Home Depot 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION (CONTINUED)

THE HOME DEPOT, INC. AND SUBSIDIARIES

operating expenses was primarily attributable to higher costs

associated with merchandise resets and store renovations as we

invested in new signage, fixtures and general maintenance of our

stores, a continued investment in store leadership positions in our

stores and rising workers’ compensation expense due in part to

medical cost inflation. These increases were partially offset by a

decrease in store payroll expense which resulted from improve-

ment in labor productivity and effective wage rate management.

Pre-opening expenses as a percent of sales were 0.2% for

both fiscal 2002 and fiscal 2001. We opened 203 new stores in

fiscal 2002 as compared to 204 new stores in fiscal 2001.

General and administrative expenses as a percent of sales

were 1.7% for both fiscal 2002 and fiscal 2001.

Interest and investment income as a percent of sales was

0.1% for both fiscal 2002 and 2001. Interest expense as a per-

cent of sales was 0.0% for fiscal 2002 and 0.1% for fiscal 2001.

Our combined federal and state effective income tax rate

decreased to 37.6% for fiscal 2002 from 38.6% for fiscal 2001.

The decrease in fiscal 2002 was attributable to higher tax

credits and a lower effective state income tax rate compared

to fiscal 2001.

Fiscal 2001 compared to fiscal year ended January 28, 2001

(“fiscal 2000”)

Fiscal 2001 included 53 weeks as compared to 52 weeks in fiscal

2000. Net sales for fiscal 2001 increased 17.1% to $53.6 billion

from $45.7 billion in fiscal 2000. This increase was attributable

to, among other things, the 204 new stores opened during

fiscal 2001 and full year sales from the 204 new stores opened

during fiscal 2000. Approximately $880 million of the increase

in sales was attributable to the additional week in fiscal 2001.

Comparable store-for-store sales were flat in fiscal 2001 due

to the weak economic environment resulting from certain factors

including, but not limited to, low consumer confidence and

high unemployment.

Gross profit as a percent of sales was 30.2% for fiscal

2001 compared to 29.9% for fiscal 2000. The rate increase

was primarily attributable to a lower cost of merchandise result-

ing from product line reviews, purchasing synergies created by

our newly centralized merchandising structure and an increase

in the number of tool rental centers from 342 at the end of fiscal

2000 to 466 at the end of fiscal 2001.

Operating expenses as a percent of sales were 20.9% for

fiscal 2001 compared to 20.7% for fiscal 2000. Included in

operating expenses are selling and store operating expenses

which, as a percent of sales, increased to 19.0% in fiscal 2001

from 18.6% in fiscal 2000. The increase was primarily attributa-

ble to growth in store occupancy costs resulting from higher

depreciation and property taxes due to our investment in new

stores, combined with increased energy costs. Also, credit card

transaction fees were higher than the prior year due to increased

penetration of total credit sales. These increases were partially

offset by a decrease in store payroll expense due to an improve-

ment in labor productivity which resulted from initiatives inside

the store and new systems enhancements.

Store initiatives included our SPI initiative which was intro-

duced to every Home Depot store in fiscal 2001. Under SPI our

stores receive and handle inventory at night, allowing our associ-

ates to spend more time with customers during peak selling

hours. In addition, our Pro program was in 535 of our Home

Depot stores at the end of fiscal 2001, providing dedicated store

resources to serve the specific needs of professional customers.

Pre-opening expenses as a percent of sales were 0.2% for

fiscal 2001 and 0.3% for fiscal 2000. We opened 204 new

stores in both fiscal 2001 and 2000. The decrease was primarily

due to shorter pre-opening periods as we re-engineered our

store opening process.

General and administrative expenses as a percent of sales

were 1.7% for fiscal 2001 compared to 1.8% for fiscal 2000.

This decrease was primarily due to cost savings associated with

the reorganization of certain components of our organizational

structure, such as the centralization of our merchandising

organization and our focus on expense control in areas such

as travel.

Interest and investment income as a percent of sales was

0.1% for both fiscal 2001 and 2000. Interest expense as a

percent of sales was 0.1% for both fiscal 2001 and 2000.

Our combined federal and state effective income tax rate

decreased to 38.6% for fiscal 2001 from 38.8% for fiscal 2000.

The decrease in fiscal 2001 was attributable to higher tax

credits and a lower effective state income tax rate compared

to fiscal 2000.

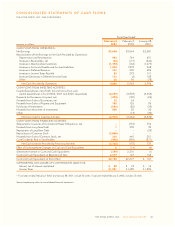

LIQUIDITY AND CAPITAL RESOURCES

Cash flow generated from operations provides us with a signifi-

cant source of liquidity. For fiscal 2002, cash provided by oper-

ations decreased to $4.8 billion from $6.0 billion in fiscal 2001.

The decrease was primarily due to a 7.9% increase in average

inventory per store resulting from our focus on improving our

in-stock position in fiscal 2002.

During fiscal 2002, we experienced a significant growth in

days payable outstanding to 42 days at the end of fiscal 2002

from 34 days at the end of fiscal 2001. The growth in days

payable is the result of our efforts to move our payment terms to

industry averages. We have realized the majority of the benefit

from our renegotiated payment terms.

24 THE HOME DEPOT, INC. 2002 ANNUAL REPORT