Home Depot 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

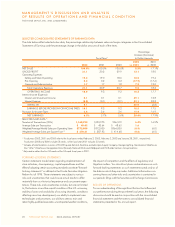

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION (CONTINUED)

THE HOME DEPOT, INC. AND SUBSIDIARIES

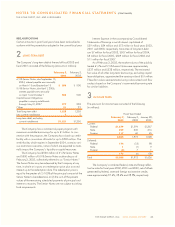

Effective February 3, 2003, we adopted the fair value method

of recording compensation expense related to all stock options

granted after February 2, 2003, in accordance with SFAS Nos. 123

and 148. Accordingly, the fair value of stock options as deter-

mined on the date of grant using the Black-Scholes option-pricing

model will be expensed over the vesting period of the related

stock options. The estimated negative impact on diluted earnings

per share is approximately $.02 for fiscal 2003. The actual

impact may differ from this estimate as the estimate is based

upon a number of factors including, but not limited to, the number

of stock options granted and the fair value of the stock options

on the date of grant.

RECENT ACCOUNTING PRONOUNCEMENTS

In January 2003, the Financial Accounting Standards Board

(“FASB”) issued Interpretation No. 46, “Consolidation of Variable

Interest Entities.” Interpretation No. 46 requires consolidation of

a variable interest entity if a company’s variable interest absorbs

a majority of the entity’s losses or receives a majority of the entity’s

expected residual returns, or both. We do not have a variable

interest in the SPE created as part of our off-balance sheet struc-

tured financing arrangements and, therefore, we are not required

to consolidate the SPE. We do not expect Interpretation No. 46 to

have any impact on our consolidated financial statements.

In January 2003, the Emerging Issues Task Force issued

EITF 02-16, “Accounting by a Customer (Including a Reseller) for

Certain Consideration Received from a Vendor,” which states that

cash consideration received from a vendor is presumed to be a

reduction of the prices of the vendor’s products or services and

should, therefore, be characterized as a reduction of Cost of

Merchandise Sold when recognized in our Consolidated

Statements of Earnings. That presumption is overcome when the

consideration is either a reimbursement of specific, incremental,

identifiable costs incurred to sell the vendor’s products, or a pay-

ment for assets or services delivered to the vendor. EITF 02-16

is effective for arrangements entered into after December 31,

2002. We are currently assessing the impact of the adoption of

EITF 02-16 and do not expect the adoption to materially impact

net earnings in fiscal 2003. We do, however, expect that certain

payments received from our vendors that are currently reflected

as a reduction in advertising expense, which is classified as

Selling and Store Operating Expense, will be reclassified as a

reduction of Cost of Merchandise Sold.

In December 2002, the FASB issued Interpretation No. 45,

“Guarantor’s Accounting and Disclosure Requirements for

Guarantees, Including Indirect Guarantees of Indebtedness of

Others,” which provides for additional disclosures to be made by

a guarantor in its interim and annual financial statements about

its obligations and requires, under certain circumstances, a guar-

antor to recognize, at the inception of a guarantee, a liability for

the fair value of the obligation undertaken in issuing the guarantee.

We have adopted the disclosure requirements for the fiscal year

ended February 2, 2003. We do not expect the recognition and

measurement provisions of Interpretation No. 45 for guarantees

issued or modified after December 31, 2002, to have a material

impact on our consolidated financial statements.

THE HOME DEPOT, INC. 2002 ANNUAL REPORT 27