Pfizer 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

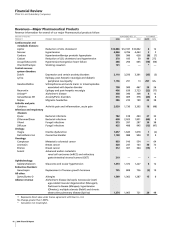

developments with respect to certain patent litigation relating

to Detrol/Detrol LA.

•

Camptosar is indicated as first-line therapy for metastatic

colorectal cancer in combination with 5-fluorouracil and

leucovorin. It is also indicated for patients in whom metastatic

colorectal cancer has recurred or progressed despite following

initial fluorouracil-based therapy. Camptosar is for intravenous

use only. Revenues of $903 million in 2006 were comparable to

2005. The National Comprehensive Cancer Network (NCCN), an

alliance of 20 of the world’s leading cancer centers, has issued

guidelines recommending Camptosar as an option across all

lines of treatment for advanced colorectal cancer.

•

Sutent is an oral multi-kinase inhibitor that combines anti-

angiogenic and anti-tumor activity to inhibit the blood supply

to tumors and has direct anti-tumor effects. Sutent was

approved by the FDA and launched in the U.S. in January 2006

for advanced renal cell carcinoma, including metastatic renal

cell carcinoma, and gastrointestinal stromal tumors (GIST) after

disease progression on or intolerance to imatinib mesylate.

Since approval, Sutent has been used to treat more than 7,500

patients in the U.S. In January 2007, Sutent received full

marketing authorization and extension of the indication to first-

line treatment of advanced and/or metastatic renal cell

carcinoma (mRCC), as well as approval as a second-line

treatment for GIST, in the E.U.

Data from a first-line Phase 3 trial was published in the

January 11, 2007, New England Journal of Medicine, in which

Sutent doubled progression-free survival versus interferon-

alpha (11 months vs. 5 months). In November 2006, the NCCN

published updated kidney cancer guidelines, confirming Sutent

as an appropriate first-line therapy. In its other core indication,

Sutent is the first approved agent to show a clinical benefit after

imatinib failure in GIST. As reported in the October 10, 2006,

issue of The Lancet, Sutent treatment produced a four fold

increase in median time to tumor progression vs. placebo (27.3

weeks vs. 6.4 weeks). Sutent has received approvals or

registration in several countries in Asia and Latin America and

is expected to launch in many more markets worldwide in

2007. Sutent recorded $219 million in sales worldwide in 2006

and had been used to treat more than 15,000 patients as of

December 2006.

•

Xalatan/Xalacom, a prostaglandin analogue used to lower the

intraocular pressure associated with glaucoma and ocular

hypertension, is the most-prescribed branded glaucoma

medicine in the world. Clinical data showing its advantages in

treating intraocular pressure compared with beta blockers

should support the continued growth of this important

medicine. Xalacom, the only fixed combination prostaglandin

(Xalatan) and beta blocker, is available primarily in European

markets. Xalatan/Xalacom sales grew 6% in 2006 compared to

2005.

•

Zyrtec provides strong, rapid and long-lasting relief for seasonal

and year-round allergies and hives with once-daily dosing.

Zyrtec continues to be the most-prescribed antihistamine in the

U.S. in a challenging market. Sales increased 15% in 2006

compared to 2005. In February 2006, we began a new DTC

advertising campaign featuring new insight that allergy

symptoms can worsen over time due to exposure to new

allergens. We will lose U.S. exclusivity for Zyrtec in December

2007. Since we sold our rights to market Zyrtec over-the-

counter in connection with the sale of our Consumer Healthcare

business, we expect no revenue from Zyrtec after the expiration

of the U.S. patent in December.

•

Alliance revenues reflect revenues primarily associated with our

co-promotion of Aricept, Macugen, Rebif and Spiriva.

—Aricept, discovered and developed by our alliance partner

Eisai Co., Ltd, is the world’s leading medicine to treat

symptoms of Alzheimer’s disease.

—Macugen, discovered and developed by our alliance partner

OSI Pharmaceuticals, Inc. (OSI), is for the treatment of AMD.

We are in negotiations with OSI to return the U.S. rights to

Macugen to OSI in exchange for a royalty-free license to

market Macugen outside the U.S.

—Rebif, discovered and developed by Serono S.A. (Serono), is

used to treat symptoms of relapsing forms of multiple

sclerosis. Pfizer co-promotes Rebif with Serono in the U.S.

—Spiriva, discovered and developed by our alliance partner

Boehringer Ingelheim (BI), is used to treat chronic obstructive

pulmonary disease, a chronic respiratory disorder that

includes chronic bronchitis and emphysema.

Alliances allow us to co-promote or license these products for

sale in certain countries. Under the co-promotion agreements,

these products are marketed and promoted with our alliance

partners. We provide funding through cash, staff and other

resources to sell, market, promote and further develop these

products.

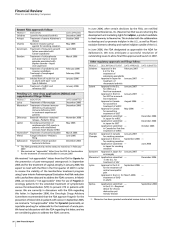

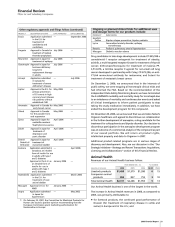

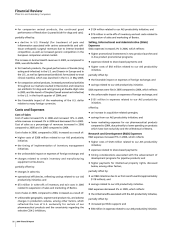

Product Developments

We continue to invest in R&D to provide future sources of revenues

through the development of new products, as well as through

additional uses for existing in-line and alliance products. We

have a broad and deep pipeline of medicines in development.

However, there are no assurances as to when, or if, we will receive

regulatory approval for additional indications for existing products

or any of our other products in development. Below are significant

regulatory actions by, and filings pending with, the FDA and

other regulatory authorities.

2006 Financial Report 19

Financial Review

Pfizer Inc and Subsidiary Companies