Home Depot 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

THE HOME DEPOT, INC. AND SUBSIDIARIES

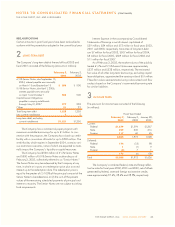

RECLASSIFICATIONS

Certain amounts in prior fiscal years have been reclassified to

conform with the presentation adopted in the current fiscal year.

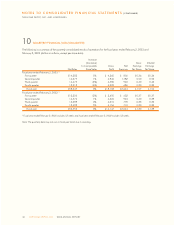

2LONG-TERM DEBT

The Company’s long-term debt at the end of fiscal 2002 and

fiscal 2001 consisted of the following (amounts in millions):

February 2, February 3,

2003 2002

61/2% Senior Notes; due September 15,

2004; interest payable semi-annually

on March 15 and September 15 $ 500 $ 500

53/8% Senior Notes; due April 1, 2006;

interest payable semi-annually

on April 1 and October 1 500 500

Capital Lease Obligations;

payable in varying installments

through May 31, 2027 277 232

Other 51 23

Total long-term debt 1,328 1,255

Less current installments 75

Long-term debt, excluding

current installments $1,321 $1,250

The Company has a commercial paper program with

maximum available borrowings for up to $1 billion. In con-

nection with the program, the Company has a back-up credit

facility with a consortium of banks for up to $800 million. The

credit facility, which expires in September 2004, contains vari-

ous restrictive covenants, none of which are expected to mate-

rially impact the Company’s liquidity or capital resources.

The Company had $500 million of 61/2% Senior Notes

and $500 million of 53/8% Senior Notes outstanding as of

February 2, 2003, collectively referred to as “Senior Notes.”

The Senior Notes may be redeemed by the Company at any

time, in whole or in part, at a redemption price plus accrued

interest up to the redemption date. The redemption price is

equal to the greater of (1) 100% of the principal amount of the

Senior Notes to be redeemed, or (2) the sum of the present

values of the remaining scheduled payments of principal and

interest to maturity. The Senior Notes are not subject to sinking

fund requirements.

Interest Expense in the accompanying Consolidated

Statements of Earnings is net of interest capitalized of

$59 million, $84 million and $73 million in fiscal years 2002,

2001 and 2000, respectively. Maturities of long-term debt

are $7 million for fiscal 2003, $507 million for fiscal 2004,

$8 million for fiscal 2005, $509 million for fiscal 2006 and

$11 million for fiscal 2007.

As of February 2, 2003, the market values of the publicly

traded 61/2% and 53/8% Senior Notes were approximately

$537 million and $538 million, respectively. The estimated

fair value of all other long-term borrowings, excluding capital

lease obligations, approximated the carrying value of $51 million.

These fair values were estimated using a discounted cash flow

analysis based on the Company’s incremental borrowing rate

for similar liabilities.

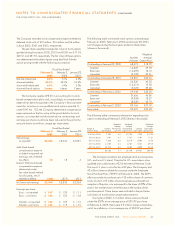

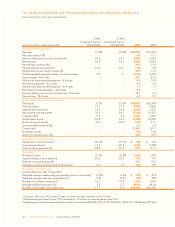

3INCOME TAXES

The provision for income taxes consisted of the following

(in millions):

Fiscal Year Ended

February 2, February 3, January 28,

2003 2002 2001

Current:

Federal $1,679 $1,594 $1,267

State 239 265 216

Foreign 117 60 45

2,035 1,919 1,528

Deferred:

Federal 174 (12) 98

State 1(1) 9

Foreign (2) 7 1

173 (6) 108

Tot a l $2,208 $1,913 $1,636

The Company’s combined federal, state and foreign effec-

tive tax rates for fiscal years 2002, 2001 and 2000, net of offsets

generated by federal, state and foreign tax incentive credits,

were approximately 37.6%, 38.6% and 38.8%, respectively.

THE HOME DEPOT, INC. 2002 ANNUAL REPORT 35