Nordstrom 2000 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2000 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cyan Mag Yelo Blk

20100444 Nordstrom

2001 Annual Report • 44pgs. + 4 covers pg. 17

8.375 x 10.875 • PDF • 150 lpi

PMS

5773

PMS

5503

17

NORDSTROM, INC. AND SUBSIDIARIES

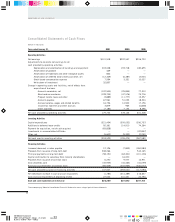

be met. Assuming Façonnable performed at 100% of the

plan, the contingent payments would be approximately $20

million. For the fiscal year ended January 31, 2000, net

cash used in investing activities decreased approximately

$68 million compared to the fiscal year ended January 31,

1999, primarily due to an increase in funds provided by

developers to defray part of the Company’s costs of

constructing new stores.

The Company’s capital expenditures aggregated

approximately $652 million over the last three years, net of

developer reimbursements, principally to add new stores and

facilities and to improve existing stores and facilities. Over

3.4 million square feet of retail store space has been added

during this time period, representing an increase of 27%

since January 31, 1998.

The Company plans to spend approximately $1.2 billion, net

of developer reimbursements, on capital projects during the

next three years, including new stores, the remodeling of

existing stores, new systems and technology, and other

items. At January 31, 2001, approximately $428 million

has been contractually committed for the construction of new

stores, buildings or the remodel of existing stores. Although

the Company has made commitments for stores opening in

2001 and beyond, it is possible that some stores may not be

opened as scheduled because of delays inherent in the

development process, or because of the termination of store

site negotiations.

In addition to its cash flow from operations, the Company

has $500 million available under its revolving credit facility.

Management believes that the Company’s current financial

strength and credit position enable it to maintain its existing

stores and to take advantage of attractive growth

opportunities. The Company has senior unsecured debt

ratings of Baa1 and A- and commercial paper ratings of P-2

and A-2 from Moody’s and Standard and Poor’s, respectively.

The Company owns a 49% interest in a limited partnership

which is constructing a new corporate office building in

which the Company will be the primary occupant. In

accordance with Emerging Issues Task Force Issue No.

97-10 "The Effect of Lessee Involvement in Asset

Construction", the Company is considered to be the owner of

the property. Construction in progress includes capitalized

costs related to this building of $57 million as of January

31, 2001. The Company is a guarantor of a $93 million

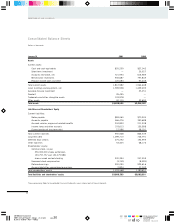

SQUARE FOOTAGE BY MARKET AREA AT JANUARY 31, 2001

2,942,000

18.3% Northwest

1,568,000

9.8% Rack

4,036,000

25.1% East Coast

4,878,000

30.4% Southwest

2,506,000

15.6% Central States

126,000

0.8% Other