Nordstrom 2000 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2000 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cyan Mag Yelo Blk

20100444 Nordstrom

2001 Annual Report • 44pgs. + 4 covers pg. 25

8.375 x 10.875 • PDF • 150 lpi

PMS

5773

PMS

5503

25

NORDSTROM, INC. AND SUBSIDIARIES

on a straight-line basis primarily over the life of the

applicable lease.

Fair Value of Financial Instruments: The carrying amount of

cash equivalents and notes payable approximates fair value

because of the short maturity of these instruments. The fair

value of the Company’s investment in marketable equity

securities is based upon the quoted market price and was

approximately $60,778 at January 31, 2000. The fair value

of long-term debt (including current maturities), using

quoted market prices of the same or similar issues with the

same remaining term to maturity, is approximately

$1,031,000 and $715,500 at January 31, 2001 and 2000.

Derivatives Policy: The Company limits its use of derivative

financial instruments to the management of foreign currency

and interest rate risks. The effect of these activities is not

material to the Company’s financial condition or results of

operations. The Company has no material off-balance sheet

credit risk, and the fair value of derivative financial

instruments at January 31, 2001 and 2000 is not material.

Statement of Financial Accounting Standards (“SFAS”) No.

133, “Accounting for Derivative Instruments and Hedging

Activities,” as amended by SFAS No. 137 and No. 138,

requires an entity to recognize all derivatives as either assets

or liabilities in the statement of financial position and to

measure those instruments at fair value. Adoption of this

standard, in the fiscal year beginning February 1, 2001, did

not have a material impact on the Company’s consolidated

financial statements.

Recent Accounting Pronouncements: In July 2000, the

Company adopted Financial Accounting Standards Board

Interpretation No. 44, “Accounting for Certain Transactions

Involving Stock Compensation” (“FIN No. 44”), which

provides guidance for certain issues that arose in applying

Accounting Principles Board Opinion No. 25, “Accounting

for Stock Issued to Employees” (“APB No. 25”). Adoption

of this Interpretation did not have a material impact on the

Company’s consolidated financial statements for the fiscal

year ended January 31, 2001.

In September 2000, the FASB issued SFAS No. 140

“Accounting for Transfers and Servicing of Financial Assets

and Extinguishments of Liabilities” (“SFAS No. 140”), a

replacement of SFAS No. 125 with the same title. It revises

the standards for securitizations and other transfers of

financial assets and collateral and requires certain additional

disclosures, but otherwise retains most of SFAS No. 125’s

provisions. SFAS No. 140 is effective for transfers after

March 31, 2001. Adoption of the accounting provisions of

this standard will not have a material impact on the

Company’s consolidated financial statements. The Company

has complied with all SFAS No. 140 disclosure

requirements.

Reclassifications: Certain reclassifications of prior year and

quarterly balances have been made for consistent

presentation with the current year.

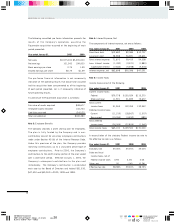

Note 2: Acquisition

On October 24, 2000, the Company acquired 100% of

Façonnable, S.A., of Nice, France, a designer, wholesaler

and retailer of high quality men’s and women’s apparel and

accessories. The Company paid $87,685 in cash and issued

5,074,000 shares of common stock of the Company for a

total consideration, including expenses, of $169,380. The

acquisition is being accounted for under the purchase

method of accounting, and, accordingly, Façonnable’s results

of operations have been included in the Company’s results of

operations since October 24, 2000. The purchase price has

been allocated to Façonnable’s assets and liabilities based

on their estimated fair values as of the date of acquisition.

The purchase also provides for contingent payments that may

be paid in fiscal 2006 based on the performance of the

subsidiary and the continued active involvement of the

principals in Façonnable, S.A. The contingent payments will

be recorded as compensation expense when it becomes

probable that the performance targets will be met.