Nordstrom 2000 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2000 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cyan Mag Yelo Blk

20100444 Nordstrom

2001 Annual Report • 44pgs. + 4 covers pg. 34

8.375 x 10.875 • PDF • 150 lpi

PMS

5773

PMS

5503

34

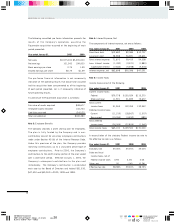

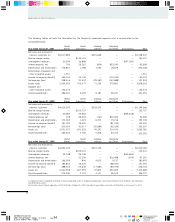

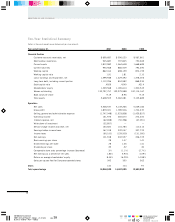

NORDSTROM, INC. AND SUBSIDIARIES

Retail Credit Catalog/ Corporate

Year ended January 31, 2001 Stores Operations Internet and Other Eliminations Total

Net sales and revenues to

external customers (b) $5,217,889 — $310,648 — — $5,528,537

Service charge income — $135,121 — — — 135,121

Intersegment revenues 30,294 26,889 — — $(57,183) —

Interest expense, net 795 29,267 (604) $33,240 — 62,698

Depreciation and amortization 176,831 1,786 7,552 16,879 — 203,048

Amortization of goodwill and

other intangible assets 1,251 — — — — 1,251

Income tax expense (benefit) 165,150 13,140 — (113,190) — 65,100

Net earnings (loss) 258,416 20,557 (29,367) (147,688) — 101,918

Assets (a)(b) 2,554,393 703,077 71,233 279,800 — 3,608,503

Goodwill and

other intangible assets 143,473 — — — — 143,473

Capital expenditures 286,941 3,095 5,187 26,231 — 321,454

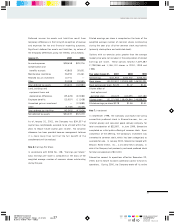

Retail Credit Catalog/ Corporate

Year ended January 31, 2000 Stores Operations Internet and Other Eliminations Total

Net sales and revenues to

external customers $4,914,293 — $234,973 — — $5,149,266

Service charge income — $125,727 — — — 125,727

Intersegment revenues 20,285 25,963 — — $(46,248) —

Interest expense, net 728 26,933 (167) $22,902 — 50,396

Depreciation and amortization 170,765 1,424 6,313 15,216 — 193,718

Income tax expense (benefit) 191,790 19,450 — (81,740) — 129,500

Net earnings (loss) 300,009 30,417 (35,685) (92,184) — 202,557

Assets (a) 2,051,327 601,320 95,241 314,193 — 3,062,081

Capital expenditures 263,352 2,792 5,206 33,702 — 305,052

Retail Credit Catalog/ Corporate

Year ended January 31, 1999 Stores Operations Internet and Other Eliminations Total

Net sales and revenues to

external customers $4,834,049 — $215,133 — — $5,049,182

Service charge income — $123,201 — — — 123,201

Intersegment revenues 23,748 26,736 — — $(50,484) —

Interest expense, net — 31,139 — $16,488 (536) 47,091

Depreciation and amortization 166,099 806 4,613 9,137 — 180,655

Income tax expense (benefit) 182,800 16,200 — (68,000) — 131,000

Net earnings (loss) 288,503 25,606 (17,681) (89,705) — 206,723

Assets (a) 2,040,938 607,255 57,803 397,693 —3,103,689

Capital expenditures 273,906 2,191 4,121 26,519 — 306,737

The following tables set forth the information for the Company’s reportable segments and a reconciliation to the

consolidated totals:

(a) Segment assets in Corporate and Other include unallocated assets in corporate headquarters, consisting primarily of land, buildings and equipment,

and deferred tax assets.

(b) Includes sales of foreign operations of $12,318 from October 24, 2000, the date of acquisition, and assets of $206,601 as of January 31, 2001.