Nordstrom 2000 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2000 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cyan Mag Yelo Blk

20100444 Nordstrom

2001 Annual Report • 44pgs. + 4 covers pg. 31

8.375 x 10.875 • PDF • 150 lpi

PMS

5773

PMS

5503

31

NORDSTROM, INC. AND SUBSIDIARIES

and expire ten years after the date of grant.

In addition to option grants, the Committee granted

355,072, 272,970 and 185,201 performance share units in

2000, 1999 and 1998, which will vest over three years if

certain financial goals are attained. Employees may elect to

receive common stock or cash upon vesting of these

performance shares. The Committee also granted 30,069

and 180,000 shares of restricted stock in 1999 and 1998,

with weighted average fair values of $32.09 and $27.75,

respectively, which vest over five years. No monetary

consideration is paid by employees who receive performance

share units or restricted stock. At January 31, 2001,

$2,741 was recorded in accrued salaries, wages and related

benefits for these performance shares. In September 2000,

the Company accelerated the vesting of 144,000 shares of

restricted stock resulting in compensation expense of

$3,039, and also cancelled 14,175 shares of restricted

stock as a result of management changes.

In May 2000, the Company’s shareholders approved an

8,000,000 share increase in the number of shares of the

Company’s common stock authorized for issuance under its

option plan. At January 31, 2001, 10,150,579 shares are

reserved for future stock option grants pursuant to the Plan.

The Company applies APB No. 25 and FIN No. 44 in

measuring compensation costs under its stock-based

compensation programs. Accordingly, no compensation cost

has been recognized for stock options issued under the Plan.

For performance share units, compensation expense is

recorded over the performance period at the fair market

value of the stock at the date when it is probable that such

shares will be earned. For restricted stock, compensation

expense is based on the market price on the date of grant

and is recorded over the vesting period. Stock-based

compensation expense for 2000, 1999 and 1998 was

$7,594, $3,331 and $10,037, respectively.

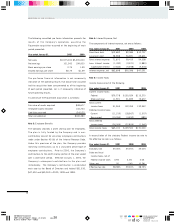

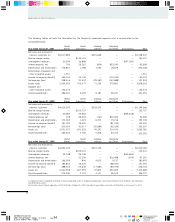

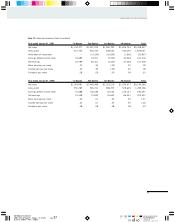

Stock option activity for the Plan was as follows:

Year ended January 31, 2001 2000 1999

Weighted- Weighted- Weighted-

Average Average Average

Exercise Exercise Exercise

Shares Price Shares Price Shares Price

Outstanding, beginning of year 8,135,301 $28 5,893,632 $27 3,401,602 $21

Granted 2,470,169 21 2,926,368 31 3,252,217 31

Exercised (181,910) 20 (341,947) 23 (599,593) 18

Cancelled (1,550,218) 28 (342,752) 30 (160,594) 27

Outstanding, end of year 8,873,342 $27 8,135,301 $28 5,893,632 $27

Options exercisable at end of year 3,833,379 $26 3,145,393 $25 2,544,092 $23

The following table summarizes information about stock options outstanding for the Plan as of January 31, 2001:

Options Outstanding Options Exercisable

Weighted-

Average Weighted- Weighted-

Remaining Average Average

Range of Contractual Exercise Exercise

Exercise Prices Shares Life (Years) Price Shares Price

$13 - $22 3,659,001 7 $20 1,446,456 $20

$23 - $32 2,855,785 7 27 1,590,360 28

$33 - $40 2,358,556 8 36 796,563 35

8,873,342 7 $27 3,833,379 $26