Pfizer 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Financial Report 45

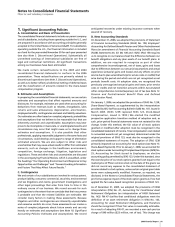

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

of business operations. For example, we entered into a number

of transition services agreements that will allow the buyer

sufficient time to prepare for the transfer of activities and to

limit the risk of business disruption. The nature, magnitude and

duration of the agreements vary depending on the specific

circumstances of the service, location and/or business need. The

agreements can include the following: manufacturing and

product supply, logistics, customer service, support of financial

processes, procurement, human resources, facilities

management, data collection and information services. Most

of these agreements extend for periods generally less than 24

months, but because of the inherent complexity of

manufacturing processes and the risk of product flow

disruption, the product supply agreements generally extend up

to 36 months.

For the period of time prior to the final transfer of these activities

to the buyer, we will continue to generate cash flows and to

report gross revenues, income and expense activity in

Discontinued operations—net of tax, although at a substantially

reduced level. After the transfer of these activities, these cash

flows and the income statement activity reported in Discontinued

operations—net of tax will be eliminated.

None of these agreements confers upon us the ability to

influence the operating and/or financial policies of the

Consumer Healthcare business under its new ownership.

•

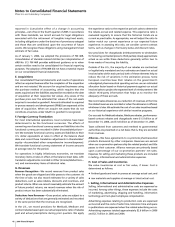

In the third quarter of 2005, we sold the last of three European

generic pharmaceutical businesses, which we had included in

our Pharmaceutical segment, for 4.7 million euro

(approximately $5.6 million). This business became a part of

Pfizer in April 2003 in connection with our acquisition of

Pharmacia. We recorded a loss of $3 million ($2 million, net of

tax) in Gains on sales of discontinued operations—net of tax in

the consolidated statement of income for 2005.

•

In the first quarter of 2005, we sold the second of three

European generic pharmaceutical businesses, which we had

included in our Pharmaceutical segment, for 70 million euro

(approximately $93 million). This business became a part of

Pfizer in April 2003 in connection with our acquisition of

Pharmacia. We recorded a gain of $57 million ($36 million, net

of tax) in Gains on sales of discontinued operations—net of tax

in the consolidated statement of income for 2005. In addition,

we recorded an impairment charge of $9 million ($6 million, net

of tax) related to the third European generic business in Income

from discontinued operations—net of tax in the consolidated

statement of income for 2005.

•

In the fourth quarter of 2004, we sold the first of three

European generic pharmaceutical businesses, which we had

included in our Pharmaceutical segment, for 53 million euro

(approximately $65 million). This business became a part of

Pfizer in April 2003 in connection with our acquisition of

Pharmacia. In addition, we recorded an impairment charge of

$61 million ($37 million, net of tax), relating to a European

generic business which was later sold in 2005, and is included

in Income from discontinued operations—net of tax in the

consolidated statement of income for 2004.

•

In the third quarter of 2004, we sold certain non-core consumer

product lines marketed in Europe by our former Consumer

Healthcare business for 135 million euro (approximately $163

million) in cash. The majority of these products were small

brands sold in single markets only and included certain products

that became a part of Pfizer in April 2003 in connection with

the acquisition of Pharmacia. We recorded a gain of $58 million

($41 million, net of tax) in Gains on sales of discontinued

operations—net of tax in the consolidated statement of income

for 2004.

•

In the second quarter of 2004, we sold our surgical ophthalmic

business, which we had included in our Pharmaceutical

segment, for $450 million in cash. This business became a part

of Pfizer in April 2003 in connection with our acquisition of

Pharmacia. The results of this business were included in Income

from discontinued operations—net of tax.

•

In the second quarter of 2004, we sold our in-vitro allergy

and autoimmune diagnostics testing (Diagnostics) business,

which we had included in the Corporate/Other segment, for

$575 million in cash. This business became a part of Pfizer in

April 2003 in connection with our acquisition of Pharmacia. The

results of this business were included in Income from

discontinued operations—net of tax.