the organizational

strength and resilience, as well as the financial depth and flexibility,

to succeed in the long term. However, no assurance can be given

that the industry-wide factors described above under “Our

Operating Environment and Response to Key Opportunities and

Challenges” or other significant factors will not have a material

adverse effect on our business and financial results.

At current exchange rates, we expect revenues in 2007 and 2008

to be comparable to 2006 with the impact of loss of exclusivity

offset by new and major in-line product growth.

We expect cash flow from operations of $12.5 billion to $13.5

billion in 2007. We expect to purchase up to $10 billion of our stock

in 2007 under our expanded share-purchase program. At current

exchange rates, our expanded AtS productivity initiative is

expected to lower the 2007 SI&A pre-tax component of Adjusted

income by $500 million, compared to 2006, and to further reduce

operating expenses as a pre-tax component of Adjusted income

in 2008. By the end of 2008, we expect to achieve an absolute net

reduction of the pre-tax expense component of Adjusted income

of between $1.5 billion and $2.0 billion compared to 2006. At

current exchange rates, we expect to generate annual growth in

adjusted diluted EPS of 6% to 9% in each of 2007 and 2008. (For

an understanding of Adjusted income, see the “Adjusted Income”

section of this Financial Review.)

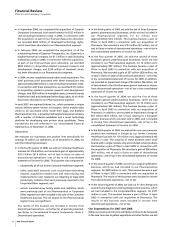

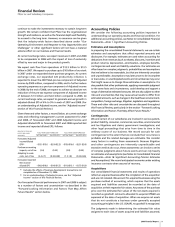

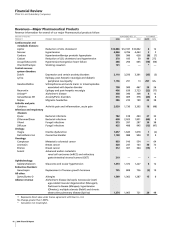

Given these and other factors, a reconciliation, at current exchange

rates and reflecting management’s current assessment for 2007

and 2008, of forecasted 2007 and 2008 Adjusted income and

Adjusted diluted EPS to forecasted 2007 and 2008 reported Net

income and reported diluted EPS, follows:

(BILLIONS OF DOLLARS,

FULL-YEAR 2007 FORECAST FULL-YEAR 2008 FORECAST

EXCEPT PER-SHARE

AMOUNTS)

NET INCOME

(a)

DILUTED EPS

(a)

NET INCOME

(a)

DILUTED EPS

(a)

Forecasted Adjusted

income/diluted

EPS

(b)

~$15.1-$15.6 ~$2.18-$2.25 ~$15.6-$16.6 ~$2.31-$2.45

Purchase accounting

impacts, net of tax (2.4) (0.35) (2.0) (0.30)

Adapting to scale

costs, net of tax (2.4-2.7) (0.35-0.38) (1.5-1.8) (0.22-0.26)

Forecasted reported

Net income/

diluted EPS ~$10.0-$10.8 ~$1.45-$1.55 ~$11.8-$13.1 ~$1.75-$1.93

(a)

Excludes the effects of business-development transactions not

completed as of December 31, 2006.

(b)

For an understanding of Adjusted income, see the “Adjusted

Income” section of this Financial Review.

Our forecasted financial performance in 2007 and 2008 is subject

to a number of factors and uncertainties—as described in the

“Forward-Looking Information and Factors That May Affect

Future Results” section below.

Accounting Policies

We consider the following accounting policies important in

understanding our operating results and financial condition. For

additional accounting policies, see Notes to Consolidated Financial

Statements—Note 1. Significant Accounting Policies.

Estimates and Assumptions

In preparing the consolidated financial statements, we use certain

estimates and assumptions that affect reported amounts and

disclosures. For example, estimates are used when accounting for

deductions from revenues (such as rebates, discounts, incentives and

product returns), depreciation, amortization, employee benefits,

contingencies and asset and liability valuations. Our estimates are

often based on complex judgments, probabilities and assumptions

that we believe to be reasonable, but that are inherently uncertain

and unpredictable. Assumptions may later prove to be incomplete

or inaccurate, or unanticipated events and circumstances may occur

that might cause us to change those estimates or assumptions. It is

also possible that other professionals, applying reasonable judgment

to the same facts and circumstances, could develop and support a

range of alternative estimated amounts. We are also subject to other

risks and uncertainties that may cause actual results to differ from

estimated amounts, such as changes in the healthcare environment,

competition, foreign exchange, litigation, legislation and regulations.

These and other risks and uncertainties are discussed throughout

this Financial Review, particularly in the section “Forward-Looking

Information and Factors That May Affect Future Results.”

Contingencies

We and certain of our subsidiaries are involved in various patent,

product liability, consumer, commercial, securities, environmental

and tax litigations and claims; government investigations; and

other legal proceedings that arise from time to time in the

ordinary course of our business. We record accruals for such

contingencies to the extent that we conclude their occurrence is

probable and the related damages are estimable. We consider

many factors in making these assessments. Because litigation

and other contingencies are inherently unpredictable and

excessive verdicts do occur, these assessments can involve a series

of complex judgments about future events and can rely heavily

on estimates and assumptions (see Notes to Consolidated Financial

Statements—Note 1B. Significant Accounting Policies: Estimates

and Assumptions). We record anticipated recoveries under existing

insurance contracts when assured of recovery.

Acquisitions

Our consolidated financial statements and results of operations

reflect an acquired business after the completion of the acquisition

and are not restated. We account for acquired businesses using the

purchase method of accounting, which requires that the assets

acquired and liabilities assumed be recorded at the date of

acquisition at their respective fair values. Any excess of the purchase

price over the estimated fair values of the net assets acquired is

recorded as goodwill. Amounts allocated to acquired IPR&D are

expensed at the date of acquisition. When we acquire net assets

that do not constitute a business under generally accepted

accounting principles in the U.S. (GAAP), no goodwill is recognized.

The judgments made in determining the estimated fair value

assigned to each class of assets acquired and liabilities assumed,

2006 Financial Report 9

Financial Review

Pfizer Inc and Subsidiary Companies