HSBC 2002 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2002 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.91

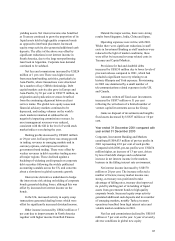

yielding assets. Net interest income also benefited

as Treasury continued to grow the proportion of its

liquid assets held in high quality corporate bonds

as opposed to interbank placement. Increased

equity swap activity also generated additional cash

deposits. The effect of the above was offset by

significant reductions in net interest income in

South America, due to the large non-performing

loan book in Argentina. Corporate loan demand

continued to be subdued.

Net fees and commissions increased by US$24

million or 1 per cent. There was higher income

from merchant banking activities, particularly in

Asia-Pacific, where transactions were structured

for a number of key CIBM relationships. Debt

capital markets activity also grew in Europe and

Asia-Pacific, by 30 per cent to US$175 million, as

origination and syndication revenues benefited

from the continuing alignment between client

service teams. The global new equity issues and

financial advisory markets continued to be

depressed, and trading volumes on the world’s

stock markets remained at subdued levels

negatively impacting commission revenues. In

asset management revenues were reduced,

consistent with the fall in the level of world stock

market indices seen during the year.

Dealing profits decreased by US$403 million

or 29 per cent. In Europe there was strong growth

in trading revenues in emerging markets and in

currency options, and improved results in

government bond trading. These were offset by

weaker revenues in debt securities trading across

all major regions. These declined against a

backdrop of widening credit spreads on corporate

debt securities following the widely publicised

accounting scandals across the US, and concerns

about a slowdown in global economic growth.

Interest rate derivatives undertaken to hedge

the interest rate risk arising on holding of corporate

bonds generated dealing losses, although this was

offset by increased net interest income on the

bonds.

In the UK, increased activity in equity swap

transactions generated dealing losses which were

offset by significantly increased dividend income.

Other income increased by US$42 million or 7

per cent due to improvements in North America

together with higher income from Rail Finance.

Outside the major centres, there were strong

results from Singapore, India, China and Japan.

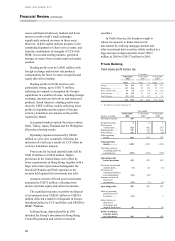

Operating expenses were in line with 2001.

Whilst there were significant reductions in staff

costs in Investment Banking as staff numbers were

reduced in the light of market conditions, these

were offset by increased revenue related costs in

Treasury and Capital Markets.

Provisions for bad and doubtful debts

increased by US$150 million due to lower levels of

provision release compared to 2001, which had

included a significant recovery relating to an

historic Olympia and York exposure. Provisioning

in 2002 was dominated by a small number of

telecommunications related exposures in the UK

and Canada.

Amounts written off fixed asset investments

increased by US$37 million or 51 per cent

reflecting the writedown of a limited number of

venture capital investments across the Group.

Gains on disposal of investments and tangible

fixed assets decreased by US$37 million or 10 per

cent.

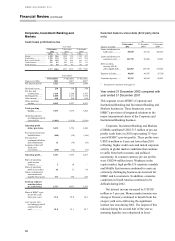

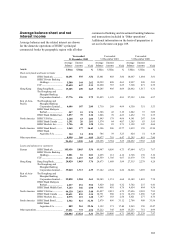

Year ended 31 December 2001 compared with

year ended 31 December 2000

Corporate, Investment Banking and Markets

contributed US$4,033 million of pre-tax profits in

2001 representing 45.8 per cent of such profits.

Compared with 2000, pre-tax profits were US$474

million higher, an increase of 13 per cent, driven

by lower bad debt charges and a substantial

increase in net interest income in the markets

business in the falling interest rate environment.

Net interest income increased by US$570

million or 20 per cent. The increase reflected a

number of factors; money market income was

strong, as treasury was positioned to take

advantage of falling rates, treasury also improved

its yield by shifting part of its holding of liquid

assets from government bonds to high quality

corporate bonds. Increased equity swap activity

generated additional cash deposits and in a number

of emerging markets, notably Turkey, treasury

operations benefited from high interest rates and

volatile market conditions in 2001.

Net fees and commissions declined by US$165

million or 7 per cent on the year. A year of severely

adverse conditions in global new equity