Pfizer 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12 2006 Financial Report

Financial Review

Pfizer Inc and Subsidiary Companies

Pension and Postretirement Benefit Plans and Defined

Contribution Plans

We provide defined benefit pension plans and defined

contribution plans for the majority of our employees worldwide.

In the U.S., we have both qualified and supplemental (non-

qualified) defined benefit plans and defined contribution plans,

as well as other postretirement benefit plans, consisting primarily

of healthcare and life insurance for retirees.

A U.S. qualified plan meets the requirements of certain sections of

the Internal Revenue Code and, generally, contributions to qualified

plans are tax-deductible. It typically provides benefits to a broad

group of employees and may not discriminate in favor of highly

compensated employees in its coverage, benefits or contributions.

We also provide benefits through non-qualified U.S. retirement

plans to certain employees. These supplemental plans, which

generally are not funded, will provide, out of our general assets,

an amount substantially equal to the amounts that would have

been payable under the defined benefit qualified pension plans,

in the absence of legislation limiting pension benefits and earnings

that may be considered in calculating pension benefits. In addition,

we provide medical and life insurance benefits to certain retirees

and their eligible dependents through our postretirement plans,

which, in general, are also unfunded obligations.

In 2006, we made required U.S. qualified plan contributions of $3

million and voluntary tax-deductible contributions in excess of

minimum requirements of $450 million to certain of our U.S.

qualified pension plans. In 2005, we made required U.S. qualified

plan contributions of $3 million and voluntary tax-deductible

contributions in excess of minimum requirements of $49 million

to certain of our U.S. qualified pension plans. In the aggregate,

the U.S. qualified pension plans are overfunded on a projected

benefit measurement basis as of December 31, 2006, and on an

accumulated benefit obligation measurement basis as of

December 31, 2006 and 2005.

In 2006, we made voluntary tax-deductible contributions of $90

million to certain of our U.S. postretirement plans via the

establishment of sections 401(h) accounts.

Outside the U.S., in general, we fund our defined benefit plans

to the extent that tax or other incentives exist and we have

accrued liabilities on our consolidated balance sheets to reflect

those plans that are not fully funded.

The accounting for benefit plans is highly dependent on actuarial

estimates, assumptions and calculations which result from a complex

series of judgments about future events and uncertainties (see

“Estimates and Assumptions” above). The assumptions and actuarial

estimates required to estimate the employee benefit obligations for

the defined benefit and postretirement plans, include discount

rate; expected salary increases; certain employee-related factors,

such as turnover, retirement age and mortality (life expectancy);

expected return on assets; and healthcare cost trend rates. Our

assumptions reflect our historical experiences and our best judgment

regarding future expectations that have been deemed reasonable

by management. The judgments made in determining the costs of

our benefit plans can materially impact our results of operations.

As such, we often obtain assistance from actuarial experts to aid in

developing reasonable assumptions and cost estimates.

Our assumption for the expected long-term rate of return-on-

assets in our U.S. pension plans, which impacts net periodic

benefit cost, is 9% for 2007 and 2006. The assumption for the

expected return-on-assets for our U.S. and international plans

reflects our actual historical return experience and our long-term

assessment of forward-looking return expectations by asset

classes, which is used to develop a weighted-average expected

return based on the implementation of our targeted asset

allocation in our respective plans. The expected return for our U.S.

plans and the majority of our international plans is applied to the

fair market value of plan assets at each year end. For our

international plans that use a market-related value of plan assets

to calculate net periodic benefit cost, shifting to fair market

value of plan assets would serve to decrease our 2007 international

pension plans’ pre-tax expense by approximately $58 million. As

a sensitivity measure, holding all other assumptions constant,

the effect of a one-percentage-point decline in the return-on-

assets assumption would be an increase in our 2007 U.S. qualified

pension plan pre-tax expense of approximately $74 million.

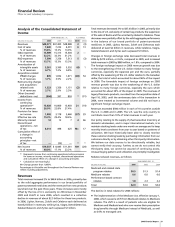

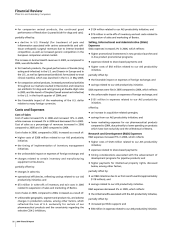

The following table shows the expected versus actual rate of

return on plan assets for the U.S. qualified pension plans:

2006 2005 2004

Expected annual rate of return 9.0% 9.0% 9.0%

Actual annual rate of return 15.2 10.1 11.5

The discount rate used in calculating our U.S. pension benefit

obligations as of December 31, 2006, is 5.9%, which represents a

0.1 percentage-point increase from our December 31, 2005, rate of

5.8%. The discount rate for our U.S. defined benefit and

postretirement plans is based on a yield curve constructed from a

portfolio of high quality corporate bonds rated AA or better for

which the timing and amount of cash flows approximate the

estimated payouts of the plans. For our international plans, the

discount rates are set by benchmarking against investment grade

corporate bonds rated AA or better. Holding all other assumptions

constant, the effect of a 0.1 percentage-point increase in the

discount rate assumption is a decrease in our 2007 U.S. qualified

pension plans’ pre-tax expense of approximately $10 million and

a decrease in the U.S. qualified pension plans’ projected benefit

obligations as of December 31, 2006, of approximately $100 million.