Nordstrom 2000 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2000 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cyan Mag Yelo Blk

20100444 Nordstrom

2001 Annual Report • 44pgs. + 4 covers pg. 16

8.375 x 10.875 • PDF • 150 lpi

PMS

5773

PMS

5503

16

NORDSTROM, INC. AND SUBSIDIARIES

Interest Expense, Net

Interest expense, net increased 24.4% in 2000 primarily

due to higher average borrowings to finance capital

expenditures, the purchase of Façonnable, S.A. and the

repurchase of shares. In 1999, interest expense, net

increased 7% as a result of higher average borrowings to

finance share repurchases. The Company repurchased 3.9

million and 10.2 million shares at an aggregate cost of

approximately $86 million and $303 million in 2000 and

1999, respectively.

Service Charge Income and Other, Net

Service charge income and other, net primarily represents

income from the Company’s credit card operations, offset by

miscellaneous expenses.

Service charge income and other, net increased in 2000 due

to higher service charge and late fee income associated with

increases in credit sales and the number of credit accounts,

and higher accounts receivable securitization gains. Service

charge income and other, net was flat in 1999.

Write-off of Investment

The Company held common shares in Streamline.com, Inc.,

an Internet grocery and consumer goods delivery company, at

a cost of approximately $33 million. Streamline ceased its

operations effective November 2000. During the year, the

Company wrote off the entire investment in Streamline.

Net Earnings

Net earnings for 2000 were lower than in 1999 due primarily

to the write-off of the Streamline investment ($20 million

after-tax, $.15 per share), non-recurring charges related to

the write-down of abandoned and impaired information and

technology projects ($6 million after-tax, $.05 per share),

and employee severance and other costs ($8 million after-

tax, $.06 per share). Net earnings, excluding non-recurring

charges would have been $136 million and $209 million in

2000 and 1999, respectively. In addition, the Company

experienced higher selling, general and administrative

expenses, partially offset by higher service charge income.

Net earnings for 1999 were slightly lower than 1998 as the

Company’s sales and gross margin improvements were offset

by increases in selling, general and administrative expenses.

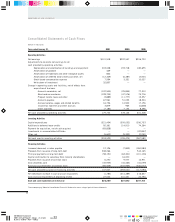

Liquidity and Capital Resources

The Company finances its working capital needs, capital

expenditures, the purchase of Façonnable, and share

repurchase activity with cash provided by operations and

borrowings.

For the fiscal year ended January 31, 2001, net cash

provided by operating activities decreased approximately

$198 million compared to the fiscal year ended January 31,

2000, primarily due to lower net earnings and an increase in

accounts receivable and merchandise inventories, partially

offset by an increase in accounts payable. The increase in

accounts payable was primarily due to a change in the

Company’s policy to pay its vendors based on receipt of

goods rather than the invoice date. For the fiscal year ended

January 31, 2000, net cash provided by operating activities

decreased approximately $223 million compared to the fiscal

year ended January 31, 1999, primarily due to the non-

recurring benefit of prior year reductions in inventories and

customer receivable account balances.

For the fiscal year ended January 31, 2001, net cash used

for investing activities increased approximately $119 million

compared to the fiscal year ended January 31, 2000,

primarily due to an increase in capital expenditures to fund

new stores and remodels. Additionally, approximately $84

million of cash, net of cash acquired, was used to purchase

Façonnable, S.A. ("Façonnable"), of Nice, France, a designer,

wholesaler and retailer of high quality men’s and women’s

apparel and accessories. The purchase also provides for

contingent payments to the principals that may be paid in

fiscal 2006 based on the performance of the subsidiary and

the continued active involvement of the principals in

Façonnable. The contingent payments will be expensed

when it becomes probable that the performance targets will