Pfizer 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Financial Report 47

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

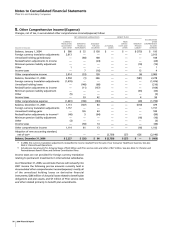

5.

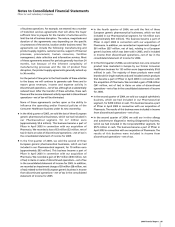

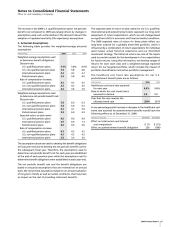

Acquisition-Related Costs

We incurred the following acquisition-related charges primarily

in connection with our acquisition of Pharmacia Corporation,

which was completed in 2003:

YEAR ENDED DEC. 31,

_________________________________________________

(MILLIONS OF DOLLARS) 2006 2005 2004

Integration costs:

(a)

Pharmacia $— $532 $ 454

Other 21 11 24

Restructuring charges:

(a)

Pharmacia (3) 372 680

Other 9 3 (7)

Total acquisition-related costs $27 $918 $1,151

(a)

Included in Restructuring charges and acquisition-related costs.

Included in Discontinued operations—net of tax are additional

pre-tax acquisition-related costs of $17 million, $38 million and

$55 million in 2006, 2005 and 2004.

A. Integration Costs

Integration costs represent external, incremental costs directly

related to an acquisition, including expenditures for consulting

and systems integration.

B. Restructuring Charges—Pharmacia

In connection with the acquisition of Pharmacia, Pfizer

management approved plans to restructure the operations of both

legacy Pfizer and legacy Pharmacia to eliminate duplicative

facilities and reduce costs. As of December 31, 2005, the

restructuring of our operations as a result of our acquisition of

Pharmacia was substantially complete. Restructuring charges

included severance, costs of vacating duplicative facilities, contract

termination and other exit costs. Total acquisition-related

expenditures (income statement and balance sheet) incurred

during 2002-2006 to achieve these synergies were $5.2 billion, on

a pre-tax basis.

We have recorded restructuring charges associated with exiting

certain activities of legacy Pfizer and legacy Pharmacia (from

April 16, 2004), including severance, costs of vacating duplicative

facilities, contract termination and other exit costs. These costs

have been recorded as a charge to the results of operations and

are included in Restructuring charges and acquisition-related

costs. The components of the restructuring charges associated with

the acquisition of Pharmacia, which were expensed, follow:

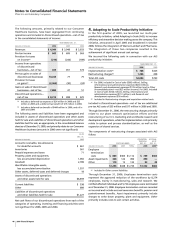

UTILIZATION ACCRUAL

THROUGH AS OF

COSTS INCURRED DEC. 31, DEC. 31,

_____________________________ ____________________

(MILLIONS OF DOLLARS) 2006 2005 2004 2003-2006 2006 2006

(a)

Employee

termination

costs $(18) $100 $371 $ 592 $ 522 $70

Asset

impairments 23 234 255 524 524 —

Other (8) 38 54 99 92 7

$ (3) $372 $680 $1,215 $1,138 $77

(a)

Included in Other current liabilities.

Through December 31, 2006, Employee termination costs

represent the approved reduction of the legacy Pfizer and legacy

Pharmacia (from April 16, 2004) work force by 4,255 employees,

mainly in corporate, manufacturing, distribution, sales and

research. We notified affected individuals and 4,005 employees

were terminated as of December 31, 2006. Employee termination

costs include accrued severance benefits and costs associated

with change-in-control provisions of certain Pharmacia

employment contracts. Asset impairments primarily include

charges to write down property, plant and equipment. Other

primarily includes costs to exit certain activities of legacy Pfizer

and legacy Pharmacia (from April 16, 2004).

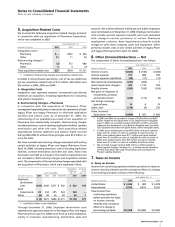

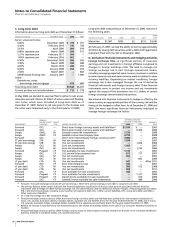

6. Other (Income)/Deductions — Net

The components of Other (income)/deductions—net follow:

YEAR ENDED DEC. 31,

___________________________________________________

(MILLIONS OF DOLLARS) 2006 2005 2004

Interest income $ (925) $ (740) $ (346)

Interest expense 517 488 359

Interest expense capitalized (29) (17) (12)

Net interest (income)/expense (437) (269) 1

Asset impairment charges

(a)

320 1,159 702

Royalty income (395) (320) (243)

Net gains on disposals of

investments, products

and product lines

(b)

(233) (172) (6)

Net foreign exchange

(gains)/losses 15 879

Other, net

(c)

(174) (9) 270

Other (income)/

deductions—net $ (904) $ 397 $ 803

(a)

In 2006 and 2004, we recorded a charge of $320 million and $691

million related to the impairment of our Depo-Provera intangible

asset. In 2005, we recorded charges totaling $1.2 billion, primarily

related to the impairment of our Bextra intangible asset. See Note

12B. Goodwill and Other Intangible Assets: Other Intangible Assets.

(b)

In 2006, gross realized gains were $65 million and gross realized

losses were $1 million on sales of available-for-sale securities. In

2005, gross realized gains were $171 million and gross realized

losses were $14 million on sales of available-for-sale securities. In

2004, gross realized gains were $25 million and gross realized

losses were $1 million on sales of available-for-sale securities.

(c)

We recorded charges totaling $369 million in 2004 related to

claims against Quigley Company, Inc., a wholly owned subsidiary

of Pfizer (see Note 19B. Legal Proceedings and Contingencies:

Product Liability Matters).

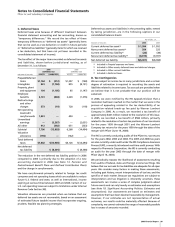

7. Taxes on Income

A. Taxes on Income

Income from continuing operations before provision for taxes on

income, minority interests and the cumulative effect of a change

in accounting principles consists of the following:

YEAR ENDED DEC. 31,

_______________________________________________________

(MILLIONS OF DOLLARS) 2006 2005 2004

United States $ 3,266 $ 985 $ 4,078

International 9,762 9,815 9,325

Total income from

continuing operations

before provision for taxes

on income, minority

interests and cumulative

effect of a change in

accounting principles $13,028 $10,800 $13,403