Nordstrom 2000 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2000 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cyan Mag Yelo Blk

20100444 Nordstrom

2001 Annual Report • 44pgs. + 4 covers pg. 22

8.375 x 10.875 • PDF • 150 lpi

PMS

5773

PMS

5503

22

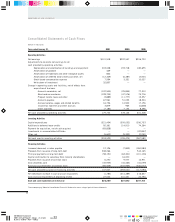

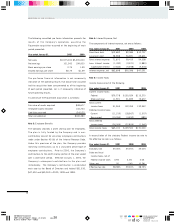

NORDSTROM, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

Dollars in thousands

Year ended January 31, 2001 2000 1999

Operating Activities

Net earnings $101,918 $202,557 $206,723

Adjustments to reconcile net earnings to net

cash provided by operating activities:

Depreciation and amortization of buildings and equipment 203,048 193,718 180,655

Amortization of goodwill 429 — —

Amortization of trademark and other intangible assets 822 — —

Amortization of deferred lease credits and other, net (12,349) (6,387) (3,501)

Stock-based compensation expense 7,594 3,331 10,037

Write-down of investment 32,857 — —

Change in operating assets and liabilities, net of effects from

acquisition of business

Accounts receivable, net (102,945) (29,854) 77,313

Merchandise inventories (128,744) (47,576) 75,776

Prepaid income taxes and other (3,889) (11,777) 15,357

Accounts payable 67,561 51,053 18,324

Accrued salaries, wages and related benefits 16,736 14,942 17,156

Income tax liabilities and other accruals 3,879 965 (4,828)

Other liabilities (7,184) 7,154 8,296

Net cash provided by operating activities 179,733 378,126 601,308

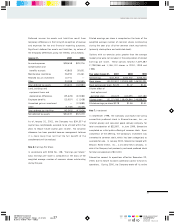

Investing Activities

Capital expenditures (321,454) (305,052) (306,737)

Additions to deferred lease credits 92,361 114,910 74,264

Payment for acquisition, net of cash acquired (83,828) — —

Investments in unconsolidated affiliates — — (32,857)

Other, net (5,602) (9,332) (2,251)

Net cash used in investing activities (318,523) (199,474) (267,581)

Financing Activities

Increase (decrease) in notes payable 12,126 (7,849) (184,984)

Proceeds from issuance of long-term debt 308,266 — 544,165

Principal payments on long-term debt (58,191) (63,341) (101,106)

Capital contribution to subsidiary from minority shareholders — 16,000 —

Proceeds from issuance of common stock 6,250 9,577 14,971

Cash dividends paid (45,935) (44,463) (44,059)

Purchase and retirement of common stock (85,509) (302,965) (346,077)

Net cash provided by (used in) financing activities 137,007 (393,041) (117,090)

Net (decrease) increase in cash and cash equivalents (1,783) (214,389) 216,637

Cash and cash equivalents at beginning of year 27,042 241,431 24,794

Cash and cash equivalents at end of year $25,259 $27,042 $241,431

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.