Home Depot 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

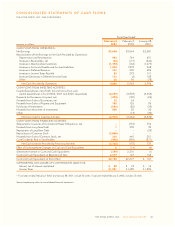

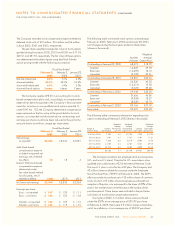

CONSOLIDATED STATEMENTS OF CASH FLOWS

THE HOME DEPOT, INC. AND SUBSIDIARIES

Fiscal Year Ended(1)

February 2, February 3, January 28,

amounts in millions 2003 2002 2001

CASH FLOWS FROM OPERATIONS:

Net Earnings $3,664 $3,044 $2,581

Reconciliation of Net Earnings to Net Cash Provided by Operations:

Depreciation and Amortization 903 764 601

Increase in Receivables, net (38) (119) (246)

Increase in Merchandise Inventories (1,592) (166) (1,075)

Increase in Accounts Payable and Accrued Liabilities 1,394 1,878 268

Increase in Deferred Revenue 147 200 486

Increase in Income Taxes Payable 83 272 151

Increase (Decrease) in Deferred Income Taxes 173 (6) 108

Other 68 96 (78)

Net Cash Provided by Operations 4,802 5,963 2,796

CASH FLOWS FROM INVESTING ACTIVITIES:

Capital Expenditures, net of $49, $5 and $16 of non-cash

capital expenditures in fiscal 2002, 2001 and 2000, respectively (2,749) (3,393) (3,558)

Payments for Businesses Acquired, net (235) (190) (26)

Proceeds from Sales of Businesses, net 22 64 –

Proceeds from Sales of Property and Equipment 105 126 95

Purchases of Investments (583) (85) (39)

Proceeds from Maturities of Investments 506 25 30

Other –(13) (32)

Net Cash Used in Investing Activities (2,934) (3,466) (3,530)

CASH FLOWS FROM FINANCING ACTIVITIES:

(Repayments) Issuances of Commercial Paper Obligations, net –(754) 754

Proceeds from Long-Term Debt 1532 32

Repayments of Long-Term Debt –– (29)

Repurchase of Common Stock (2,000) ––

Proceeds from Sale of Common Stock, net 326 445 351

Cash Dividends Paid to Stockholders (492) (396) (371)

Net Cash (Used in) Provided by Financing Activities (2,165) (173) 737

Effect of Exchange Rate Changes on Cash and Cash Equivalents 8(14) (4)

(Decrease) Increase in Cash and Cash Equivalents (289) 2,310 (1)

Cash and Cash Equivalents at Beginning of Year 2,477 167 168

Cash and Cash Equivalents at End of Year $2,188 $2,477 $ 167

SUPPLEMENTAL DISCLOSURE OF CASH PAYMENTS MADE FOR:

Interest, net of interest capitalized $50 $18 $16

Income Taxes $1,951 $ 1,685 $ 1,386

(1) Fiscal years ended February 2, 2003, and January 28, 2001, include 52 weeks. Fiscal year ended February 3, 2002, includes 53 weeks.

See accompanying notes to consolidated financial statements.

THE HOME DEPOT, INC. 2002 ANNUAL REPORT 31