Pfizer 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Financial Report 57

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

The increase in the 2006 U.S. qualified pension plans’ net periodic

benefit cost compared to 2005 was largely driven by changes in

assumptions used, such as the decline in the discount rate and the

adoption of updated mortality (life expectancy) assumptions.

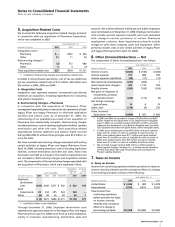

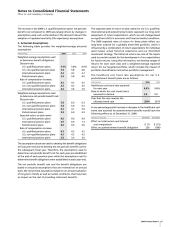

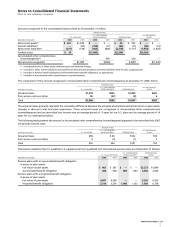

C. Actuarial Assumptions

The following table provides the weighted-average actuarial

assumptions:

(PERCENTAGES) 2006 2005 2004

Weighted-average assumptions used

to determine benefit obligations:

Discount rate:

U.S. qualified pension plans 5.9% 5.8% 6.0%

U.S. non-qualified pension plans 5.9 5.8 6.0

International pension plans 4.4 4.3 4.7

Postretirement plans 5.9 5.8 6.0

Rate of compensation increase:

U.S. qualified pension plans 4.5 4.5 4.5

U.S. non-qualified pension plans 4.5 4.5 4.5

International pension plans 3.6 3.6 3.6

Weighted-average assumptions used

to determine net periodic benefit cost:

Discount rate:

U.S. qualified pension plans 5.8 6.0 6.3

U.S. non-qualified pension plans 5.8 6.0 6.3

International pension plans 4.3 4.7 5.0

Postretirement plans 5.8 6.0 6.3

Expected return on plan assets:

U.S. qualified pension plans 9.0 9.0 9.0

International pension plans 6.9 6.9 7.3

Postretirement plans 9.0 9.0 9.0

Rate of compensation increase:

U.S. qualified pension plans 4.5 4.5 4.5

U.S. non-qualified pension plans 4.5 4.5 4.5

International pension plans 3.6 3.6 3.6

The assumptions above are used to develop the benefit obligations

at fiscal year-end and to develop the net periodic benefit cost for

the subsequent fiscal year. Therefore, the assumptions used to

determine net periodic benefit cost for each year are established

at the end of each previous year, while the assumptions used to

determine benefit obligations were established at each year-end.

The net periodic benefit cost and the benefit obligations are

based on actuarial assumptions that are reviewed on an annual

basis. We revise these assumptions based on an annual evaluation

of long-term trends, as well as market conditions, that may have

an impact on the cost of providing retirement benefits.

The expected rates of return on plan assets for our U.S. qualified,

international and postretirement plans represent our long-term

assessment of return expectations, which we will change based

on significant shifts in economic and financial market conditions.

The 2006 expected rates of return for these plans reflect our

long-term outlook for a globally diversified portfolio, which is

influenced by a combination of return expectations for individual

asset classes, actual historical experience and our diversified

investment strategy. The historical returns are one of the inputs

used to provide context for the development of our expectations

for future returns. Using this information, we develop ranges of

returns for each asset class and a weighted-average expected

return for our targeted portfolio, which includes the impact of

portfolio diversification and active portfolio management.

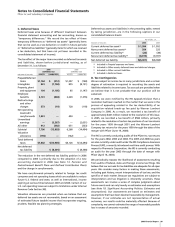

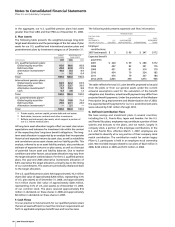

The healthcare cost trend rate assumptions for our U.S.

postretirement benefit plans are as follows:

(PERCENTAGES) 2006 2005

Healthcare cost trend rate assumed

for next year 9.9% 9.8%

Rate to which the cost trend rate is

assumed to decline 5.0 5.0

Year that the rate reaches the

ultimate trend rate 2014 2013

A one-percentage-point increase or decrease in the healthcare cost

trend rate assumed for postretirement benefits would have the

following effects as of December 31, 2006:

(MILLIONS OF DOLLARS)

INCREASE DECREASE

Effect on total service and interest

cost components $ 19 $ (15)

Effect on postretirement benefit obligation 226 (186)