Nordstrom 2000 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2000 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cyan Mag Yelo Blk

20100444 Nordstrom

2001 Annual Report • 44pgs. + 4 covers pg. 26

8.375 x 10.875 • PDF • 150 lpi

PMS

5773

PMS

5503

26

NORDSTROM, INC. AND SUBSIDIARIES

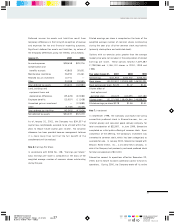

The following unaudited pro forma information presents the

results of the Company’s operations assuming the

Façonnable acquisition occurred at the beginning of each

period presented:

Year ended January 31, 2001 2000

Net sales $5,575,000 $5,205,000

Net earnings 101,000 199,000

Basic earnings per share 0.75 1.39

Diluted earnings per share $0.75 $1.39

The pro forma financial information is not necessarily

indicative of the operating results that would have occurred

had the acquisition been consummated as of the beginning

of each period presented, nor is it necessarily indicative of

future operating results.

A summary of the Façonnable acquisition is as follows:

Fair value of assets acquired $48,677

Intangible assets recorded 144,724

Liabilities assumed (24,021)

Total consideration $169,380

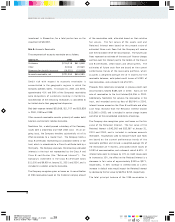

Note 3: Employee Benefits

The Company provides a profit sharing plan for employees.

The plan is fully funded by the Company and is non-

contributory except for voluntary employee contributions

made under Section 401(k) of the Internal Revenue Code.

Under this provision of the plan, the Company provides

matching contributions up to a stipulated percentage of

employee contributions. Prior to 2000, the Company’s

contributions to the profit sharing portion of the plan vested

over a seven-year period. Effective January 1, 2000, the

Company’s subsequent contributions to the plan vest

immediately. The Company’s contribution is established

each year by the Board of Directors and totaled $31,330,

$47,500 and $50,000 in 2000, 1999 and 1998.

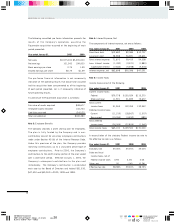

Note 4: Interest Expense, Net

The components of interest expense, net are as follows:

Year ended January 31, 2001 2000 1999

Short-term debt $12,682 $2,584 $10,707

Long-term debt 58,988 56,831 43,601

Total interest expense 71,670 59,415 54,308

Less: Interest income (1,330) (3,521) (1,883)

Capitalized interest (7,642) (5,498) (5,334)

Interest expense, net $62,698 $50,396 $47,091

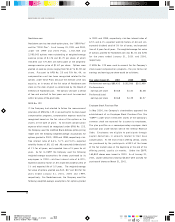

Note 5: Income Taxes

Income taxes consist of the following:

Year ended January 31, 2001 2000 1999

Current income taxes:

Federal $79,778 $130,524 $113,270

State and local 11,591 21,835 19,672

Total current

income taxes 91,369 152,359 132,942

Deferred income taxes:

Current (11,215) (18,367) (1,357)

Non-current (15,054) (4,492) (585)

Total deferred

income taxes (26,269) (22,859) (1,942)

Total income taxes $65,100 $129,500 $131,000

A reconciliation of the statutory Federal income tax rate to

the effective tax rate is as follows:

Year ended January 31, 2001 2000 1999

Statutory rate 35.00% 35.00% 35.00%

State and local

income taxes, net of

Federal income taxes 3.93 4.06 4.03

Other, net .05 (.06) (0.24)

Effective tax rate 38.98% 39.00% 38.79%