Nordstrom 2000 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2000 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Cyan Mag Yelo Blk

20100444 Nordstrom

2001 Annual Report • 44pgs. + 4 covers pg. 29

8.375 x 10.875 • PDF • 150 lpi

PMS

5773

PMS

5503

29

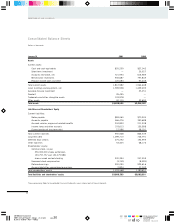

NORDSTROM, INC. AND SUBSIDIARIES

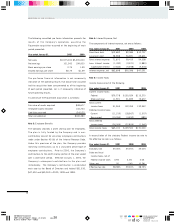

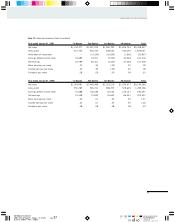

$251,109 as of January 31, 2001. Credit losses and

delinquencies of these receivables are $12,955 and $7,471

for the year ended January 31, 2001.

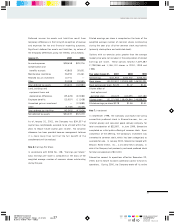

The following table illustrates historical and future default

projections using net credit losses as a percentage of

average outstanding receivables in comparison to actual

performance:

Year ended January 31, 2001 2000 1999

Original projection 5.99% 5.39% 6.94%

Actual N/A% 5.46% 6.09%

Pursuant to the terms of operative documents of the trust, in

certain events the Company may be required to fund certain

amounts pursuant to a recourse obligation for credit losses.

Based on current cash flow projections, the Company does

not believe any additional funding will be required.

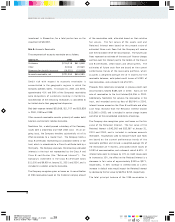

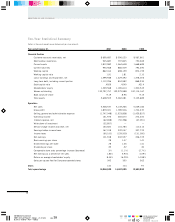

Note 9: Land, Buildings and Equipment

Land, buildings and equipment consist of the following

(at cost):

January 31, 2001 2000

Land and land improvements $60,871 $59,237

Buildings 760,029 650,414

Leasehold improvements 903,925 870,821

Capitalized software 38,642 20,150

Store fixtures and equipment 1,172,914 1,037,936

2,936,381 2,638,558

Less accumulated depreciation

and amortization (1,554,081) (1,370,726)

1,382,300 1,267,832

Construction in progress 217,638 161,660

Land, buildings and

equipment, net $1,599,938 $1,429,492

At January 31, 2001, the net book value of property located

in California is approximately $308,000. The Company

carries earthquake insurance in California with a $50,000

deductible.

At January 31, 2001, the Company has contractual

commitments of approximately $428,000 for the

construction of new stores or remodeling of existing stores.

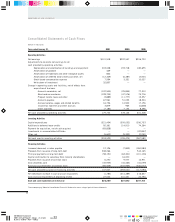

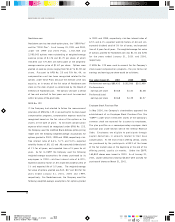

Note 10: Notes Payable

A summary of notes payable is as follows:

Year ended January 31, 2001 2000 1999

Average daily short-

term borrowings $192,392 $45,030 $195,596

Maximum amount

outstanding 360,480 178,533 385,734

Weighted average

interest rate:

During the year 6.6% 5.8% 5.5%

At year-end 6.4% 6.0% 5.2%

At January 31, 2001, the Company has an unsecured line of

credit with a group of commercial banks totaling $500,000

which is available as liquidity support for the Company’s

commercial paper program, and expires in July 2002. The

line of credit agreement contains restrictive covenants

which, among other things, require the Company to maintain

a certain minimum level of net worth and a coverage ratio (as

defined) of no less than 2 to 1. The Company pays a

commitment fee for the unused portion of the line based on

the Company’s debt rating.