Pfizer 2006 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

R&D expense also includes payments for intellectual property

rights of $292 million in 2006, $156 million in 2005 and $160

million in 2004. (For further discussion, see the “Product

Developments” section of this Financial Review.)

Acquisition-Related In-Process Research and

Development Charges

The estimated value of acquisition-related IPR&D is expensed at

the acquisition date. In 2006, we expensed $835 million of IPR&D,

primarily related to our acquisitions of Rinat and PowderMed. In

2005, we expensed $1.7 billion of IPR&D, primarily related to

our acquisitions of Vicuron and Idun. In 2004, we expensed $1.1

billion of IPR&D, related primarily to our acquisition of Esperion.

Adapting to Scale Productivity Initiative

In connection with the AtS productivity initiative, which was

launched in early 2005 and broadened in October 2006, our

management has performed a comprehensive review of our

processes, organizations, systems and decision-making procedures

in a company-wide effort to improve performance and efficiency.

On January 22, 2007, we announced additional plans to

fundamentally change the way we run our business to meet the

challenges of a changing business environment and to take

advantage of the diverse opportunities in the marketplace. We

intend to generate cost savings through site rationalization in

research and manufacturing, streamlined organizational structures,

sales force and staff function reductions, and increased outsourcing

and procurement savings. Compared to 2006, we plan to achieve

a decrease in the SI&A pre-tax component of Adjusted income of

$500 million by the end of 2007, and an absolute net reduction of

the pre-tax expense component of Adjusted income of between

$1.5 billion and $2.0 billion by the end of 2008. (For an

understanding of Adjusted income, see the “Adjusted Income”

section of this Financial Review.) Savings realized during 2006

totaled approximately $2.6 billion. The actions associated with

the expanded AtS productivity initiative include restructuring

charges, such as asset impairments, exit costs and severance costs

(including any related impacts to our benefit plans, including

settlements and curtailments) and associated implementation

costs, such as accelerated depreciation charges, primarily associated

with plant network optimization efforts, and expenses associated

with system and process standardization and the expansion of

shared services (see Notes to Consolidated Financial Statements—

Note 4. Adapting to Scale Productivity Initiative).

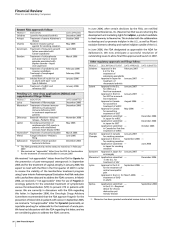

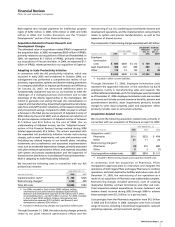

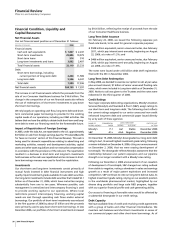

We incurred the following costs in connection with our AtS

productivity initiative:

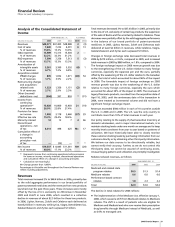

YEAR ENDED DEC. 31,

_____________________________

(MILLIONS OF DOLLARS) 2006 2005

Implementation costs

(a)

$ 788 $325

Restructuring charges

(b)

1,296 438

Total AtS costs $2,084 $763

(a)

For 2006, included in Cost of sales ($392 million), Selling,

informational and administrative expenses ($243 million),

Research and development expenses ($176 million) and in Other

(income)/deductions—net ($23 million income). For 2005, included

in Cost of sales ($124 million), Selling, informational and

administrative expenses ($151 million), and Research and

development expenses ($50 million).

(b)

Included in Restructuring charges and acquisition-related costs.

Through December 31, 2006, the restructuring charges primarily

relate to our plant network optimization efforts and the

restructuring of our U.S. marketing and worldwide research and

development operations, and the implementation costs primarily

relate to system and process standardization, as well as the

expansion of shared services.

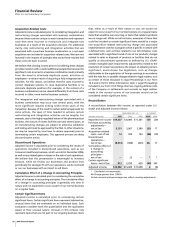

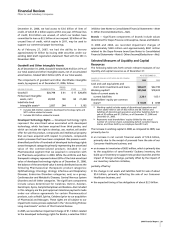

The components of restructuring charges associated with AtS follow:

UTILIZATION ACCRUAL

THROUGH AS OF

COSTS INCURRED

DEC. 31, DEC. 31,___________________________________

(MILLIONS OF DOLLARS) 2006 2005 TOTAL 2006 2006

(a)

Employee

termination

costs $ 809 $303 $1,112 $ 749 $363

Asset impairments

368 122 490 490 —

Other 119 13 132 93 39

$1,296 $438 $1,734 $1,332 $402

(a)

Included in Other current liabilities.

Through December 31, 2006, Employee termination costs

represent the approved reduction of the workforce by 8,274

employees, mainly in manufacturing, sales and research. We

notified affected individuals and 5,732 employees were terminated

as of December 31, 2006. Employee termination costs are recorded

as incurred and include accrued severance benefits, pension and

postretirement benefits. Asset impairments primarily include

charges to write down property, plant and equipment. Other

primarily includes costs to exit certain activities.

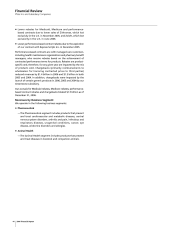

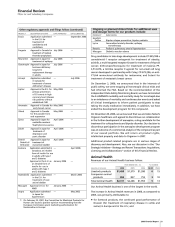

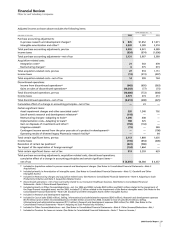

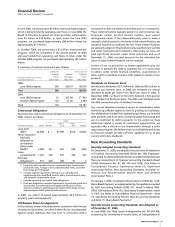

Acquisition-Related Costs

We incurred the following acquisition-related costs, primarily in

connection with our acquisition of Pharmacia on April 16, 2003:

YEAR ENDED DEC. 31,

__________________________________________

(MILLIONS OF DOLLARS) 2006 2005 2004

Integration costs

(a)

:

Pharmacia $ — $532 $ 454

Other 21 11 24

Restructuring charges

(a)

:

Pharmacia (3) 372 680

Other 9 3 (7)

Total acquisition-related costs $27 $918 $1,151

(a)

Included in Restructuring charges and acquisition-related costs.

In connection with the acquisition of Pharmacia, Pfizer

management approved plans to restructure and integrate the

operations of both legacy Pfizer and legacy Pharmacia to combine

operations, eliminate duplicative facilities and reduce costs. As of

December 31, 2005, the restructuring of our operations as a

result of our acquisition of Pharmacia was substantially complete.

Restructuring charges included severance, costs of vacating

duplicative facilities, contract termination and other exit costs.

Total acquisition-related expenditures (income statement and

balance sheet) incurred during 2002 through 2006 to achieve

these synergies were $5.2 billion, on a pre-tax basis.

Cost synergies from the Pharmacia acquisition were $4.2 billion

in 2005 and $3.6 billion in 2004. Synergies come from a broad

range of sources, including a streamlined organization, reduced

operating expenses, and procurement savings.

2006 Financial Report 23

Financial Review

Pfizer Inc and Subsidiary Companies