Home Depot 2002 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2002 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

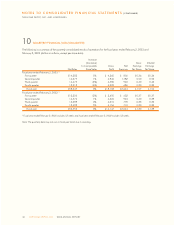

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

THE HOME DEPOT, INC. AND SUBSIDIARIES

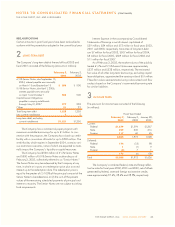

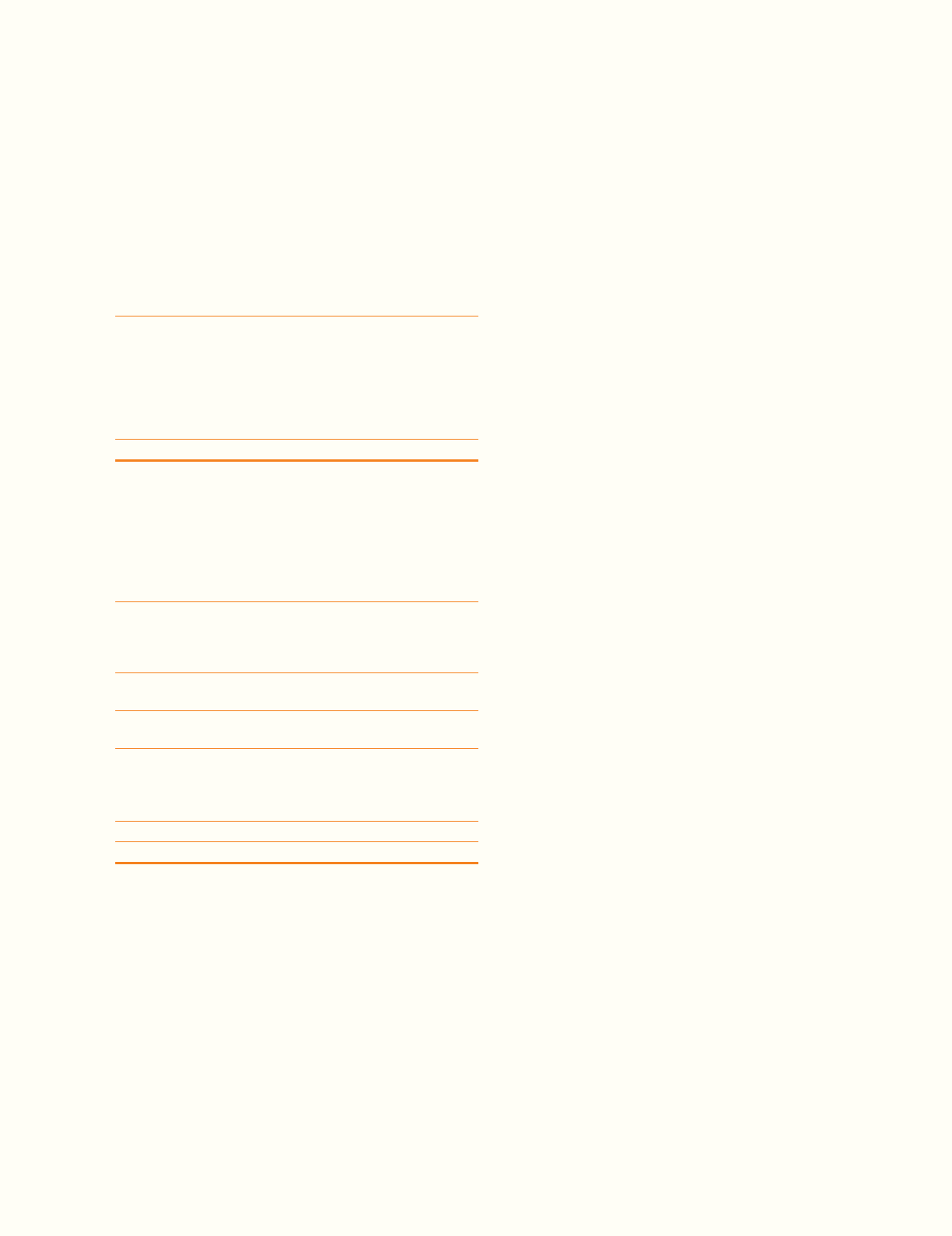

A reconciliation of income tax expense at the federal statutory

rate of 35% to actual tax expense for the applicable fiscal years

is as follows (in millions):

Fiscal Year Ended

February 2, February 3, January 28,

2003 2002 2001

Income taxes at federal

statutory rate $2,055 $1,735 $1,476

State income taxes, net

of federal income

tax benefit 156 172 146

Foreign rate differences (1) 4 5

Other, net (2) 2 9

Tot a l $2,208 $1,913 $1,636

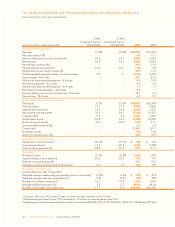

The tax effects of temporary differences that give rise to

significant portions of the deferred tax assets and deferred tax

liabilities as of February 2, 2003, and February 3, 2002, were

as follows (in millions):

February 2, February 3,

2003 2002

Deferred Tax Assets:

Accrued self-insurance liabilities $ 305 $ 220

Other accrued liabilities 92 138

Net loss on disposition of business 31 31

Total gross deferred tax assets 428 389

Valuation allowance (31) (31)

Deferred tax assets, net of

valuation allowance 397 358

Deferred Tax Liabilities:

Accelerated depreciation (571) (492)

Accelerated inventory deduction (149) –

Other (39) (55)

Total gross deferred tax liabilities (759) (547)

Net deferred tax liability $(362) $(189)

A valuation allowance existed as of February 2, 2003,

and February 3, 2002, due to the uncertainty of capital loss

utilization. Management believes the existing net deductible

temporary differences comprising the deferred tax assets will

reverse during periods in which the Company generates net

taxable income.

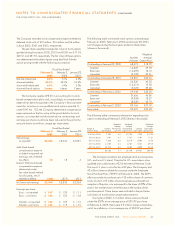

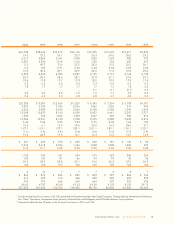

4EMPLOYEE STOCK PLANS

The 1997 Omnibus Stock Incentive Plan (“1997 Plan”) pro-

vides that incentive stock options, non-qualified stock options,

stock appreciation rights, restricted shares, performance

shares, performance units and deferred shares may be issued

to selected associates, officers and directors of the Company.

The maximum number of shares of the Company’s common

stock authorized for issuance under the 1997 Plan includes

the number of shares carried over from prior plans and the

number of shares authorized but unissued in the prior year,

plus one-half percent of the total number of outstanding shares

as of the first day of each fiscal year. As of February 2, 2003,

there were 108 million shares available for future grants

under the 1997 Plan.

Under the 1997 Plan, as of February 2, 2003, the

Company had granted incentive and non-qualified stock

options for 167 million shares, net of cancellations (of which

86 million had been exercised). Incentive stock options and

non-qualified options typically vest at the rate of 25% per year

commencing on the first anniversary date of the grant and

expire on the tenth anniversary date of the grant.

Under the 1997 Plan, as of February 2, 2003, 2 million

shares of restricted stock had been issued net of cancellations

(the restrictions on 4,600 shares have lapsed). Generally, the

restrictions on 25% of the restricted shares lapse upon the third

and sixth year anniversaries of the date of issuance with the

remaining 50% of the restricted shares lapsing upon the asso-

ciate’s attainment of age 62. The fair value of the restricted

shares is expensed over the period during which the restric-

tions lapse. The Company recorded compensation expense

related to restricted stock of $3 million in both fiscal 2002 and

2001 and $455,000 in fiscal 2000.

As of February 2, 2003, there were 2.5 million non-qualified

stock options and 1.4 million deferred stock units outstanding

under non-qualified stock option and deferred stock unit plans

that are not part of the 1997 Plan. The 2.5 million non-qualified

stock options have an exercise price of $40.75 per share and

were granted in fiscal 2000. During fiscal years 2002, 2001

and 2000, the Company granted 0, 629,000 and 750,000

deferred stock units, respectively, to several key officers vesting

at various dates. Each deferred stock unit entitles the officer to

one share of common stock to be received up to five years after

the vesting date of the deferred stock unit, subject to certain

deferral rights of the officer. The fair value of the deferred stock

units on the grant dates was $27 million and $31 million for

deferred units granted in fiscal 2001 and 2000, respectively.

These amounts are being amortized over the vesting periods.

36 THE HOME DEPOT, INC. 2002 ANNUAL REPORT