Pfizer 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 2006 Financial Report

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

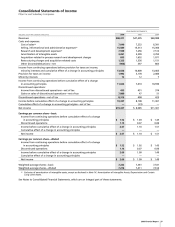

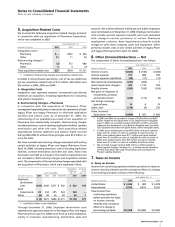

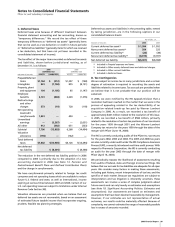

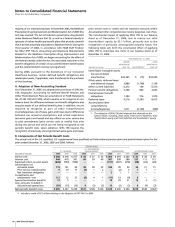

The following amounts, primarily related to our Consumer

Healthcare business, have been segregated from continuing

operations and included in Discontinued operations—net of tax

in the consolidated statements of income:

YEAR ENDED DEC. 31,

_____________________________________________________

(MILLIONS OF DOLLARS) 2006 2005 2004

Revenues $ 4,044 $ 3,948 $ 3,933

Pre-tax income $ 643 $ 695 $ 563

Provision for taxes

on income

(a)

(210) (244) (189)

Income from operations

of discontinued

businesses—net of tax 433 451 374

Pre-tax gains on sales of

discontinued businesses 10,243 77 75

Provision for taxes

on gains

(b)

(2,363) (30) (24)

Gains on sales of discontinued

businesses—net of tax 7,880 47 51

Discontinued operations—

net of tax $ 8,313 $ 498 $ 425

(a)

Includes a deferred tax expense of $24 million in 2006 and $25

million in 2005 and a deferred tax benefit of $15 million in 2004.

(b)

Includes a deferred tax benefit of $444 million in 2006, and nil in

2005 and 2004.

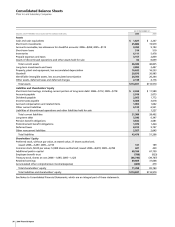

The following assets and liabilities have been segregated and

included in Assets of discontinued operations and other assets

held for sale and Liabilities of discontinued operations and other

liabilities held for sale, as appropriate, in the consolidated balance

sheet as of December 31, 2005, and primarily relate to our Consumer

Healthcare business (amounts in 2006 were not significant):

AS OF

DEC. 31,

(MILLIONS OF DOLLARS) 2005

Accounts receivable, less allowance

for doubtful accounts $ 661

Inventories 561

Prepaid expenses and taxes 71

Property, plant and equipment,

less accumulated depreciation 1,002

Goodwill 2,789

Identifiable intangible assets,

less accumulated amortization 1,557

Other assets, deferred taxes and deferred charges 18

Assets of discontinued operations

and other assets held for sale $6,659

Current liabilities $ 538

Other 689

Liabilities of discontinued operations

and other liabilities held for sale $1,227

Net cash flows of our discontinued operations from each of the

categories of operating, investing and financing activities were

not significant for 2006, 2005 and 2004.

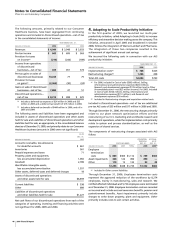

4.

Adapting to Scale Productivity Initiative

In the first quarter of 2005, we launched our multi-year

productivity initiative, called Adapting to Scale (AtS), to increase

efficiency and streamline decision-making across the company. This

initiative, announced in April 2005 and broadened in October

2006, follows the integration of Warner-Lambert and Pharmacia.

The integration of those two companies resulted in the

achievement of significant annual cost savings.

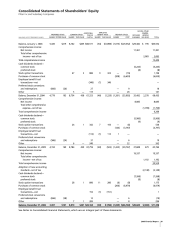

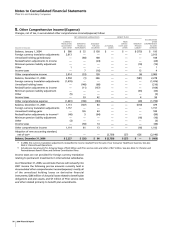

We incurred the following costs in connection with our AtS

productivity initiative:

YEAR ENDED DEC. 31,

__________________________________

(MILLIONS OF DOLLARS) 2006 2005

Implementation costs

(a)

$ 788 $325

Restructuring charges

(b)

1,296 438

Total AtS costs $2,084 $763

(a)

For 2006, included in Cost of sales ($392 million), Selling,

informational and administrative expenses ($243 million),

Research and development expenses ($176 million) and in Other

(income)/deductions—net ($23 million income). For 2005, included

in Cost of sales ($124 million), Selling, informational and

administrative expenses ($151 million), and Research and

development expenses ($50 million).

(b)

Included in Restructuring charges and acquisition-related costs.

Included in Discontinued operations—net of tax are additional

pre-tax AtS costs of $35 million and $17 million in 2006 and 2005.

Through December 31, 2006, the restructuring charges primarily

relate to our plant network optimization efforts and the

restructuring of our U.S. marketing and worldwide research and

development operations, while the implementation costs primarily

relate to system and process standardization, as well as the

expansion of shared services.

The components of restructuring charges associated with AtS

follow:

UTILIZATION ACCRUAL

THROUGH AS OF

COSTS INCURRED DEC. 31, DEC. 31,

_________________________ ___________________

(MILLIONS OF DOLLARS) 2006 2005 TOTAL 2006 2006

(a)

Employee

termination

costs $ 809 $303 $1,112 $ 749 $363

Asset impairments 368 122 490 490 —

Other 119 13 132 93 39

$1,296 $438 $1,734 $1,332 $402

(a)

Included in Other current liabilities.

Through December 31, 2006, Employee termination costs

represent the approved reduction of the workforce by 8,274

employees, mainly in manufacturing, sales and research. We

notified affected individuals and 5,732 employees were terminated

as of December 31, 2006. Employee termination costs are recorded

as incurred and include accrued severance benefits, pension and

postretirement benefits. Asset impairments primarily include

charges to write down property, plant and equipment. Other

primarily includes costs to exit certain activities.