Nordstrom 2000 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2000 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cyan Mag Yelo Blk

20100444 Nordstrom

2001 Annual Report • 44pgs. + 4 covers pg. 30

8.375 x 10.875 • PDF • 150 lpi

PMS

5773

PMS

5503

30

NORDSTROM, INC. AND SUBSIDIARIES

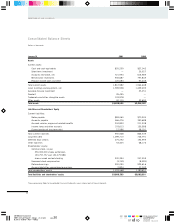

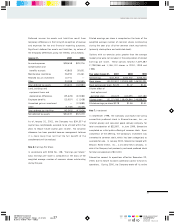

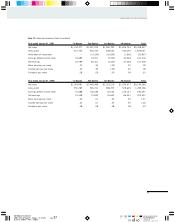

Note 11: Long-Term Debt

A summary of long-term debt is as follows:

January 31, 2001 2000

Senior debentures, 6.95%,

due 2028 $300,000 $300,000

Senior notes, 5.625%,

due 2009 250,000 250,000

Senior notes, 8.950%,

due 2005 300,000 —

Medium-term notes, payable by

Nordstrom Credit, Inc.,

7.25%-8.67%, due 2001-2002 87,750 145,350

Notes payable, of

Nordstrom Credit, Inc.,

6.7%, due 2005 100,000 100,000

Other 74,546 9,632

Total long-term debt 1,112,296 804,982

Less current portion (12,586) (58,191)

Total due beyond one year $1,099,710 $746,791

Aggregate principal payments on long-term debt are as

follows: 2001-$12,586; 2002-$131,150; 2003-$1,157;

2004-$1,224; 2005-$400,208 and thereafter-$565,971.

The Company owns a 49% interest in a limited partnership

which is constructing a new corporate office building in

which the Company will be the primary occupant. In

accordance with Emerging Issues Task Force Issue No. 97-

10 “The Effect of Lessee Involvement in Asset

Construction”, the Company is considered to be the owner of

the property. Construction in progress includes capitalized

costs related to this building of $57,270, which includes

noncash amounts of $41,883, as of January 31, 2001. The

corresponding finance obligation of $53,060 as of January

31, 2001 is included in other long-term debt. This finance

obligation will be amortized as rental payments are made by

the Company to the limited partnership over the life of

permanent financing, expected to be 20-25 years. The

amortization will begin once construction is complete,

estimated to be July 2001. The Company is a guarantor of a

$93,000 credit facility of the limited partnership. The

credit facility provides for interest at either the LIBOR rate

plus .75%, or the greater of the Federal Funds rate plus .5%

and the prime rate, and matures in August 2002 (6.36% at

January 31, 2001).

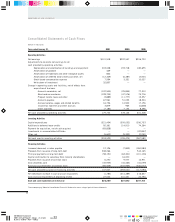

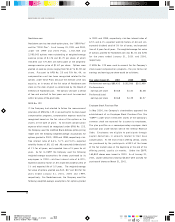

Note 12: Leases

The Company leases land, buildings and equipment under

noncancelable lease agreements with expiration dates

ranging from 2001 to 2080. Certain leases include renewal

provisions at the Company’s option. Most of the leases

provide for additional rent payments based upon specific

percentages of sales and require the Company to pay for

certain common area maintenance and other costs.

Future minimum lease payments as of January 31, 2001 are

as follows: 2001-$59,434; 2002-$52,741; 2003-$51,305;

2004-$49,866; 2005-$47,396 and thereafter-$362,567.

The following is a schedule of rent expense:

Year ended January 31, 2001 2000 1999

Minimum rent:

Store locations $16,907 $18,794 $19,167

Offices, warehouses

and equipment 21,070 19,926 19,208

Percentage rent:

Store locations 9,241 7,441 8,603

Total rent expense $47,218 $46,161 $46,978

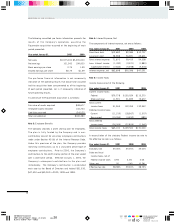

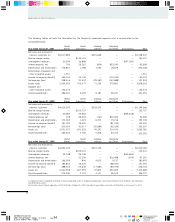

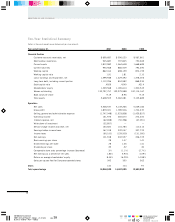

Note 13: Stock-Based Compensation

Stock Option Plan

The Company has a stock option plan (the “Plan”)

administered by the Compensation Committee of the Board

of Directors (the “Committee”) under which stock options,

performance share units and restricted stock may be granted

to key employees of the Company. Stock options are issued

at the fair market value of the stock at the date of grant.

Options vest over periods ranging from four to eight years,