Pfizer 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 2006 Financial Report

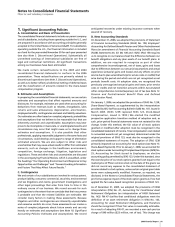

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

reported in Cumulative effect of a change in accounting

principles—net of tax in the fourth quarter of 2005. In accordance

with these standards, we record accruals for legal obligations

associated with the retirement of tangible long-lived assets,

including obligations under the doctrine of promissory estoppel

and those that are conditional upon the occurrence of future

events. We recognize these obligations using management’s best

estimate of fair value.

As of January 1, 2004, we adopted the provisions of FIN 46R,

Consolidation of Variable Interest Entities (an interpretation of

ARB No. 51). FIN 46R provides additional guidance as to when

certain entities need to be consolidated for financial reporting

purposes. The adoption of FIN 46R did not have a material impact

on our consolidated financial statements.

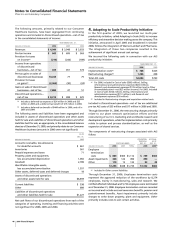

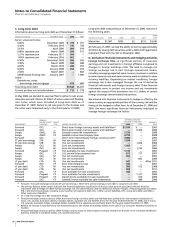

E. Acquisitions

Our consolidated financial statements and results of operations

reflect an acquired business after the completion of the acquisition

and are not restated. We account for acquired businesses using

the purchase method of accounting, which requires that the

assets acquired and the liabilities assumed be recorded at the date

of acquisition at their respective fair values. Any excess of the

purchase price over the estimated fair values of the net assets

acquired is recorded as goodwill. Amounts allocated to acquired

in-process research and development (IPR&D) are expensed at the

date of acquisition. When we acquire net assets that do not

constitute a business under GAAP, no goodwill is recognized.

F. Foreign Currency Translation

For most international operations, local currencies have been

determined to be the functional currencies. The effects of

converting non-functional currency assets and liabilities into the

functional currency are recorded in Other (income)/deductions—

net. We translate functional currency assets and liabilities to their

U.S. dollar equivalents at rates in effect at the balance sheet

date and record these translation adjustments in Shareholders’

equity—Accumulated other comprehensive income/(expense).

We translate functional currency statement of income amounts

at average rates for the period.

For operations in highly inflationary economies, we translate

monetary items at rates in effect at the balance sheet date, with

translation adjustments recorded in Other (income)/deductions—

net, and nonmonetary items at historical rates.

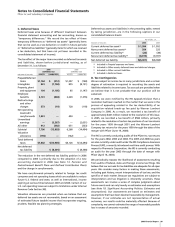

G. Revenues

Revenue Recognition—We record revenues from product sales

when the goods are shipped and title passes to the customer. At

the time of sale, we also record estimates for a variety of sales

deductions, such as sales rebates, discounts and incentives, and

product returns. When we cannot reasonably estimate the amount

of future product returns, we record revenues when the risk of

product return has been substantially eliminated.

Deductions from Revenues—Gross product sales are subject to a

variety of deductions that are generally estimated and recorded

in the same period that the revenues are recognized.

In the U.S., we record provisions for Medicaid, Medicare and

contract rebates based upon our actual experience ratio of rebates

paid and actual prescriptions during prior quarters. We apply

the experience ratio to the respective period’s sales to determine

the rebate accrual and related expense. This experience ratio is

evaluated regularly to ensure that the historical trends are as

current as practicable. As appropriate, we will adjust the ratio to

better match our current experience or our expected future

experience. In assessing this ratio, we consider current contract

terms, such as changes in formulary status and discount rates.

Our provisions for chargebacks (reimbursements to wholesalers

for honoring contracted prices to third parties) closely approximate

actual as we settle these deductions generally within two to

three weeks of incurring the liability.

Outside of the U.S., the majority of our rebates are contractual

or legislatively mandated and our estimates are based on actual

invoiced sales within each period; both of these elements help to

reduce the risk of variations in the estimation process. Some

European countries base their rebates on the government’s

unbudgeted pharmaceutical spending and we use an estimated

allocation factor based on historical payments against our actual

invoiced sales to project the expected level of reimbursement. We

obtain third-party information that helps us to monitor the

adequacy of these accruals.

We record sales allowances as a reduction of revenues at the time

the related revenues are recorded or when the allowance is offered,

whichever is later. We estimate the cost of our sales incentives based

on our historical experience with similar incentive programs.

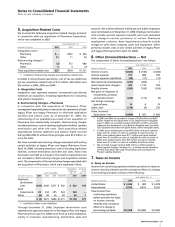

Our accruals for Medicaid rebates, Medicare rebates, performance-

based contract rebates and chargebacks were $1.5 billion as of

December 31, 2006, and $1.8 billion as of December 31, 2005.

Taxes collected from customers and remitted to governmental

authorities are presented on a net basis; that is, they are excluded

from revenues.

Alliances—We have agreements to co-promote pharmaceutical

products discovered by other companies. Revenues are earned

when our co-promotion partners ship the related product and title

passes to their customer. Alliance revenues are primarily based

upon a percentage of our co-promotion partners’ net sales.

Expenses for selling and marketing these products are included

in Selling, informational and administrative expenses.

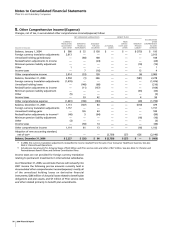

H. Cost of Sales and Inventories

We value inventories at cost or fair value, if lower. Cost is

determined as follows:

•

finished goods and work in process at average actual cost; and

•

raw materials and supplies at average or latest actual cost.

I. Selling, Informational and Administrative Expenses

Selling, informational and administrative costs are expensed as

incurred. Among other things, these expenses include the costs

of marketing, advertising, shipping and handling, information

technology and non-plant employee compensation.

Advertising expenses relating to production costs are expensed

as incurred and the costs of radio time, television time and space

in publications are expensed when the related advertising occurs.

Advertising expenses totaled approximately $2.6 billion in 2006

and $2.7 billion in 2005 and 2004.