Home Depot 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

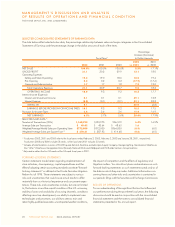

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION (CONTINUED)

THE HOME DEPOT, INC. AND SUBSIDIARIES

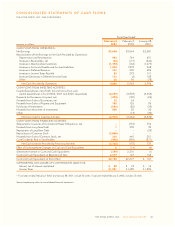

As of February 2, 2003, we had approximately $2.3 billion

in cash and short-term investments. We believe that our current

cash position, cash flow generated from operations, funds avail-

able from the $1 billion commercial paper program and the

ability to obtain alternate sources of financing should be sufficient

to enable us to complete our capital expenditure programs

through the next several fiscal years.

QUANTITATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK

Our exposure to market risk results primarily from fluctuations in

interest rates. Although we have international operating entities,

our exposure to foreign currency rate fluctuations is not signifi-

cant to our financial condition and results of operations. Our

objective for holding derivative instruments is primarily to decrease

the volatility of earnings and cash flow associated with fluctua-

tions in interest rates.

We have financial instruments that are sensitive to changes

in interest rates. These instruments include primarily fixed rate

debt. As of February 2, 2003, we had $500 million of 53/8%

Senior Notes and $500 million of 61

/2% Senior Notes outstand-

ing. The market values of the publicly traded 53/8% and 61

/2%

Senior Notes as of February 2, 2003, were approximately

$538 million and $537 million, respectively. We have an interest

rate swap agreement, with the notional amount of $300 million,

that swaps fixed rate interest on $300 million of our $500 million

53/8% Senior Notes for a variable interest rate equal to LIBOR

plus 30 basis points and expires on April 1, 2006.

IMPACT OF INFLATION AND CHANGING PRICES

Although we cannot accurately determine the precise effect of

inflation on operations, we do not believe inflation has had a

material effect on sales or results of operations.

CRITICAL ACCOUNTING POLICIES

Our significant accounting policies are disclosed in Note 1 to

our consolidated financial statements. The following discussion

addresses our most critical accounting policies, which are those

that are both important to the portrayal of our financial condition

and results of operations and that require significant judgment or

use of complex estimates.

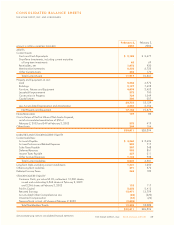

REVENUE RECOGNITION

We recognize revenue, net of estimated returns, at the time the

customer takes possession of the merchandise or receives ser-

vices. We estimate the liability for sales returns based on our

historical return levels. The methodology used is consistent with

other retailers. We believe that our estimate for sales returns is an

accurate reflection of future returns. When we receive payment

from customers before the customer has taken possession of the

merchandise or the service has been performed, the amount

received is recorded in Deferred Revenue in the accompanying

Consolidated Balance Sheets.

INVENTORY

Our inventory is stated at the lower of cost (first-in, first-out) or

market, with approximately 93% valued under the retail method

and the remainder under the cost method. Retailers with many

different types of merchandise at low unit cost with a large num-

ber of transactions frequently use the retail method. Under the

retail method, inventory is stated at cost which is determined by

applying a cost-to-retail ratio to the ending retail value of inventory.

As our inventory retail value is adjusted regularly to reflect market

conditions, our inventory methodology approximates the lower of

cost or market. Accordingly, there were no significant valuation

reserves related to our inventory as of February 2, 2003 and

February 3, 2002. In addition, we reduce our ending inventory

value for estimated losses related to shrink. This estimate is deter-

mined based upon analysis of historical shrink losses and recent

shrink trends.

SELF INSURANCE

We are self-insured for certain losses related to general liability,

product liability, workers’ compensation and medical claims.

Our liability represents an estimate of the ultimate cost of claims

incurred as of the balance sheet date. The estimated liability is

not discounted and is established based upon analysis of histori-

cal data and actuarial estimates, and is reviewed by manage-

ment and third party actuaries on a quarterly basis to ensure that

the liability is appropriate. While we believe these estimates are

reasonable based on the information currently available, if actual

trends, including the severity or frequency of claims, medical cost

inflation, or fluctuations in premiums, differ from our estimates,

our results of operations could be impacted.

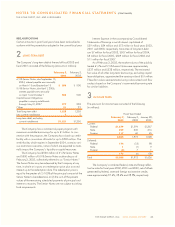

CHANGE IN ACCOUNTING FOR

STOCK-BASED COMPENSATION

During fiscal 2002 and all fiscal years prior, we elected to account

for our stock-based compensation plans under Accounting

Principles Board Opinion No. 25 (“APB 25”), “Accounting for Stock

Issued to Employees,” which requires the recording of compen-

sation expense for some, but not all, stock-based compensation,

rather than the alternative accounting permitted by Statement of

Financial Accounting Standards (“SFAS”) No. 123, “Accounting

for Stock-Based Compensation.”

In December 2002, SFAS No. 148, “Accounting for Stock-

Based Compensation – Transition and Disclosure,” was issued,

which provides three alternative methods of transition for a

voluntary change to the fair value method of accounting for

stock-based compensation in accordance with SFAS No. 123.

26 THE HOME DEPOT, INC. 2002 ANNUAL REPORT