Nordstrom 2000 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2000 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cyan Mag Yelo Blk

20100444 Nordstrom

2001 Annual Report • 44pgs. + 4 covers pg. 28

8.375 x 10.875 • PDF • 150 lpi

PMS

5773

PMS

5503

28

NORDSTROM, INC. AND SUBSIDIARIES

investment in Streamline, for a total pre-tax loss on the

investment of $32,857.

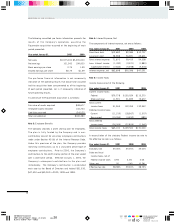

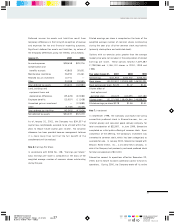

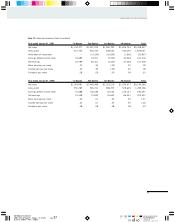

Note 8:Accounts Receivable

The components of accounts receivable are as follows:

January 31, 2001 2000

Customers $716,218 $611,858

Other 22,266 20,969

Allowance for doubtful accounts (16,531) (15,838)

Accounts receivable, net $721,953 $616,989

Credit risk with respect to accounts receivable is

concentrated in the geographic regions in which the

Company operates stores. At January 31, 2001 and 2000,

approximately 41% and 38% of the Company’s receivables

were obligations of customers residing in California.

Concentration of the remaining receivables is considered to

be limited due to their geographical dispersion.

Bad debt expense totaled $20,368, $11,707 and $23,828

in 2000, 1999 and 1998.

Other accounts receivable consists primarily of vendor debit

balances and cosmetic rebates receivable.

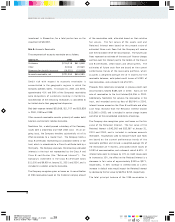

Nordstrom fsb, a wholly-owned subsidiary of the Company,

issues both a proprietary and VISA credit card. On an on-

going basis, the Company transfers substantially all of its

VISA receivables to a master trust. The Company holds a

Class B certificate, representing an undivided interest in the

trust, which is subordinate to a Class A certificate held by a

third party. The Company also owns the remaining undivided

interests in the trust not represented by the Class A and

Class B certificates (the “Retained Interest”). The

Company’s investment in the Class B certificate totals

$11,000 and $9,900 at January 31, 2001 and 2000, and is

included in customer accounts receivable.

The Company recognizes gains or losses on its securitization

of VISA receivables based on the historical carrying amount

of the receivables sold, allocated based on their relative

fair values. The fair values of the assets sold and

Retained Interest were based on the present value of

estimated future cash flows that the Company will receive

over the estimated life of the securitization. The future cash

flows represent an estimate of the excess of finance charges

and fees over the interest paid to the holders of the Class A

and B certificates, credit losses and servicing fees. The

estimates of future cash flow are based on the current

performance trends of the receivable portfolio, which

assumes a weighted-average life of 5 months for the

receivable balances, anticipated credit losses of 5.99% of

new receivables, and a discount rate of 6.50%.

Proceeds from collections reinvested in previous credit card

securitizations totaled $485,422 in 2000. Gains on the

sale of receivables to the trust totaled $5,356 in 2000.

Additionally, Nordstrom fsb services the receivables in the

trust, and recorded servicing fees of $8,564 in 2000.

Interest income earned on the Class B certificate and other

cash flows received from the Retained Interest totaled

$10,060 in 2000, and is included in service charge income

and other on the consolidated statements of earnings.

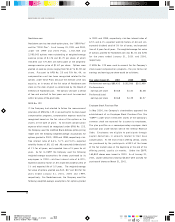

The Company also recognizes gains and losses on the fair

value of the Retained Interest. The fair value of the

Retained Interest is $42,052 and $32,567 at January 31,

2001 and 2000, and is included in customer accounts

receivable. Assumptions used to measure future cash flows

are based on the current performance trends of the

receivable portfolio and include a weighted-average life of

the receivables of 5 months, anticipated credit losses of

5.99% of new receivables, and a discount rate of 6.50%. If

interest rates were to increase by 10% or credit losses were

to increase by 10%, the effect on the Retained Interest is a

decrease in fair value of approximately $339 or $371,

respectively. A 20% increase in interest rates or a 20%

increase in default rates would impact the Retained Interest

by decreasing the fair value by $678 or $743, respectively.

The total principal balance of the VISA receivables is