Nordstrom 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cyan Mag Yelo Blk

20100444 Nordstrom

2001 Annual Report • 44pgs. + 4 covers pg. 27

8.375 x 10.875 • PDF • 150 lpi

PMS

5773

PMS

5503

27

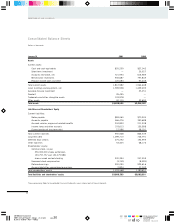

NORDSTROM, INC. AND SUBSIDIARIES

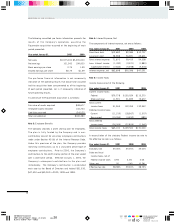

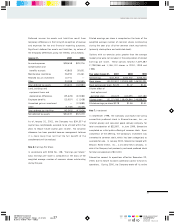

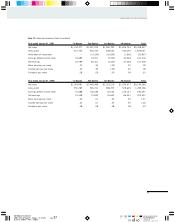

Deferred income tax assets and liabilities result from

temporary differences in the timing of recognition of revenue

and expenses for tax and financial reporting purposes.

Significant deferred tax assets and liabilities, by nature of

the temporary differences giving rise thereto, are as follows:

January 31, 2001 2000

Accrued expenses $28,658 $29,276

Compensation and

benefits accruals 43,803 35,651

Merchandise inventories 26,290 24,461

Realized loss on investment 12,751 —

Other 23,098 15,595

Total deferred tax assets 134,600 104,983

Land, buildings and

equipment basis and

depreciation differences (25,678) (22,982)

Employee benefits (10,937) (11,008)

Unrealized gain on investment — (10,889)

Other (3,748) (3,025)

Total deferred tax liabilities (40,363) (47,904)

Net deferred tax assets $94,237 $57,079

As of January 31, 2001, the Company has $34,357 of

capital loss carryforwards available to be utilized within five

years to reduce future capital gain income. No valuation

allowance has been provided because management believes

it is more likely than not that the full benefit of the

carryforwards will be realized.

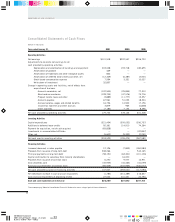

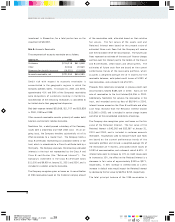

Note 6: Earnings Per Share

In accordance with SFAS No. 128, “Earnings per Share,”

basic earnings per share is computed on the basis of the

weighted average number of common shares outstanding

during the year.

Diluted earnings per share is computed on the basis of the

weighted average number of common shares outstanding

during the year plus dilutive common stock equivalents

(primarily stock options and restricted stock).

Options with an exercise price greater than the average

market price were not included in the computation of diluted

earnings per share. These options totaled 7,409,387

2,798,966 and 1,146,113 shares in 2000, 1999 and

1998.

Year ended January 31, 2001 2000 1999

Net earnings $101,918 $202,557 $206,723

Basic shares 131,012,412 137,814,589 146,241,091

Basic earnings per share $0.78 $1.47 $1.41

Dilutive effect of

stock options and

restricted stock 100,673 610,255 617,180

Diluted shares 131,113,085 138,424,844 146,858,271

Diluted earnings per share $0.78 $1.46 $1.41

Note 7: Investment

In September 1998, the Company purchased non-voting

convertible preferred stock in Streamline.com, Inc., an

Internet grocery and consumer goods delivery company, for

total consideration of $22,857. In June 1999, Streamline

completed an initial public offering of common stock. Upon

completion of the offering, the Company’s investment was

converted to common stock, which has been categorized as

available-for-sale. In January 2000, Streamline merged with

Beacon Home Direct, Inc., a privately-held company, in

which the Company had previously purchased preferred stock

for total consideration of $10,000.

Streamline ceased its operations effective November 22,

2000, due to failure to obtain additional capital to fund its

operations. During 2000, the Company wrote off its entire