Home Depot 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION (CONTINUED)

THE HOME DEPOT, INC. AND SUBSIDIARIES

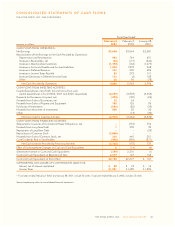

Cash used in investing activities decreased to $2.9 billion

in fiscal 2002 from $3.5 billion in fiscal 2001. Capital expendi-

tures decreased to $2.7 billion in fiscal 2002 from $3.4 billion

in fiscal 2001. This decrease was due primarily to a shift in the

timing of spending for future store openings. We opened

203 new stores in fiscal 2002 compared to 204 new stores in

fiscal 2001. We own 195 and 188 of the stores opened in fiscal

2002 and fiscal 2001, respectively, and lease the remainder.

We plan to open 206 stores in fiscal 2003, including 6

Home Depot Landscape Supply stores, and expect total capital

expenditures to be approximately $4.0 billion, which includes a

higher level of investment in store remodeling, technology and

other initiatives as compared to fiscal 2002.

Cash used in financing activities in fiscal 2002 was

$2.2 billion compared with $173 million in fiscal 2001. This

change is primarily due to the repurchase of approximately

68.6 million shares of our common stock for $2 billion, pur-

suant to the Share Repurchase Program approved by our Board

of Directors in July 2002.

We have a commercial paper program that allows borrow-

ings for up to a maximum of $1 billion. As of February 2, 2003,

there were no borrowings outstanding under the program. In

connection with the program, we have a back-up credit facility

with a consortium of banks for up to $800 million. The credit

facility, which expires in September 2004, contains various

restrictive covenants, none of which are expected to impact our

liquidity or capital resources.

We use capital and operating leases, as well as three off-

balance sheet leases created under structured financing arrange-

ments, to finance about 22% of our real estate. The net present

value of capital lease obligations is reflected in our Consolidated

Balance Sheets in Long-Term Debt. The three off-balance sheet

leases were created to purchase land and fund the construc-

tion of certain stores, office buildings and distribution centers.

Two of these lease agreements involve a special purpose entity

(“SPE”) which meets the criteria for non-consolidation estab-

lished by generally accepted accounting principles and is not

owned by or affiliated with our Company, management or offi-

cers. Operating and off-balance sheet leases are not reflected

in our Consolidated Balance Sheets in accordance with gener-

ally accepted accounting principles.

As of the end of fiscal 2002, our long-term debt-to-equity

ratio was 6.7%. If the estimated net present value of future

payments under the operating and off-balance sheet leases

were capitalized, our long-term debt-to-equity ratio would

increase to 28.5%.

THE HOME DEPOT, INC. 2002 ANNUAL REPORT 25

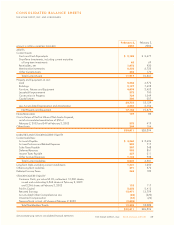

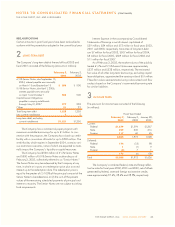

The following table summarizes our significant contractual obligations and commercial commitments as of February 2, 2003

(amounts in millions):

Payments Due By Fiscal Year

Contractual Obligations(1) Total 2003 2004-2005 2006-2007 Thereafter

Long-Term Debt $1,051 $ 2 $502 $502 $ 45

Capital Lease Obligations 834 44 89 93 608

Operating Leases 7,308 541 988 864 4,915

Amount of Commitment Expiration Per Fiscal Year

Commercial Commitments(2) Total 2003 2004-2005 2006-2007 Thereafter

Letters of Credit $ 930 $921 $ 9 $ – $ –

Guarantees 799 – 72 504 223

(1) Contractual obligations include long-term debt comprised primarily of $1 billion of Senior Notes further discussed in “Quantitative and Qualitative

Disclosures about Market Risk”and future minimum lease payments under capital and operating leases, which include off-balance sheet leases,

used in the normal course of business.

(2) Commercial commitments include letters of credit for certain business transactions and guarantees provided under the off-balance sheet

leases. We issue letters of credit for insurance programs, import purchases and construction contracts. Under the three off-balance sheet leases

for certain stores, office buildings and distribution centers, we have provided residual value guarantees. The estimated maximum amount of the

residual value guarantees at the end of the leases is $799 million. The leases expire at various dates during fiscal 2005 through 2008 with two

of the leases having an option to renew through 2025. Events or circumstances that would require us to perform under the guarantees include

1) our default on the leases with the assets being sold for less than the initial book value, or 2) we decide not to purchase the assets at the end

of the leases and the sale of the assets results in proceeds less than the initial book value of the assets. Our guarantees are limited to 82% of the

initial book value of the assets. The expiration dates of the residual value guarantees as disclosed in the table above are based on the expiration

of the leases; however, the expiration dates will change if the leases are renewed.