Home Depot 2002 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2002 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FUNDAMENTALS

More than 1.16 billion customer transactions per year and an average

ticket of $49.43 drove total sales growth for our Company in fiscal

2002. Strong gains in gross margin, driven by our centralized mer-

chandising organization, drove profitability to record highs.

REINVESTING FOR FUTURE

GROWTH WHILE PROTECTING

CORE INVESTMENTS

In fiscal 2002, our capital expenditures totaled $2.7 billion, primarily

funding the construction of 203 new stores. In fiscal 2003, we will

increase our capital spending by 48% to $4 billion, in support of

both new and existing stores, as well as technology innovations.

We have targeted $250 million for store remodels, $360 million for

technology and $360 million for other store initiatives.

REINVESTING IN OUR COMPANY

In fiscal 2002, we completed a $2 billion share repurchase program,

or approximately 69 million shares of our common stock. In addition,

we increased our quarterly dividend by 20% in the fourth quarter.

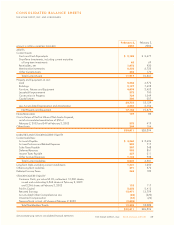

BALANCE SHEET STRENGTH

The Home Depot’s financial strength ranks among the best in retailing.

At the end of fiscal 2002, we had total equity of $19.8 billion, with

a long-term debt-to-equity ratio of 6.7%, and strong liquidity with

$2.3 billion in cash and short-term investments. We own 82% of our

stores, which are unencumbered, and drive high returns on the capital

we have invested in our business.

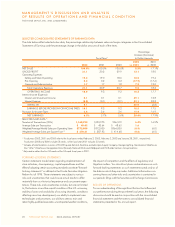

WE BELIEVE THAT VALUE IS CREATED BY SALES

GROWTH AND INCREASING RATES OF RETURN

ON THE CAPITAL WE INVEST. IN 2002, OUR SALES

GREW BY APPROXIMATELY $4.6 BILLION AND OUR

RETURN ON INVESTED CAPITAL GREW BY 50 BASIS

POINTS TO 18.8%. WE REPORTED $3.7 BILLION IN

NET EARNINGS FOR THE YEAR, AND IN THE SECOND

QUARTER OF 2002 BECAME THE SECOND RETAILER

IN HISTORY TO POST NET EARNINGS OF $1 BILLION

IN ONE QUARTER. OUR FINANCIAL STRENGTH IS

UNPARALLELED IN RETAILING AND IS A COMPETITIVE

ADVANTAGE AS WE ARE WELL POSITIONED FOR

FUTURE GROWTH.

A SOLID SET OF

FINANCIAL ATTRIBUTES.

MORE THAN ONE

FINANCIAL METRIC.

20