Pfizer 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

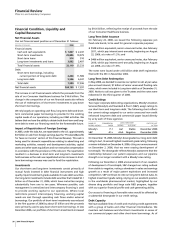

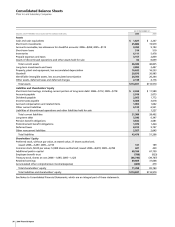

December 31, 2006, we had access to $3.6 billion of lines of

credit, of which $1.2 billion expire within one year. Of these lines

of credit, $3.4 billion are unused, of which our lenders have

committed to loan us $2.2 billion at our request. $2 billion of the

unused lines of credit, which expire in 2011, may be used to

support our commercial paper borrowings.

As of February 27, 2007, we had the ability to borrow

approximately $1 billion by issuing debt securities under our

existing debt shelf registration statement filed with the SEC in

November 2002.

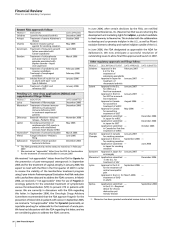

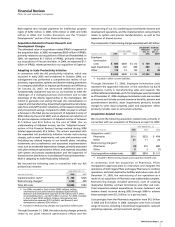

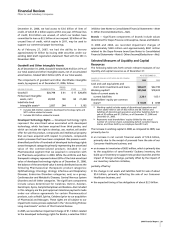

Goodwill and Other Intangible Assets

As of December 31, 2006, Goodwill totaled $20.9 billion (17% of

our total assets) and other intangible assets, net of accumulated

amortization, totaled $24.3 billion (20% of our total assets).

The components of goodwill and other identifiable intangible

assets, by segment, as of December 31, 2006, follow:

ANIMAL

(MILLIONS OF DOLLARS) PHARMACEUTICAL HEALTH OTHER TOTAL

Goodwill $20,798 $ 61 $ 17 $20,876

Finite-lived intangible

assets, net

(a)

20,995 169 84 21,248

Indefinite-lived

intangible assets

(b)

2,857 244 1 3,102

(a)

Includes $20.3 billion related to developed technology rights and

$471 million related to brands.

(b)

Includes $3.0 billion related to brands.

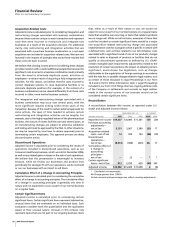

Developed Technology Rights — Developed technology rights

represent the amortized value associated with developed

technology, which has been acquired from third parties, and

which can include the right to develop, use, market, sell and/or

offer for sale the product, compounds and intellectual property

that we have acquired with respect to products, compounds

and/or processes that have been completed. We possess a well-

diversified portfolio of hundreds of developed technology rights

across therapeutic categories primarily representing the amortized

value of the commercialized products included in our

Pharmaceutical segment that we acquired in connection with

our Pharmacia acquisition in 2003. While the Arthritis and Pain

therapeutic category represents about 28% of the total amortized

value of developed technology rights as of December 31, 2006,

the balance of the amortized value is evenly distributed across the

following Pharmaceutical therapeutic product categories:

Ophthalmology; Oncology; Urology; Infectious and Respiratory

Diseases; Endocrine Disorders categories; and, as a group,

Cardiovascular and Metabolic Diseases; Central Nervous System

Disorders and All Other categories. The significant components

include values determined for Celebrex, Detrol, Xalatan,

Genotropin, Zyvox, Campto/Camptosar and Exubera. Also included

in this category are the post-approval milestone payments made

under our alliance agreements for certain Pharmaceutical

products, such as Rebif, Spiriva, Celebrex (prior to our acquisition

of Pharmacia) and Macugen. These rights are all subject to our

impairment review process explained in the “Accounting Policies:

Long-Lived Assets” section of this Financial Review.

In 2005, we recorded an impairment charge of $1.1 billion related

to the developed technology rights for Bextra, a selective COX-2

inhibitor (see Notes to Consolidated Financial Statements—Note

6. Other (Income)/Deductions—Net).

Brands — Significant components of brands include values

determined for Depo-Provera contraceptive, Xanax and Medrol.

In 2006 and 2004, we recorded impairment charges of

approximately $320 million and approximately $691 million

related to the Depo-Provera brand (see Notes to Consolidated

Financial Statements—Note 6. Other (Income)/Deductions—Net).

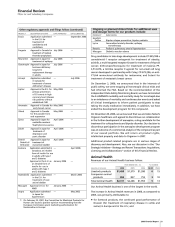

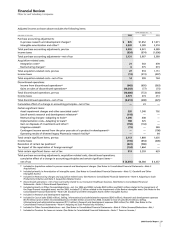

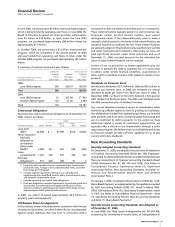

Selected Measures of Liquidity and Capital

Resources

The following table sets forth certain relevant measures of our

liquidity and capital resources as of December 31:

AS OF DECEMBER 31,

__________________________________

(MILLIONS OF DOLLARS, EXCEPT RATIOS AND PER COMMON

SHARE DATA) 2006 2005

Cash and cash equivalents and

short-term investments and loans $28,227 $22,736

Working capital

(a)

$25,560 $18,433

Ratio of current assets to

current liabilities 2.20:1 1.65:1

Shareholders’ equity per common

share

(b)

$ 10.05 $ 8.98

(a)

Working capital includes assets of discontinued operations and

other assets held for sale of $62 million and $6.7 billion and

liabilities of discontinued operations and other liabilities held for

sale of $2 million and $1.2 billion, as of December 31, 2006 and

December 31, 2005.

(b)

Represents total shareholders’ equity divided by the actual

number of common shares outstanding (which excludes treasury

shares, and those held by our employee benefit trust).

The increase in working capital in 2006, as compared to 2005, was

primarily due to:

•

an increase in net current financial assets of $14.6 billion,

primarily due to the receipt of proceeds from the sale of our

Consumer Healthcare business; and

•

an increase in inventories of $633 million, which is primarily due

to the acquisition of sanofi-aventis’ Exubera inventory, the

build-up of inventory to support new product launches and the

impact of foreign exchange, partially offset by the impact of

our inventory reduction initiative,

partially offset by:

•

the change in net assets and liabilities held for sale of about

$5.4 billion, primarily reflecting the sale of our Consumer

Healthcare business; and

•

the expected timing of tax obligations of about $2.5 billion.

2006 Financial Report 29

Financial Review

Pfizer Inc and Subsidiary Companies