Pfizer 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 2006 Financial Report

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

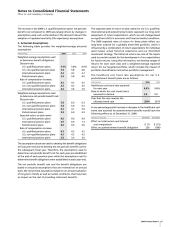

majority of our international plans. In December 2003, the Medicare

Prescription Drug Improvement and Modernization Act of 2003 (the

Act) was enacted. The Act introduced a prescription drug benefit

under Medicare (Medicare Part D), as well as a federal subsidy to

sponsors of retiree healthcare benefit plans that provide a benefit

that is at least actuarially equivalent to Medicare Part D. During the

third quarter of 2004, in accordance with FASB Staff Position

No.106-2 (FSP 106-2), Accounting and Disclosure Requirements

Related to the Medicare Prescription Drug Improvement and

Modernization Act of 2003, we began accounting for the effect of

the federal subsidy under the Act; the associated reduction to the

benefit obligations of certain of our postretirement benefit plans

and the related benefit cost was not significant.

During 2006, pursuant to the divestiture of our Consumer

Healthcare business, certain defined benefit obligations and

related plan assets, if applicable, were transferred to the purchaser

of that business.

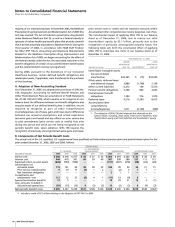

A. Adoption of New Accounting Standard

As of December 31, 2006, we adopted the provisions of SFAS No.

158, Employers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans (an amendment of FASB Statements

No. 87, 88, 106 and 132R), which requires us to recognize on our

balance sheet the difference between our benefit obligations and

any plan assets of our defined benefit plans. In addition, we are

required to recognize as part of other comprehensive

income/(expense), net of taxes, gains and losses due to differences

between our actuarial assumptions and actual experience

(actuarial gains and losses) and any effects on prior service due

to plan amendments (prior service costs or credits) that arise

during the period and which are not being recognized as net

periodic benefit costs. Upon adoption, SFAS 158 requires the

recognition of previously unrecognized actuarial gains and losses,

prior service costs or credits and net transition amounts within

Accumulated other comprehensive income (expense), net of tax.

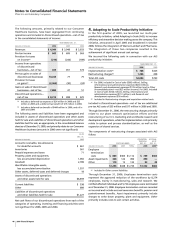

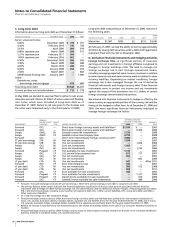

The incremental impact of applying SFAS 158 to our balance

sheet as of December 31, 2006, was to reduce our total

shareholders’ equity by $2.1 billion, primarily due to the

recognition of previously unrecognized actuarial losses. The

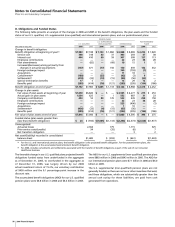

following table sets forth the incremental effect of applying

SFAS 158 to individual line items in our balance sheet as of

December 31, 2006:

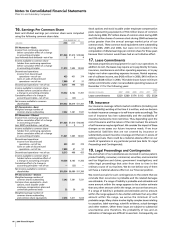

YEAR ENDED DEC. 31, 2006

________________________________________________________

BEFORE AFTER

ADOPTION OF ADOPTION OF

(MILLIONS OF DOLLARS) SFAS 158 ADJUSTMENTS

(a)

SFAS 158

Identifiable intangible assets,

less accumulated

amortization $24,365 $ (15) $24,350

Other assets, deferred taxes

and deferred charges 3,886 (1,748) 2,138

Other current liabilities 6,372 138 6,510

Pension benefit obligations 2,768 864 3,632

Postretirement benefit

obligations 1,394 576 1,970

Deferred taxes 9,216 (1,201) 8,015

Accumulated other

comprehensive

income/(expense) 1,671 (2,140) (469)

(a)

The adoption of SFAS 158 also impacted the subtotals on the

balance sheet, including, Total assets, Total current liabilities, Total

shareholders’ equity and Total liabilities and shareholders’ equity.

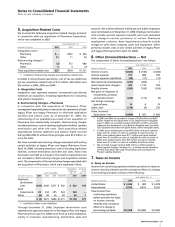

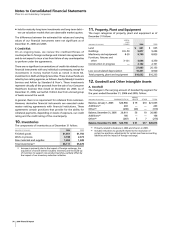

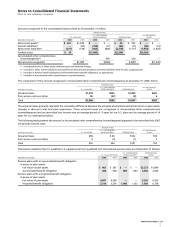

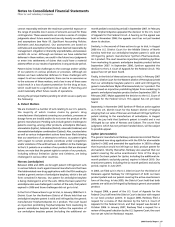

B. Components of Net Periodic Benefit Costs

The annual cost of the U.S. qualified, U.S. supplemental (non-qualified) and international pension plans and postretirement plans for the

years ended December 31, 2006, 2005 and 2004, follows:

PENSION PLANS

U.S. SUPPLEMENTAL

U.S. QUALIFIED (NON-QUALIFIED) INTERNATIONAL POSTRETIREMENT PLANS

(MILLIONS OF DOLLARS) 2006 2005 2004 2006 2005 2004 2006 2005 2004 2006 2005 2004

Service cost $ 368 $ 318 $ 277 $43 $37 $33 $ 303 $ 293 $ 264 $47 $38 $39

Interest cost 444 410 391 60 59 60 307 309 288 127 113 113

Expected return on plan assets (628) (594) (569) — — — (311) (297) (278) (28) (23) (20)

Amortization of:

Actuarial losses 119 101 99 45 39 35 106 95 59 36 21 15

Prior service costs/(credits) 9 10 17 (3) 1 2 — (2) 5 1 11

Net transition obligation — ————— 2 11— ——

Curtailments and

settlements—net 117 12 37 (8) 41(17) 19 (9) 6 ——

Special termination benefits 17 5————14 29 21 12 2 (1)

Less: amounts included in

discontinued operations (81) (15) (13) 4 (2) (2) 15 (2) (2) 9 (4) (3)

Net periodic benefit costs $ 365 $ 247 $ 239 $141 $138 $129 $ 419 $ 445 $ 349 $210 $148 $144

(a)

(a)

Includes a credit of $21 million relating to the adoption of FSP 106-2 in 2004.