Pfizer 2006 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Financial Report 15

Financial Review

Pfizer Inc and Subsidiary Companies

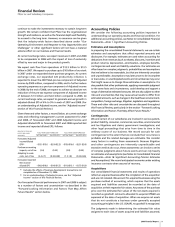

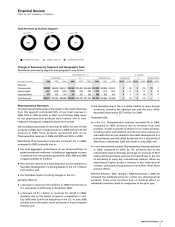

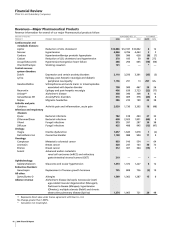

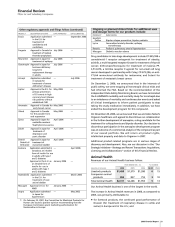

Change in Revenues by Segment and Geographic Area

Worldwide revenues by segment and geographic area follow:

YEAR ENDED DEC. 31, % CHANGE

____________________________________________________________________________________________ _______________________________________________

WORLDWIDE U.S. INTERNATIONAL WORLDWIDE U.S. INTERNATIONAL

___________________________ ___________________________ ___________________________ ______________ ______________ _______________

(MILLIONS OF DOLLARS) 2006 2005 2004 2006 2005 2004 2006 2005 2004 06/05 05/04 06/05 05/04 06/05 05/04

Revenues:

Pharmaceutical $45,083 $44,269 $46,121 $24,503 $23,465 $26,606 $20,580 $20,804 $19,515 2 (4) 4 (12) (1) 7

Animal Health 2,311 2,206 1,953 1,032 993 878 1,279 1,213 1,075 5 13 4 13 5 13

Corporate/Other 977 930 914 287 287 298 690 643 616 5 2 — (4) 7 4

Total Revenues $48,371 $47,405 $48,988 $25,822 $24,745 $27,782 $22,549 $22,660 $21,206 2 (3) 4 (11) — 7

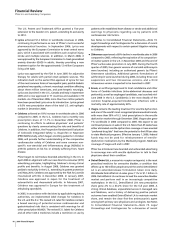

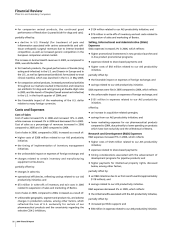

Total Revenues by Business Segment

93.2% 93.4% 94.1%

4.8%

2.0%

4.6%

2.0%

4.0%

1.9%

2006 2005 2004

PHARMACEUTICAL ANIMAL HEALTH CORPORATE/OTHER

Pharmaceutical Revenues

Our pharmaceutical business is the largest in the world. Revenues

from this segment contributed 93% of our total revenues in

2006, 93% in 2005 and 94% in 2004. As of October 2006, seven

of our pharmaceutical products were number one in their

respective therapeutic categories based on revenues.

We recorded product sales of more than $1 billion for each of nine

products in 2006, each of eight products in 2005 and each of ten

products in 2004. These products represented 64% of our

Pharmaceutical revenues in 2006 and 2005 and 69% in 2004.

Worldwide Pharmaceutical revenues increased 2% in 2006,

compared to 2005, primarily due to:

•

the solid aggregate performance of our broad portfolio of

patent-protected medicines, including an aggregate increase

in revenues from new products launched in 2004, 2005 and 2006

of approximately $1.5 billion;

•

the one-time reversal of a sales deduction accrual related to a

favorable development in a pricing dispute in the U.S. of about

$170 million; and

•

the favorable impact of pricing changes in the U.S.,

partially offset by:

•

a decrease in revenues of $1.4 billion in 2006 from the loss of

U.S. exclusivity on Zithromax in November 2005;

•

a decrease by $1.1 billion in revenues for Zoloft in 2006,

primarily due to the launch of generic competition in mid-

July 2006 after Zoloft lost exclusivity in the U.S. in June 2006

and also due to the earlier loss of exclusivity in many European

markets; and

•

the strengthening of the U.S. dollar relative to many foreign

currencies, primarily the Japanese yen and the euro, which

decreased revenues by $277 million for 2006.

Geographically:

•

in the U.S., Pharmaceutical revenues increased 4% in 2006,

compared to 2005, primarily due to revenues from new

products, as well as growth in several of our major products,

including Lipitor and Celebrex, and the one-time reversal of a

sales deduction accrual related to favorable development in a

pricing dispute, partially offset by the loss of U.S. exclusivity of

Zithromax in November 2005 and Zoloft in June 2006; and

•

in our international markets, Pharmaceutical revenues declined

in 2006, compared to 2005, by 1%, primarily due to the

unfavorable impact of foreign exchange on revenues of $277

million (0.6%) and lower revenues from Zoloft due to the loss

of exclusivity in many key international markets. While we

experienced higher product volumes in our international

markets, continued pricing pressures more than offset those

positive effects.

Effective January 1, 2007, January 1, 2006 and January 1, 2005, we

increased the published prices for certain U.S. pharmaceutical

products. These price increases had no material effect on

wholesaler inventory levels in comparison to the prior year.