Nordstrom 2000 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2000 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cyan Mag Yelo Blk

20100444 Nordstrom

2001 Annual Report • 44pgs. + 4 covers pg. 33

8.375 x 10.875 • PDF • 150 lpi

PMS

5773

PMS

5503

33

NORDSTROM, INC. AND SUBSIDIARIES

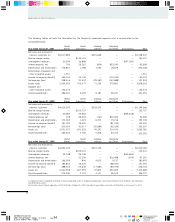

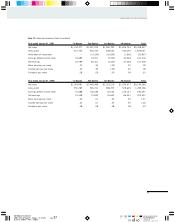

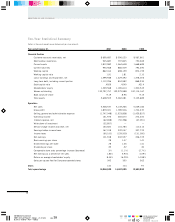

Note 14: Supplementary Cash Flow Information

Supplementary cash flow information includes the following:

Year ended January 31, 2001 2000 1999

Cash paid during

the year for:

Interest (net of

capitalized interest) $58,190 $54,195 $44,418

Income taxes 88,911 129,566 126,157

Note 15: Segment Reporting

The Company has three reportable segments which have

been identified based on differences in products and

services offered and regulatory conditions: the Retail Stores,

Credit Operations, and Catalog/Internet segments. The

Retail Stores segment derives its sales from high-quality

apparel, shoes and accessories for women, men and

children, sold through retail store locations. It includes the

Company’s Product Development Group which coordinates

the design and production of private label merchandise

sold in the majority of the Company’s retail stores. Credit

Operations segment revenues consist primarily of finance

charges earned through issuance of the Nordstrom

proprietary and VISA credit cards. The Catalog/Internet

segment generates revenues from direct mail catalogs and

the Nordstrom.com and Nordstromshoes.com Web sites.

The Company’s senior management utilizes various

measurements to assess segment performance and to

allocate resources to segments. The measurements used to

compute net earnings for reportable segments are consistent

with those used to compute net earnings for the Company.

The accounting policies of the operating segments are the

same as those described in the summary of significant

accounting policies in Note 1. Corporate and Other includes

certain expenses and a portion of interest expense which are

not allocated to the operating segments. Intersegment

revenues primarily consist of fees for credit card services

and are based on fees charged by third party cards.