Pfizer 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

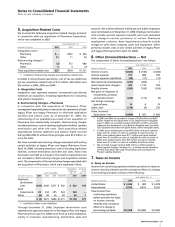

44 2006 Financial Report

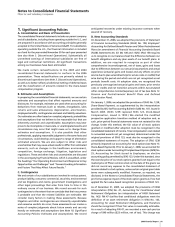

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

production technology, to manufacture and sell Exubera, an

inhaled form of insulin for use in adults with type 1 and type

2 diabetes, and the insulin-production business and facilities

located in Frankfurt, Germany, previously jointly owned by

Pfizer and sanofi-aventis, for approximately $1.4 billion in cash

(including transaction costs). In 2006, in connection with the

acquisition, as part of our final purchase price allocation, we

recorded $1.0 billion of developed technology rights, $218

million of inventory, and $166 million of Goodwill, all of which

have been allocated to our Pharmaceutical segment. The

amortization of the developed technology rights is primarily

included in Cost of sales. Prior to the acquisition, in connection

with our collaboration agreement with sanofi-aventis, we

recorded a research and development milestone due to us

from sanofi-aventis of $118 million ($71 million, after tax) in

Research and development expenses upon the approval of

Exubera in January 2006 by the FDA.

•

In December 2006, we completed the acquisition of PowderMed

Ltd. (PowderMed), a U.K. company which specializes in the

emerging science of DNA-based vaccines for the treatment of

influenza and chronic viral diseases, and in May 2006, we

completed the acquisition of Rinat Neurosciences Corp. (Rinat),

a biologics company with several new central-nervous-system

product candidates. In 2006, the aggregate cost of these and

other smaller acquisitions was approximately $880 million. In

connection with those transactions, we recorded $835 million in

Acquisition-related in-process research and development charges.

•

In September 2005, we completed the acquisition of all of the

outstanding shares of Vicuron Pharmaceuticals Inc. (Vicuron), a

biopharmaceutical company focused on the development of

novel anti-infectives, for approximately $1.9 billion in cash

(including transaction costs). In connection with the acquisition,

as part of our final purchase price allocation, we recorded $1.4

billion in Acquisition-related in-process research and development

charges, and $243 million of Goodwill, which has been allocated

to our Pharmaceutical segment.

•

In April 2005, we completed the acquisition of Idun

Pharmaceuticals Inc. (Idun), a biopharmaceutical company

focused on the discovery and development of therapies to

control apoptosis, and in August 2005, we completed the

acquisition of Bioren Inc. (Bioren), which focuses on technology

for optimizing antibodies. In 2005, the aggregate cost of these

and other smaller acquisitions was approximately $340 million

in cash (including transaction costs). In connection with these

transactions, we recorded $262 million in Acquisition-related in-

process research and development charges.

•

In September 2004, we completed the acquisition of

Campto/Camptosar (irinotecan), from sanofi-aventis for $525

million in cash (including transaction costs). In 2004, in

connection with the acquisition, as part of our final purchase

price allocation, we recorded $445 million of developed

technology rights, which have been allocated to our

Pharmaceutical segment.

•

In February 2004, we completed the acquisition of all the

outstanding shares of Esperion Therapeutics, Inc. (Esperion), a

biopharmaceutical company, for $1.3 billion in cash (including

transaction costs). In 2004, in connection with the acquisition,

as part of our final purchase price allocation, we recorded

$920 million in Acquisition-related in-process research and

development charges, and $239 million of Goodwill, which

has been allocated to our Pharmaceutical segment.

•

In 2004, we also completed several other small acquisitions. The

total purchase price associated with these transactions was

approximately $430 million in cash (including transaction costs).

In connection with these transactions, we recorded $151 million

in Acquisition-related in-process research and development

charges, and $206 million in intangible assets, primarily brands

(indefinite-lived) and developed technology rights, all of which

have been allocated to our Pharmaceutical segment.

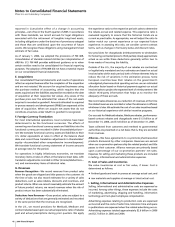

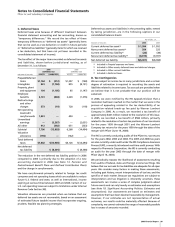

3. Discontinued Operations

We evaluate our businesses and product lines periodically for

strategic fit within our operations. As of December 31, 2006, we

sold the following:

•

In the fourth quarter of 2006, we sold our Consumer Healthcare

business for $16.6 billion, and recorded a gain of approximately

$10.2 billion ($7.9 billion, net of tax) in Gains on sales of

discontinued operations—net of tax in the consolidated

statement of income for 2006. This business was composed of:

substantially all of our former Consumer Healthcare segment;

other associated amounts, such as purchase-accounting

impacts, acquisition-related costs and restructuring and

implementation costs related to our Adapting to Scale (AtS)

productivity initiative that were previously reported in the

Corporate/Other segment; and

certain manufacturing facility assets and liabilities, which

were previously part of our Pharmaceutical or Corporate/

Other segment but were included in the sale of our Consumer

Healthcare business. The net impact to the Pharmaceutical

segment was not significant.

The results of this business are included in Income from

discontinued operations—net of tax for all periods presented.

Legal title to certain assets and legal control of the business in

certain non-U.S. jurisdictions did not transfer to the buyer on the

closing date of December 20 because the satisfaction of specific

local requirements was pending. These operations represent a

small portion of our Consumer Healthcare business and all are

expected to close within one year of the transaction date, most

within a few months. In order to ensure that the buyer was

placed in the same economic position as if the assets, operations

and activities of those businesses had been transferred on that

date, we entered into an agreement that passed the risks and

rewards of ownership to the buyer from December 20. We have

treated these delayed-close businesses as sold for accounting

purposes.

For a period of time, we will continue to generate cash flows

and to report income statement activity in Discontinued

operations—net of tax that are associated with our former

Consumer Healthcare business. The activities that will give rise

to these impacts are transitional in nature and generally result

from agreements that ensure and facilitate the orderly transfer