Pfizer 2006 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

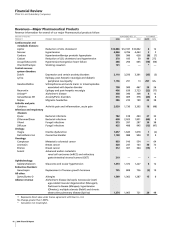

Pharmaceutical—Selected Product Descriptions

•

Lipitor, for the treatment of elevated LDL-cholesterol levels in

the blood, is the most widely used treatment for lowering

cholesterol and the best-selling pharmaceutical product of any

kind in the world, reaching about $12.9 billion in worldwide

sales in 2006, an increase of 6% compared to 2005. In the U.S.,

sales of $7.8 billion represent growth of 6% over 2005.

Internationally, Lipitor sales in 2006 increased 5% compared to

2005.

The growth in Lipitor revenues was driven by a combination of

factors, including dosage-form escalation and pricing (including

a favorable development in a pricing dispute in the U.S.), as well

as changes in rebate patterns. We continue to see aggressive

competition from branded and generic agents, particularly

when additional generic agents became available in the U.S.

near the end of 2006. Lipitor began to face competition in the

U.S. from generic pravastatin (Pravachol) in April 2006 and

generic simvastatin (Zocor) in June 2006, as well as other

competitive pressures. These launches have impacted the

dynamics of the statin market and increased pressure on Lipitor.

In October 2006, we launched a new advertising campaign

for Lipitor that highlights its strong benefit profile, particularly

its benefit in reducing the risk of heart attack and stroke in

patients with multiple risk factors for heart disease. This builds

on the consumer advertising that was implemented in April

2006. Scientific data continue to reinforce the trend toward the

use of higher dosages of statins for greater cholesterol

reduction.

See Notes to Consolidated Financial Statements—Note 19.

Legal Proceedings and Contingencies for a discussion of recent

developments with respect to certain patent litigation relating

to Lipitor.

•

Norvasc is the world’s most-prescribed branded medicine for

treating hypertension. Norvasc maintains exclusivity in many

major markets globally, including the U.S., Japan, Canada and

Australia, but has experienced patent expirations in many E.U.

countries. Norvasc sales in 2006 increased 3% compared to

2005. See Notes to Consolidated Financial Statements—Note 19.

Legal Proceedings and Contingencies for a discussion of recent

developments with respect to certain patent litigation relating

to Norvasc.

•

Caduet, single-pill therapy combining Norvasc and Lipitor,

recorded worldwide revenues of $370 million with a growth

rate of 99% in 2006 compared to 2005. Caduet was launched

in the U.S. in May 2004 and continues to grow at significantly

higher rates than the overall U.S. cardiovascular market. This

was largely driven by a more focused message platform and a

highly targeted consumer campaign. Caduet is available in

more than 15 other countries. Caduet has now received

approvals in 58 markets with drug applications pending in

nine additional markets and applications planned in 13 other

countries. In early 2007, Caduet is expected to be launched in

Spain and Taiwan.

See Notes to Consolidated Financial Statements—Note 19.

Legal Proceedings and Contingencies for a discussion of recent

developments with respect to certain patent litigation relating

to Caduet.

•

Chantix/Champix, the first new prescription treatment for

smoking cessation in nearly a decade, became available to

patients in the U.S. in August 2006. In September 2006, the

European Commission approved Champix in Europe for

smoking cessation and it was launched in select E.U. markets

in December 2006. Chantix/Champix is available with a patient

support plan, which smokers can customize to address their

individual behavioral triggers as they try to quit smoking. We

are pricing Chantix/Champix for a cash market, given the low

coverage for smoking-cessation products in medical plans.

•

Exubera, the first inhaled human insulin therapy for glycemic

control received approvals from both the FDA and the European

Commission for the treatment of adults with type 1 and type

2 diabetes in early 2006. Millions of people with diabetes are

not achieving or maintaining acceptable blood sugar levels,

despite the availability of current therapies. Exubera represents

a medical advance that offers to patients a novel method of

introducing insulin into their systems through the lungs. Since

May 2006, Exubera has been launched in Germany, Ireland, the

U.K. and in the U.S. Within the U.S., a comprehensive education

and training program for physicians was completed at the end

of 2006. During this time, we increased our understanding of

the fundamental drivers of the market. To further support

patients and healthcare professionals, Pfizer also provides a

24-hour-a-day, 7-day-a-week call center staffed by healthcare

professionals. Similar programs are also in place in European

markets where the product has been launched. An expanded

roll-out of Exubera to primary-care physicians in the U.S began

in January 2007. The manufacturing process for Exubera is

complex, involving novel technology. Initial supplies of Exubera

were available across the U.S. beginning in September 2006.

Sales to date have been minimal, reflecting a phased roll-out

of this product in connection with our education and training

programs for healthcare specialists.

•

Zoloft, which lost exclusivity in the U.S. in June 2006 and earlier

in many European markets, experienced a 35% revenue decline

in 2006 compared to 2005. It is indicated for the treatment of

major depressive disorder, panic disorder, obsessive-compulsive

disorder (OCD) in adults and children, post-traumatic stress

disorder (PTSD), premenstrual dysphoric disorder (PMDD) and

social anxiety disorder (SAD). Zoloft is approved for acute and

long-term use in all of these indications, with the exception of

PMDD. Zoloft was launched in Japan in July 2006 for the

indications of depression/depressed state and panic disorder.

•

Geodon/Zeldox, a psychotropic agent, is a dopamine and

serotonin receptor antagonist indicated for the treatment of

schizophrenia and acute manic or mixed episodes associated

with bipolar disorder. It is available in both an oral capsule and

rapid-acting intramuscular formulation. In the U.S., Geodon had

a new prescription share of 6.8% for December 2006. Geodon

has become the fastest growing anti-psychotic medication in

the U.S. In 2006, total Geodon worldwide sales grew 29%

compared to 2005. Geodon growth was driven by the

recognition of its efficacy by prescribers as clinical experience

increased, and by a favorable metabolic profile.

2006 Financial Report 17

Financial Review

Pfizer Inc and Subsidiary Companies