Nordstrom 2000 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2000 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cyan Mag Yelo Blk

20100444 Nordstrom

2001 Annual Report • 44pgs. + 4 covers pg. 32

8.375 x 10.875 • PDF • 150 lpi

PMS

5773

PMS

5503

32

NORDSTROM, INC. AND SUBSIDIARIES

Nordstrom.com

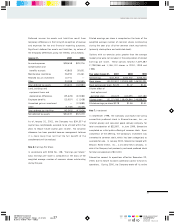

Nordstrom.com has two stock option plans, the “1999 Plan”

and the “2000 Plan”. As of January 31, 2001 and 2000,

under the 1999 and 2000 Plans, 1,767,565 and

2,590,000 options were outstanding at weighted-average

exercise prices of $1.76 and $1.70 per share; of which

300,654 and 775,500 are exercisable at the weighted-

average exercise price of $1.67 per share. Options were

granted at exercise prices ranging from $1.67 to $1.92 per

share. Pursuant to APB No. 25 and FIN No. 44, no

compensation cost has been recognized related to the

options under these Plans because the exercise price was

equal to, or in excess of the fair value of Nordstrom.com

stock on the date of grant as determined by the Board of

Directors of Nordstrom.com. The options vest over a period

of two and one-half to four years and must be exercised

within ten years of the grant date.

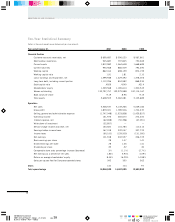

SFAS No. 123

If the Company had elected to follow the measurement

provisions of SFAS No. 123 in accounting for its stock-based

compensation programs, compensation expense would be

recognized based on the fair value of the options or the

shares at the date of grant. To estimate compensation

expense which would be recognized under SFAS No. 123,

the Company used the modified Black-Scholes option-pricing

model with the following weighted-average assumptions for

options granted in 2000, 1999 and 1998, respectively: risk-

free interest rates of 6.4%, 5.7% and 5.2%; expected

volatility factors of .65, .61 and .46; expected dividend yield

of 1% for all years; and expected lives of 5 years for all

years. As for its ESPP, the Company used the following

weighted-average assumptions for shares purchased by its

employees in 2000: risk-free interest rate of 6.02%;

expected volatility factor of .65; expected dividend yield of

1% and expected life of 0.5 years. The weighted-average

fair value of options granted was $12, $17 and $14 for the

years ended January 31, 2001, 2000 and 1999,

respectively. For Nordstrom.com, the Company used the

following weighted-average assumptions for options granted

in 2000 and 1999, respectively: risk-free interest rates of

6.5% and 6.1%; expected volatility factors of .64 and .61;

expected dividend yield of 0% for all years; and expected

lives of 5 years for all years. The weighted-average fair value

of options granted for Nordstrom.com was $1.04 and $.96

for the years ended January 31, 2001 and 2000,

respectively.

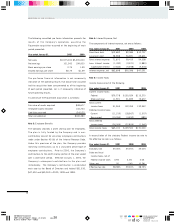

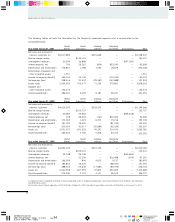

If SFAS No. 123 were used to account for the Company’s

stock-based compensation programs, the pro forma net

earnings and earnings per share would be as follows:

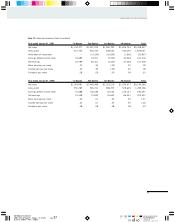

Year ended January 31, 2001 2000 1999

Pro forma net earnings $89,433 $192,936 $201,499

Pro forma basic

earnings per share $0.68 $1.40 $1.38

Pro forma diluted

earnings per share $0.68 $1.39 $1.37

Employee Stock Purchase Plan

In May 2000, the Company’s shareholders approved the

establishment of an Employee Stock Purchase Plan (the

“ESPP”) under which 3,500,000 shares of the Company’s

common stock are reserved for issuance to employees.

The plan qualifies as a noncompensatory employee stock

purchase plan under Section 423 of the Internal Revenue

Code. Employees are eligible to participate through

payroll deductions in amounts related to their base

compensation. At the end of each offering period, shares

are purchased by the participants at 85% of the lower

of the fair market value at the beginning or the end of the

offering period, usually six months. Under the ESPP,

165,842 shares were issued in 2000. As of January 31,

2001, payroll deductions totaling $2,602 were accrued for

purchase of shares on March 31, 2001.