Home Depot 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

THE HOME DEPOT, INC. AND SUBSIDIARIES

The Company and its eligible subsidiaries file a consoli-

dated U.S. federal income tax return. Non-U.S. subsidiaries,

which are consolidated for financial reporting purposes, are not

eligible to be included in consolidated U.S. federal income tax

returns. Separate provisions for income taxes have been deter-

mined for these entities. The Company intends to reinvest the

unremitted earnings of its non-U.S. subsidiaries and postpone

their remittance indefinitely. Accordingly, no provision for

U.S. income taxes for non-U.S. subsidiaries was recorded in

the accompanying Consolidated Statements of Earnings.

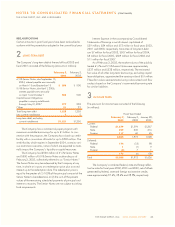

DEPRECIATION AND AMORTIZATION

The Company’s buildings, furniture, fixtures and equipment

are depreciated using the straight-line method over the estimated

useful lives of the assets. Improvements to leased assets are

amortized using the straight-line method over the life of the

lease or the useful life of the improvement, whichever is shorter.

The Company’s property and equipment is depreciated using

the following estimated useful lives:

Life

Buildings 10-45 years

Furniture, fixtures and equipment 5-20 years

Leasehold improvements 5-30 years

Computer equipment and software 3-5 years

REVENUES

The Company recognizes revenue, net of estimated returns,

at the time the customer takes possession of merchandise or

receives services. When the Company receives payment from

customers before the customer has taken possession of the

merchandise or the service has been performed, the amount

received is recorded in Deferred Revenue in the accompanying

Consolidated Balance Sheets.

SERVICE REVENUES

Total revenues include service revenues generated through a variety

of installation and home maintenance programs in Home Depot

and EXPO stores as well as through the Company’s subsidiary,

HD Builder Solutions Group, Inc. In these programs, the customer

selects and purchases materials for a project and the Company

provides or arranges professional installation. When the Company

subcontracts the installation of a project and the subcontractor

provides material as part of the installation, both the material and

labor are included in service revenues. The Company recognizes

this revenue when the service for the customer is completed. All

payments received prior to the completion of services are recorded

in Deferred Revenue in the accompanying Consolidated Balance

Sheets. Net service revenues, including the impact of deferred

revenue, were $2.0 billion, $1.6 billion and $1.3 billion for the

fiscal years 2002, 2001 and 2000, respectively.

SELF INSURANCE

The Company is self-insured for certain losses related to general

liability, product liability, workers’ compensation and medical

claims. The expected ultimate cost for claims incurred as of

the balance sheet date is not discounted and is recognized

as a liability. The expected ultimate cost of claims is estimated

based upon analysis of historical data and actuarial estimates.

ADVERTISING

Television and radio advertising production costs along with media

placement costs are expensed when the advertisement first appears.

Included in Current Assets in the accompanying Consolidated

Balance Sheets are $20 million and $15 million at the end of

fiscal years 2002 and 2001, respectively, relating to prepayments

of production costs for print and broadcast advertising.

Gross advertising expense is classified as Selling and Store

Operating Expenses and was $895 million, $817 million and

$722 million, in fiscal years 2002, 2001 and 2000, respectively.

Advertising allowances earned from vendors fully offset gross

advertising expenses. In fiscal 2002, 2001 and 2000, advertis-

ing allowances exceeded gross advertising expense by $30 mil-

lion, $31 million and $62 million, respectively. These excess

amounts were recorded as a reduction in Cost of Merchandise

Sold in the accompanying Consolidated Statements of Earnings.

SHIPPING AND HANDLING COSTS

The Company accounts for certain shipping and handling

costs related to the shipment of product to customers from

vendors as Cost of Merchandise Sold. However, cost of shipping

and handling to customers by the Company is classified as

Selling and Store Operating Expenses. The cost of shipping

and handling, including internal costs and payments to third

parties, classified as Selling and Store Operating Expenses

was $341 million, $278 million and $226 million in fiscal

years 2002, 2001 and 2000, respectively.

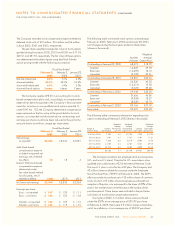

COST IN EXCESS OF THE FAIR VALUE OF NET ASSETS ACQUIRED

Goodwill represents the excess of purchase price over fair

value of net assets acquired. In accordance with Statement of

Financial Accounting Standards (“SFAS”) No. 142, “Goodwill

and Other Intangible Assets,” the Company stopped amortiz-

ing goodwill effective February 4, 2002. Amortization expense

was $8 million in both fiscal 2001 and fiscal 2000. The

Company assesses the recoverability of goodwill at least

annually by determining whether the fair value of each report-

ing entity supports its carrying value. The Company completed

its assessment of goodwill for fiscal 2002 and recorded an

impairment charge of $1.3 million.

THE HOME DEPOT, INC. 2002 ANNUAL REPORT 33