Home Depot 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (CONTINUED)

THE HOME DEPOT, INC. AND SUBSIDIARIES

IMPAIRMENT OF LONG-LIVED ASSETS

The Company reviews long-lived assets for impairment when

circumstances indicate the carrying amount of an asset may not

be recoverable. Impairment is recognized to the extent the sum

of undiscounted estimated future cash flows expected to result

from the use of the asset is less than the carrying value. When

the Company commits to relocate or close a location, a charge

is recorded to Selling and Store Operating Expenses to write

down the related assets to the estimated net recoverable value.

In August 2002, the Company adopted SFAS No. 146,

“Accounting for Costs Associated with Exit or Disposal Activities.” In

accordance with SFAS No. 146, the Company recognizes Selling

and Store Operating Expense for the net present value of future

lease obligations, less estimated sublease income when the loca-

tion closes. Prior to the adoption of SFAS No. 146, the Company

recognized this Selling and Store Operating Expense when the

Company committed to a plan to relocate or close a location.

STOCK-BASED COMPENSATION

During fiscal 2002 and all fiscal years prior, the Company

elected to account for its stock-based compensation plans

under Accounting Principles Board Opinion No. 25 (“APB 25”),

“Accounting for Stock Issued to Employees,” which requires

the recording of compensation expense for some, but not all,

stock-based compensation rather than the alternative

accounting permitted by SFAS No. 123, “Accounting for

Stock-Based Compensation.”

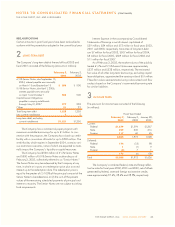

The following table illustrates the effect on net earnings

and earnings per share if the Company had applied the fair

value recognition provisions of SFAS No. 123 to stock-based

compensation (amounts in millions, except per share data):

Fiscal Year Ended

February 2, February 3, January 28,

2003 2002 2001

Net Earnings

As reported $3,664 $3,044 $2,581

Pro forma $3,414 $2,800 $2,364

Basic Earnings per Share

As reported $ 1.57 $ 1.30 $ 1.11

Pro forma $ 1.46 $ 1.20 $ 1.02

Diluted Earnings per Share

As reported $ 1.56 $ 1.29 $ 1.10

Pro forma $ 1.46 $ 1.19 $ 1.01

In December 2002, SFAS No. 148, “Accounting for Stock-

Based Compensation –Transition and Disclosure,” was issued,

which provides three alternative methods of transition for a

voluntary change to the fair value method of accounting for

stock-based compensation in accordance with SFAS No. 123.

Effective February 3, 2003, the Company adopted the fair value

method of recording compensation expense related to all stock

options granted after February 2, 2003, in accordance with

SFAS Nos. 123 and 148. Accordingly, the fair value of stock

options as determined on the date of grant using the Black-

Scholes option-pricing model will be expensed over the vesting

period of the related stock options. The estimated negative

impact on diluted earnings per share is approximately $.02 for

fiscal 2003. The actual impact may differ from this estimate as

the estimate is based upon a number of factors including, but

not limited to, the number of stock options granted and the fair

value of the stock options on the date of grant.

DERIVATIVES

The Company measures derivatives at fair value and recognizes

these assets or liabilities on the Consolidated Balance Sheets.

Recognition of changes in the fair value of a derivative in the

Consolidated Statements of Earnings or Consolidated Statements

of Stockholders’ Equity and Comprehensive Income depends

on the intended use of the derivative and its designation. The

Company designates derivatives based upon criteria estab-

lished by SFAS Nos. 133 and 138, “Accounting for Derivative

Instruments and Hedging Activities.” The Company’s primary

objective for holding derivative instruments is to decrease the

volatility of earnings and cash flow associated with fluctuations

in interest rates.

COMPREHENSIVE INCOME

Comprehensive income includes net earnings adjusted for

certain revenues, expenses, gains and losses that are excluded

from net earnings under generally accepted accounting principles.

Examples include foreign currency translation adjustments and

unrealized gains and losses on certain hedge transactions.

FOREIGN CURRENCY TRANSLATION

The assets and liabilities denominated in a foreign currency

are translated into U.S. dollars at the current rate of exchange

on the last day of the reporting period. Revenues and expenses

are translated at the average monthly exchange rates, and

equity transactions are translated using the actual rate on the

day of the transaction.

USE OF ESTIMATES

Management of the Company has made a number of estimates

and assumptions relating to the reporting of assets and liabilities,

the disclosure of contingent assets and liabilities, and reported

amounts of revenues and expenses in preparing these financial

statements in conformity with generally accepted accounting

principles. Actual results could differ from these estimates.

34 THE HOME DEPOT, INC. 2002 ANNUAL REPORT