Home Depot 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

THE HOME DEPOT, INC. AND SUBSIDIARIES

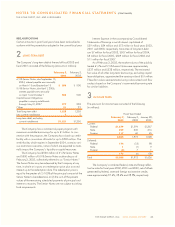

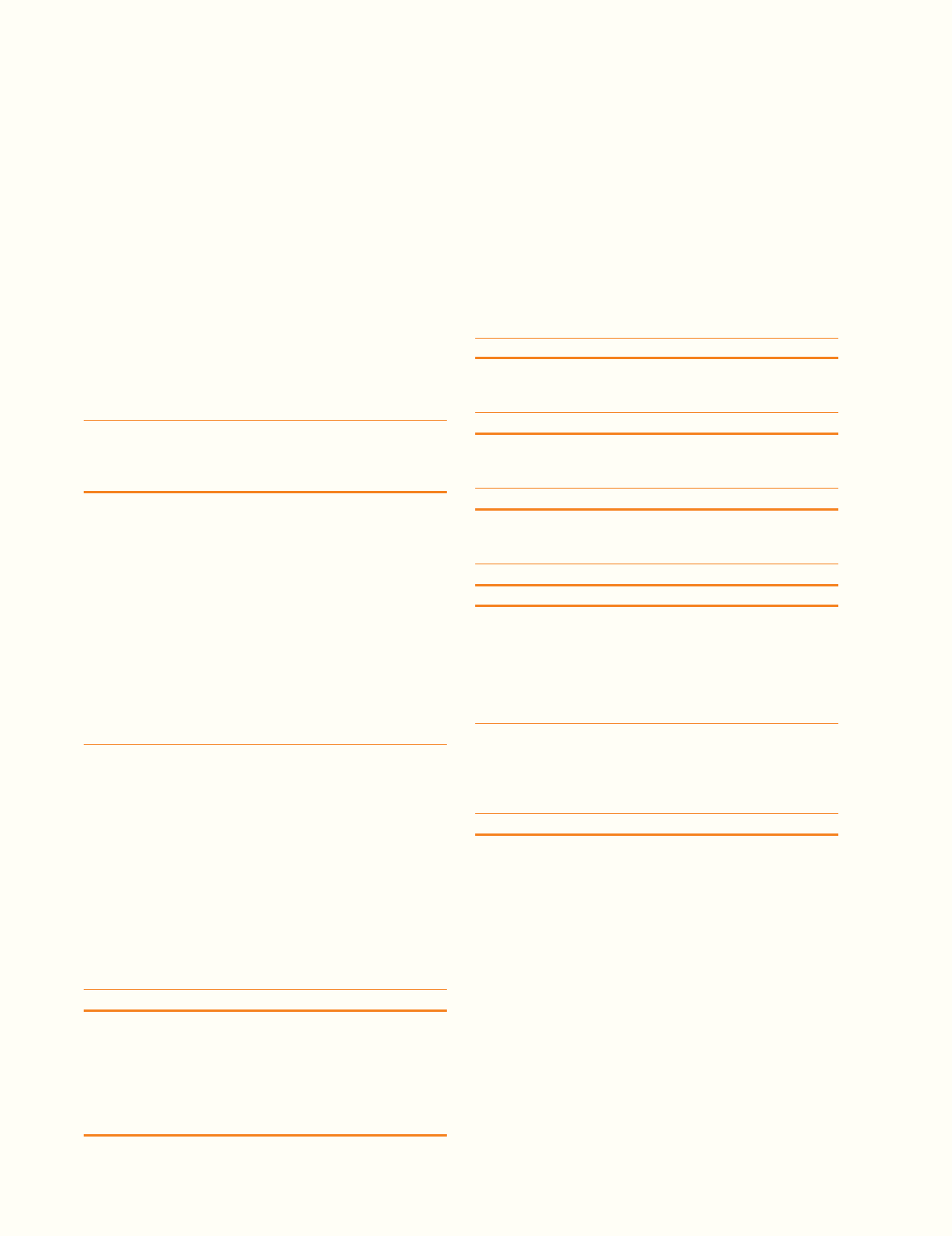

The Company recorded stock compensation expense related to

deferred stock units of $12 million, $16 million and $6 million

in fiscal 2002, 2001 and 2000, respectively.

The per share weighted average fair value of stock options

granted during fiscal years 2002, 2001 and 2000 was $17.34,

$20.51 and $31.96, respectively. The fair value of these options

was determined at the date of grant using the Black-Scholes

option-pricing model with the following assumptions:

Fiscal Year Ended

February 2, February 3, January 28,

2003 2002 2001

Risk-free interest rate 4.0% 5.1% 6.4%

Assumed volatility 44.3% 48.1% 54.6%

Assumed dividend yield 0.5% 0.4% 0.3%

Assumed lives of options 5 years 6 years 7 years

The Company applies APB 25 in accounting for its stock-

based compensation plans and, accordingly, no compensation

expense has been recognized in the Company’s financial state-

ments for incentive or non-qualified stock options granted. If,

under SFAS No. 123, the Company determined compensation

expense based on the fair value at the grant date for its stock

options, as computed and disclosed above, net earnings and

earnings per share would have been reduced to the pro forma

amounts below (in millions, except per share data):

Fiscal Year Ended

February 2, February 3, January 28,

2003 2002 2001

Net earnings,

as reported $3,664 $3,044 $2,581

Add: Stock-based

compensation expense

included in reported net

earnings, net of related

tax effects 10 13 4

Deduct: Total stock-based

compensation expense

determined under

fair value based method

for all awards, net of

related tax effects (260) (257) (221)

Pro forma net earnings $3,414 $2,800 $2,364

Earnings per share:

Basic – as reported $ 1.57 $ 1.30 $ 1.11

Basic – pro forma $ 1.46 $ 1.20 $ 1.02

Diluted – as reported $ 1.56 $ 1.29 $ 1.10

Diluted – pro forma $ 1.46 $ 1.19 $ 1.01

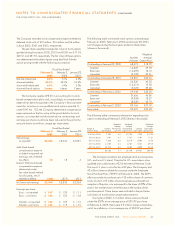

The following table summarizes stock options outstanding at

February 2, 2003, February 3, 2002 and January 28, 2001,

and changes during the fiscal years ended on these dates

(shares in thousands):

Weighted

Number Average

of Shares Option Price

Outstanding at January 30, 2000 68,419 $18.79

Granted 14,869 49.78

Exercised (14,689) 13.15

Canceled (2,798) 30.51

Outstanding at January 28, 2001 65,801 $26.46

Granted 25,330 40.33

Exercised (16,614) 15.03

Canceled (5,069) 39.20

Outstanding at February 3, 2002 69,448 $33.33

Granted 31,656 40.86

Exercised (9,908) 18.27

Canceled (8,030) 42.74

Outstanding at February 2, 2003 83,166 $37.09

Exercisable 29,431 $29.48

The following table summarizes information regarding stock

options outstanding at February 2, 2003 (shares in thousands):

Weighted Weighted Weighted

Average Average Average

Range of Options Remaining Outstanding Options Exercisable

Exercise Prices Outstanding Life (Yrs) Option Price Exercisable Option Price

$ 6.00 to 12.00 7,090 3.5 $10.24 7,090 $10.24

12.01 to 20.00 1,191 4.7 17.21 1,191 17.21

20.01 to 30.00 7,438 5.6 22.19 6,090 21.78

30.01 to 42.00 41,745 8.4 37.67 11,161 39.12

42.01 to 54.00 25,702 8.5 48.80 3,899 52.48

83,166 7.7 $37.09 29,431 $29.48

The Company maintains two employee stock purchase plans

(U.S. and non-U.S. plans). The plan for U.S. associates is a tax-

qualified plan under Section 423 of the Internal Revenue Code.

The non-U.S. plan is not a Section 423 plan. The Company had

43 million shares available for issuance under the Employee

Stock Purchase Plans (“ESPPs”) at February 2, 2003. The ESPPs

allow associates to purchase up to 152 million shares of common

stock, of which 109 million shares have been purchased from

inception of the plan, at a price equal to the lower of 85% of the

stock’s fair market value on the first day or the last day of the

purchase period. These shares were included in the pro forma

calculation of stock-based compensation expense.

During fiscal 2002, 5.2 million shares were purchased

under the ESPPs at an average price of $30.89 per share.

At February 2, 2003, there were 2.3 million shares outstanding,

net of cancellations, at an average price of $34.09 per share.

THE HOME DEPOT, INC. 2002 ANNUAL REPORT 37